A reader asked me today if I knew anything about a forecast of an imminent US Dollar Apocalypse of September 30, 2016. After digging around, I found this article on Daily Reckoning. It turns out that the Chinese RMB is going to get included in the Special Drawing Rights (SDR) basket of currencies as of 4pm on Friday, September 30, 2016. The weight of CNY is going to be 10.9%, which is higher than the weight of the Japanese Yen at 8.3%.

The story of RMB inclusion in SDR is another nail in the coffin of King Dollar. The article then went on to reiterate the thesis about the destruction of the USD as a store of value.

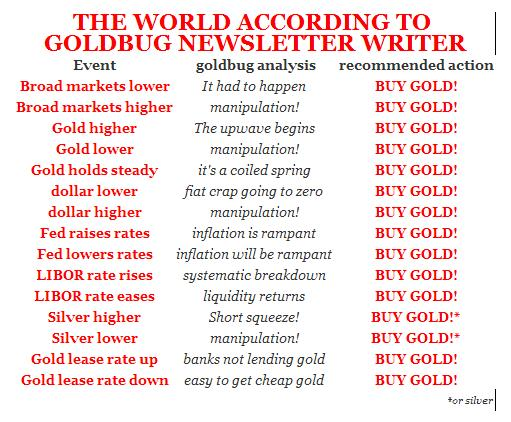

The obvious solution is, of course, to buy gold. Oh, PUH-LEEZ!

Sorry to disappoint the goldbugs, but some simple calculations show that gold to be an inferior investment to a USD cash position if we factor in T-Bill interest payments.

The investment record

Let’s start with the inflationista’s favorite metal, gold. According to onlygold.com, the price of gold in 1900 was $20.67 and it was $1060.00 in 2015, which amounts to a return of 3.5% per annum. According to this inflation calculator, the inflation rate between 1900 and 2015 was 2.9%, which make gold`s real rate of return 0.6% over that period. Remember, this period included Washington taking the Dollar off the gold standard, two world wars, and Richard Nixon shutting down the gold window.

By contrast, the Credit Suisse Global Investment Handbook reveals that the real rate of return on USD T-Bills was 0.8%.

Despite all the harping about the loss of purchasing power, it turns out that USD invested in T-Bills showed a superior return to holding gold. Incidentally, I have not included the storage fees associated with holding gold in a vault, or as an alternative, the price of the guns, ammunition, freeze-dried food, claymore mines, and other equipment you will need to defend the gold yourself in your Idaho mountain stronghold.

Still not convinced? Isn’t it curious that even the perennially bearish Zero Hedge has not picked up on this end-of-world scenario? Ask yourself this, “How seriously can you believe an Apocalyptic scenario that even Zero Hedge won’t touch?”

Cam: Several obvious rejoinders:

1) Of the 100 year time period in which the dollar lost 96% of it value in gold terms, at least 58 of those years (until Nixon reneged on our promise to redeem dollars for gold upon demand) the Fed was run by people who thought it extremely important that the dollar be strong so that foreign central banks would not redeem. And yet the dollar plummeted in value versus gold then anyway.

2) During the 1930s depression and WW2 there was an extremely strong flight from foreign currencies to dollars, quite rationally, since the currencies of our enemies, which were major world powers, became worthless, and the currencies of all the other major combatants were under pressure too because the war was being fought on their land, not ours, And yet that wasn’t good enough to keep the dollar strong versus gold either.

3) To add say 5%/year to the value of the dollar on the grounds that in the past that is what one would have earned on t-bills, would be a valid complaint about the prospects for gold if that is what one could earn today on t-bills. I presume you have noticed that the return on t-bills these days is about 0%, has been for many years, and shows no signs of rising much above that anytime soon. In fact, it can’t rise much above that, because the rise in the amount of government debt throughout the world has been so great that even a T-bill rate of half of 5% would divert almost all of the now “discretionary” spending by most government budgets to debt service. Politically huge spending cuts or tax increases would be impossible, so anything that caused interest rates to rise much would cause big increases in government deficits, which in turn would cause big increases in central bank money printing, which would make gold rise even faster versus dollars than it has in the past.

To compare the prospective return on gold versus the dollar while pretending that one can still invest dollars in t-bills and earn 5%, as one could in the increasingly distant past, is as silly as saying that the prospects of owning stocks is as good today as it was in October 1974, when the DJIA was 575, and nearly all stocks sold at mid-single digits P/Es. Not saying the market can’t go up from here, but from a fundamental value point of view the situation is not comparable.

This is a pretty obvious point that you ignore: Whether you personally approve or not, gold has been accepted as money for many thousands of years everywhere in the world. Fiat currencies like the dollar are also accepted as money, for sometimes as much as a few centuries before they become worthless. People can trade in dollars for gold by buying gold, or the reverse by selling gold. Of the two monies, which effectively compete, the amount of gold cannot increase very much at all because it is a difficult process to find, mine, and process it. The amount of dollars can increase by infinite amounts at the whim of ex-tenured economics professors at the Fed who believe in truly stupid theories that claim that money printing makes the economy better.

You have a choice of owning either of the currencies; one of them will effectively have no increase in supply over time, the other has its supply increasing at a rapid rate with no natural limit. Which would you rather own, that which is getting relatively more scarce or that which can be created out of thin air without any limit?

As for your chart in which the answer of gold bugs is always to buy gold, I have been following you for many years, long before this paid newsletter, and you bring that out regularly. One could easily add another column in which your response to all possible situations is to never buy gold.

If world governments and central banks were run the way they were when no government wanted to lose its gold supply because their currency retained value ONLY because it could be exchanged for gold, then sure, one could ignore gold as a store of value. Now that every significant government spends far more than it takes in and borrows the rest from a money printing central bank, and the central bankers are aggressively trying to make their currencies drop, complaining that inflation is below their targets (i.e., their currency isn’t dropping fast enough in purchasing power), only a fool would think that owning the paper currencies is a better idea than owning some gold, which no central bank can create.

Rick, great summary and I agree on every point.

Another bullish point that is new and not in the 100 year history is the recent economic growth surge in emerging countries. Folks in these countries value gold in a much different way than in the developed world and they are becoming wealthier therefor able to buy a lot more gold.

There is nobody on earth who can say with any confidence what will happen to fiat money after all of these Central Bank experiments are ended. How do they unwind all of this?

Bernanke in a famous 2002 speech said the end game could be ‘helicopter money’ or throwing hundred dollar bills out of helicopters. Of course, they would use a different way of distributing free money such as guaranteed minimum incomes or one time large tax rebates. No Central Banker in the 100 years period talked like this.

I am not a gold bug. I use momentum and the gold miners index is outperforming over the running nine month period I monitor. I will stay long while it outperforms and sell when it doesn’t. That means my clients will be in if it goes to $10,000 or out if it goes nowhere.

Here is a longer term technical indicator that has turned bullish for bullion, the Coppock Curve.

https://product.datastream.com/dscharting/gateway.aspx?guid=b40023c5-7b05-4f38-b5d8-71c706c157aa&action=REFRESH

And here’s the Coppock for Gold Miners Index

https://product.datastream.com/dscharting/gateway.aspx?guid=97e70747-b834-4f9a-af69-3c75cc926441&action=REFRESH

In my experience when a sector has been in a Coppock sub-zero downtrend for three years or more and then turns up, the ensuing bull market can last for years.

BTW here is a link to the Wikipedia explanation of the Coppock Curve

https://en.wikipedia.org/wiki/Coppock_curve

I agree with Ken. Gold has its role in a portfolio for its cyclical effects as a trading vehicle but don’t expect it to perform well over the long run.

IMHO, gold is actually quite useless, apart from the fact that it looks nice, is artisan-friendly and doesn’t rust. In the past, it was convenient for transactions because it is easy to verify its genuineness. Also, gold is not brittle like diamonds. Quite possibly however, gold will in the future no longer be scarce: the average asteroid has more gold than has ever been produced on earth. So, nobody really needs it, but in the unlikely case it ever got really expensive, technology will make it cheap again. Doesn’t sound like something into which I’d put my life’s savings.

Most people in the developed world agree with you Martin. They are more willing to put their life savings in a safe place like Deutsche Bank or some Italian banks that have been around for centuries. Now that governments after enormous GFC bank bailouts, will not back-stop banks to nth degree, that confidence in banks will erode with bank failures. Witness Cypress.

Also negative deposit rates make it costly to hold savings in counties with negative rates. There is a movement afoot to call in large denomination currency to force savers to leave money in banks. Savers in emerging countries have learned to mistrust financial institutions and they view gold differently. Will we learn the same lessons?

Speaking of Deutsche Bank, do you think it’s current state presents a major risk to the financial system? Similar to the effect Lehman had on the markets back in 2008-09.

Lehman was a shock that nobody expected. Since then, there have been preparations and tactics put in place for a large financial organization to go under without causing a risk to the system. Therefor, expect a nasty but contained situation.

Quite a lively discussion!!

For readers who suffer from insomnia here is the prescription from Zero Hedge:

http://www.zerohedge.com/news/2016-09-30/everything-you-need-know-about-gold-50-stunning-slides

Personally, I do not know any investment that can be put “under the mattress” for long periods of time. The drawdowns are substantial and difficult to stomach. Luckily, both gold and dollar have both periods of out performance that can be captured by any trend trading method. The trends are multi-year and fairly well defined. Ken’s suggestion of the Coppock’s method or a long term moving average should work.

Being originally from India I can vouch for the Indian consumer’s love affair with gold. However, gold in India has been more for jewellery. When I was in India people never bought gold coins mostly jewellery.

To Ken and Alex discussion on Deutsche Bank I can only add that Deutsche Bank is not the “only dead Bank walking”. The problem is wide spread and there are manly European (Italian) Banks that are under capitalized or have large bad debt loans on their books that have to be written off. This is an accident waiting to happen. How the Bond Market reacts to this is yet to be seen. My take is that we will have a buyers strike that will make interest rates rise rapidly. There will be a flight to the dollar. Historically gold and the dollar have had an inverse relationship. This time it is possible that it might not hold as there is a flight to safety.