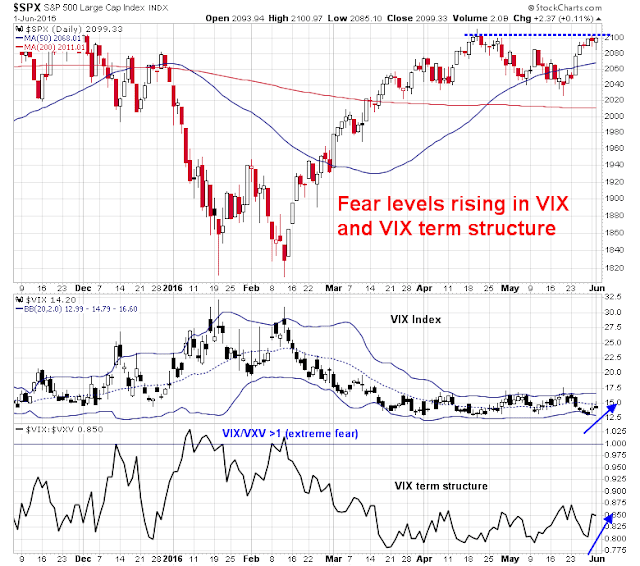

Mid-week market update: As the US equity market consolidates its gains near resistance and all-time highs, I remain constructive on stock prices for the following five reasons:

- Momentum is positive

- Breadth is positive

- Bullish support from overseas markets

- Greed is fading, which is supportive of further gains

- Overbought conditions are fading (ditto)

Momentum is positive

I recently highlighted this tweet from Leuthold Group and the SPX has indeed closed May above the key 2062 level. If history is any guide, stock prices should move higher from here.

Breadth is positive

The chart below shows the SPX A-D Line hit another all-time high yesterday (data has not been updated to Wednesday at pixel time). The SPX A-D Line is an apple-to-apples comparison and doesn’t have the problems of what is in the NYSE Composite when technicians analyze market breadth with the NYSE A-D Line,

Bullish support from overseas markets

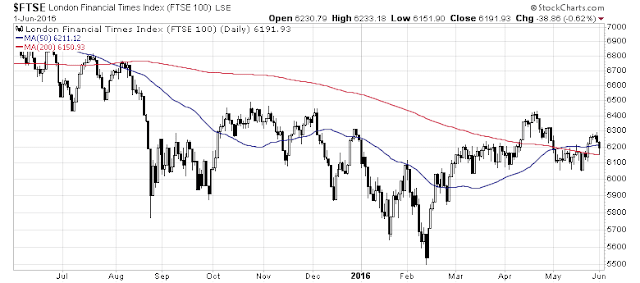

It is always useful to see if an advance or retreat is confirmed by other markets, which is another way of analyzing market breadth, but on a global basis. That’s called inter-market analysis, or cross-asset analysis. The picture from overseas is also supportive of further gains, European markets are in rally mode. The FTSE 100 above its 200 dma and just testing its 50 dma support.

The Euro STOXX 50 is rising as well. While it has cleared its 50 dma, it has yet to breach its 200 dma.

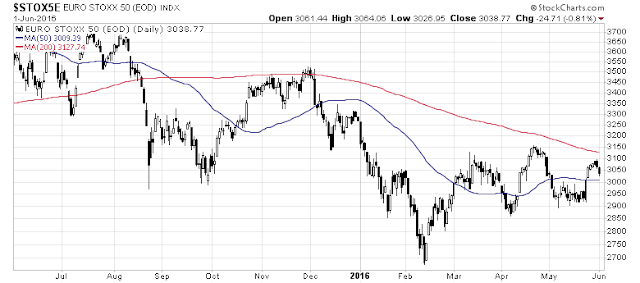

The Chinese market and the markets of its major Asian trading partners are showing signs of healing. All Asian markets are in minor uptrends and the Shanghai market rallied above a key resistance level two days ago.

Greed is fading

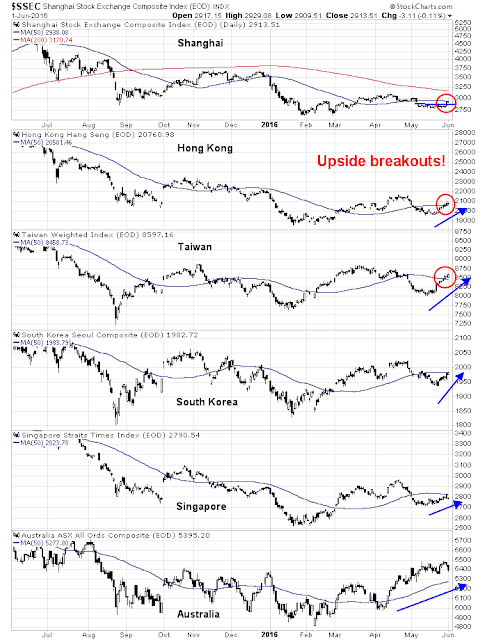

The option market is showing indications that complacency and greed are fading. The VIX Index has risen above its 20 dma, indicating rising fear, and the term structure of the VIX, as measured by the VIX to VXV (3-month VIX) is also signaling rising fear, or falling greed.

Overbought readings are fading

Intermediate term (1-3 week time horizon) breadth metrics are not overbought and the market has room to move higher given the positive breadth and momentum backdrop. This chart from IndexIndicators of the net 20-day highs-lows shows that the market is starting to retreat from a minor overbought condition, which gives it more room to advance.

The combination of these indicators do not mean that stock prices will necessarily rocket up tomorrow, or even this week. There are a number of binary events that could be a source of volatility this week, such as the Employment Report and Janet Yellen’s speech this Friday.

Nevertheless, trading and investing is a matter of playing the odds – and the odds are tilted in favor of the bulls right now.

Disclosure: Long SPXL