Mid-week market update: The world is full of surprises. Not only was I beside myself when news of the Bragelina breakup hit the tape, I mistakenly believed that the stock market did not display sufficient fear to form a durable bottom (see the trading comments in Is a recession just around the corner?).

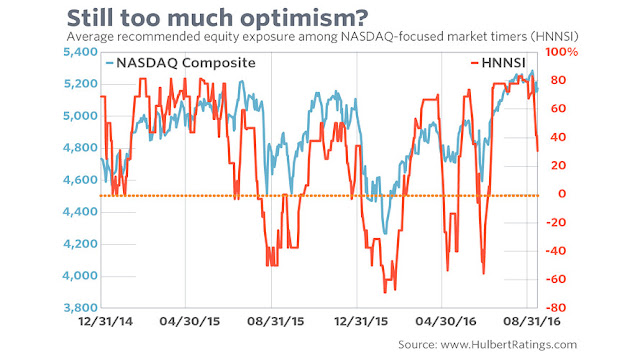

Last week, Mark Hulbert found that the bullishness of his sample of NASDAQ market timers had retreated but readings weren’t at a bearish extreme, which suggested that a scenario of more market choppiness.

The CNN Money Fear and Greed Index had fallen to levels where the market had bounced before, but it could have gone a lot lower. Even if it were to bottom at these levels, I would not necessarily discount a W-shaped bottom where the index declined to the recent lows before rising again.

I was wrong. Life is full of surprises.

A re-test of the highs?

I should have known better. The Twitter poll by Helene Meisler last Friday was a foreshadowing of what was to come. These polls are notoriously good contrarian indicators. There were too many short-term bears.

In the wake of the news from the BoJ and the Federal Reserve, SPX rallied above its interim resistance at 2150. The most likely short-term path is a re-test of the old highs at 2200. The next level of resistance is the 50 dma, which currently stands at 2168. In all likelihood, the gap at 2168-2177 will get filled.

In all likelihood, the market will rise and re-test technical resistance at the old highs, following by a failure and a retracement back to test support at around 2120. We may need more to see more fear and capitulation in order to launch a durable rally into year-end.

While my inner investor remains intermediate term bullish, my inner trader is using the trading range as his base case scenario and will probably lighten up on his long positions should the market rally to the top of the range. He remains data dependent – as always.

Disclosure: Long SPXL, TNA

The Fed decision today reaffirms lower for longer. It also tells us that the scare mongering speeches by Yellen and others over the last month is just them trying to deflate any bubble that might happen if investors get too optimistic. They want to keep rates low to help the economy without a booming stock market overheating. Investors will start to disregard these Fed speeches calling for higher rates.

Lower for longer stock market sectors, the same ones that led from mid-January all soared today, gold miners, base metal miners, energy, dividend ETFs, utlities, commodity currencies like the Canadian dollar. We could see a melt up in these areas especially gold miners and dividend ETFs.

Another view on interest rates:

http://video.cnbc.com/gallery/?video=3000553207

If the long bond which was severely oversold cannot take out its previous July high on this rally and makes a subsequent new low then we can definitively say that we have seen the low yields. All asset prices will be marked up or down based on their relationship to bonds.

” In all likelihood, the gap at 2168-2177 will get filled.” Looks like we can check that box today 9/22/16.