Let me make myself very clear. As a Canadian, I have no horse in the American presidential race, but Donald Trump is a clown. He is a loose cannon on deck. He could also become the next president of the United States.

So when does the market start to discount the potential effects of a Trump presidency?

Fiscal and monetary policy

While Donald Trump`s statements tend to go all over the place, it is useful to evaluate a Trump Administration within a fiscal and monetary policy framework. There are some things that we do know.

Trump likes to spend. He also likes debt – a lot. In an interview with CNBC, he stated that he was not afraid of debt:

Asked whether the United States needed to pay its debts in full, or whether he could negotiate a partial repayment, Mr. Trump told the cable network CNBC, “I would borrow, knowing that if the economy crashed, you could make a deal.”

He added, “And if the economy was good, it was good. So, therefore, you can’t lose.”

We know that fiscal policy is likely to be expansionary and deficit enhancing (see Analysis: Trump’s tax plan will cost $9.5 trillion). Debt will skyrocket, but Trump is also willing to threaten default in order to “make a deal” and reduce the national debt load. What about the Federal Reserve? Won’t that kind of expansionary fiscal policy mean a tight monetary policy, which might be reminiscent of the loose fiscal-tighten money of the Reagan era, which saw the USD soar?

Not necessarily. Trump has also stated that he is likely to replace Janet Yellen as Fed chair (via CNBC):

It’s not that Janet Yellen is doing a bad job. The Fed’s longstanding easy-money policy — with a federal funds rate now at 0.25 percent — is to Trump’s liking, he told CNBC on Thursday. “I love the concept of a strong dollar,” he said, but it creates havoc in markets and trade, while higher rates would make it more expensive for the country to service its debts.

Instead, Trump says he would invoke his TV catch phrase from “The Apprentice” to tell Yellen “You’re fired” simply because she’s not a Republican.

Supposing that Trump does replace Yellen, what kind of candidate could he find to become the Fed chair? Assuming that he doesn’t pick someone who is totally unqualified, such as his one of his offspring, for the job, he needs a mainstream economist who is sympathetic to the idea of helicopter money where fiscal and monetary policy work together to stimulate the economy (see We are all helicopter pilots now). How about someone like Richard (“balance sheet recession”) Koo, the Taiwanese-American who is now the Nomura chief economist whose policy prescriptions amount to “spend until it hurts…and then spend some more”?

Given such a fiscal and monetary policy framework, many parts of the market reactions are quite predictable. The price of hard assets, like gold and collectibles, would soar. The USD would tank. The path of equity prices is less clear, but large cap multi-nationals would act like inflation hedges as foreign currency denominated earnings would boost growth, while small caps and companies focused on the domestic economy could face considerable headwinds.

I`ve been monitoring the USD Index, which breached an important support level and bounced, but remains in a downtrend. Should the market start to seriously discount the prospect of a Trump presidency, watch for the greenback to fall considerably further. Such a development would be commodity friendly and, initially, equity friendly as USD weakness would boost the multi-nationals doing business overseas.

This scenario is predicated on the assumption that there are no severe disruptions from an unpredictable foreign policy.

Can Trump win?

How likely is this scenario? Could Trump actually win? Conventional electoral math indicates that Hillary Clinton has a large lead over Donald Trump (via the NY Times):

Trump would have to improve his margin by 10% points to win:

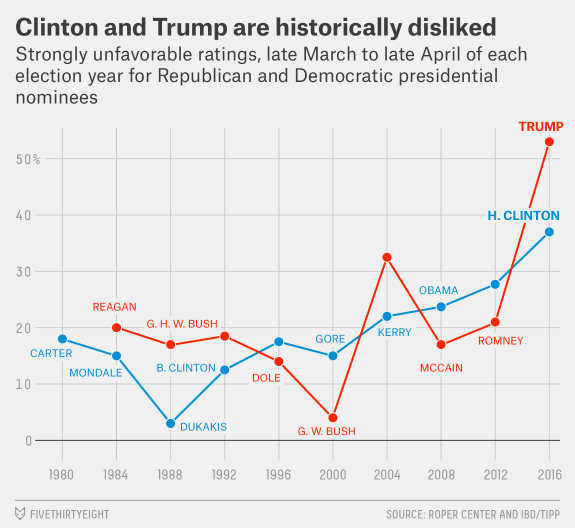

That possibility is more likely than you might think. Nate Silver pointed out that the country hasn’t seen an election where both candidates have such high unfavorable ratings, so electoral results could be highly unpredictable. Now that the primary season is winding down, the polling margin between Clinton and Trump could swing all over the place.

There have been no shortage of opinions of how Trump could win:

- Michael Moore, who is no Trump fan, thought that he just needs to win the midwesterners.

- Jonah Goldberg thought that Trump just needs to become the mythic protagonist in a more entertaining story: “And, more to the point, The Hillary Story is far less entertaining than The Trump Story.”

- Scott Adams, the creator of the Dilbert cartoons, stated in a Washington Post interview that he thinks Trump will win in a landslide because “he is running on our emotion…and sly appeals to our own irrationality.”

- Trump knows that people are basically irrational.

- Knowing that people are irrational, Trump aims to appeal an an irrational level.

- By running on emotion, facts don`t matter.

- If facts don`t matter, then you can`t really be “wrong”.

- With fewer facts in play, it`s easier to bend reality.

- To bend reality, Trump is a master at identity politics – and identity is the strongest persuader.

Be prepared

As well, how might the Fed react? Imagine that it`s August or September. The domestic and global economic situation is not very much changed from today. Trump has edged up in the polls and within striking distance of Clinton. Gold catches a bid and the USD weakens. Would the Fed slam on the brakes ahead of an election in what might be perceived as a political act, especially when they focus on inflation ex-food and energy and the hard asset price spikes could be “transitory”?

I don’t know. But investors and traders have to be prepared for such a scenario.

For my American friends who are totally horrified that Donald Trump might become president, I offer Maple Match as a possible personal solution to your angst (not sure if this is even a serious website):

Given the costs associated with being a reserve currency do you think that it is likely that the US will seek to end its status as the global reserve with either candidate?

I laughed. I cried. I give this post a 10!

How in the world did Dukakis rank as the least unlikeable candidate since Carter? Shows there’s not much correlation between likability and power.

I say Trump’s in with a very good chance but like everything else in the US the panic is media-driven and overblown. I’d buy The Trump Dip in a heartbeat.

You’re reading the chart wrong. It shows that Dukakis had the least unfavorable rating (least disliked) in late March or early April of the campaign year.

Note that the chart doesn’t show what the candidate’s positive ratings were.

Yes. That’s right. He’s the least unfavourable (i.e.: least disliked) and the furthest from power of any of them.

I’m no Trump fan but I think the path forward will be illuminated by an understanding of Trump’s success. On that, all I’ll say is I recently saw these sites on the abandoned cities in the US from lost manufacturing base:

https://www.youtube.com/watch?v=GqfAzpTGPGo

http://citymethodistchurch.com/city_methodist_church_virtualtour.html

It’s shocking and so little talked about, most don’t know. Thousands of empty, abandoned buildings left to adventurous “urban exploration”. Do you have cities like these in Canada Cam?

Canada suffers from a lack of manufacturing competitiveness when compared to its NAFTA neighbors. The manufacturing heartland of Ontario and Quebec faced headwinds when CADUSD rose as oil prices rose, but manufacturing hollowed out in those regions. Mind you, it’s nothing like Detroit, etc.

See http://humblestudentofthemarkets.blogspot.com/2015/06/uh-oh-canada.html