The top panel of the chart shows that S&P 500 has handily beaten global markets since the GFC and it has retreated back to the rising trend line. Conventional technical analysis calls for investors to buy the dip, with a stop loss just below the trend line. I argue for the Sell America trade of minimizing exposure to USD assets in a broadly diversified portfolio.

Reasons to Should Sell America

I have numerous reasons to Sell America, largely owing to a regime change in market character.

One disturbing development is the rise in yields was mainly attributable to an increase in term premium, or the rate investors demand to hold longer maturity instruments. While the term premium isn’t excessively high, it does show an increasing discomfort that the Fed and the U.S. Treasury may be losing control of the long end of the yield curve.

In addition, there is growing unease over the U.S. fiscal position. The WSJ reported that JPMorgan Chase CEO Jamie Dimon recent warned about a “crack in the bond market”, and “And I tell this to my regulators…it’s going to happen, and you’re going to panic. I just don’t know if it’s going to be a crisis in six months or six years.”

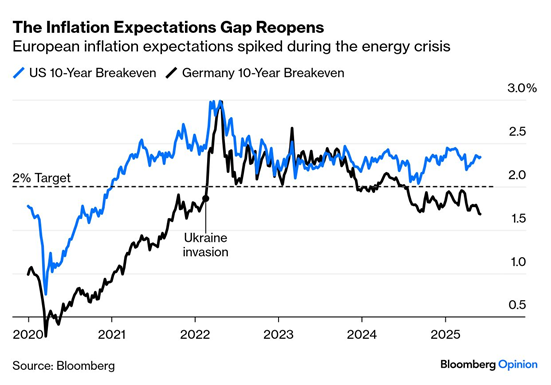

The growing yield gap is attributable to a bifurcation in inflation expectations.

The difference in yields and inflation expectations can be attributable to U.S. tariff policy. The U.S. is a significant importer, while the Eurozone and other regions tend to be net exporters. Tariffs represent an inflationary shock to the U.S. and a deflationary shock to the rest of the world. This is starting to show up in the PMI data.

The bifurcation in inflation expectations explains why the Fed is on hold in its easing policy while the rest of the world are cutting interest rates.

In summary, the combination of deteriorating U.S. fiscal position and the trade war policy pivot is contributing to falling confidence in the USD and USD assets. A CFA Institute survey conducted 15–31 July 2024 found “that the dollar remains entrenched as the dominant reserve currency…[and] growing concerns among investment professionals about the long-term sustainability of US fiscal policy”.

Better Non-U.S. Equity Bargains

Now that we have established that USD assets are likely to come under some downward pressure, what about the stock market?

Non-U.S. markets present cheap valuations by historical standards. U.S. forward P/E ratios are off the charts in comparison to other markets.

There are reasons why some markets are cheap, but a simple comparison to the Eurozone shows better growth expectations across the Atlantic. The Economic Surprise Index, which measures whether economic data is beating or missing expectations, is rising in the Eurozone while falling in the U.S.

Turning to Asia, a comparison of the subcomponents U.S. and China PMIs shows that while both plunged initially, China recovered but U.S. PMI subcomponents continue to fall.

U.S. Technology Leadership

I began this publication by arguing it’s time to underweight U.S. assets and the S&P 500 in favour of non-U.S. equities, but one key risk to my investment thesis is the sustainability of U.S. technology leadership. U.S. equity dominance since the GFC was mainly attributable to technology leadership, first by the so-called FANG names, which later became the Magnificent Seven. A bet against U.S. stocks is a bet against the Magnificent Seven.

A Bloomberg podcast with JPMorgan Asset Management strategist Michael Cembalest which argues that AI is the stock market bet of the century may shed some light on the issue.

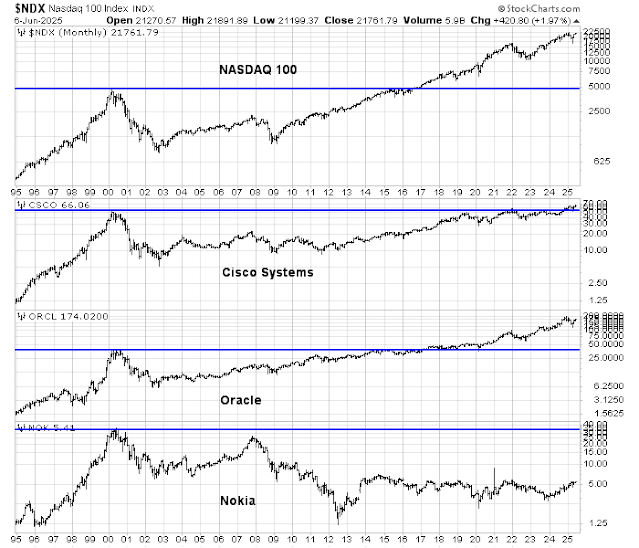

The experience of the internet bubble was instructive inasmuch as much of the value derived from widespread internet adoption accrued to the end-user. While equipment manufacturers and telecom distributors did earn some profits, eventual excess capacity cratered NASDAQ stocks. The NASDAQ 100, along with leading names like Cisco and Oracle took over a decade to regain their 2000 highs. Other crowd favourites such as AOL and Lucent were merged out of existence, and others, like Nokia, never regained their bubble highs.

Related to AI and the question of U.S. technology dominance is an investment opportunity highlighted by James van Geelen, who was early to spot the trend in weight-loss drugs and AI. Van Geelen believes that we are early in a 10-year growth opportunity in household robots, as reported by MarketWatch.

Discussing his “aha” moment on robots, van Geelen said he was speaking with an engineer friend who had been buying robot dogs from China, sticking a chip on the back and finding they could function like a guard dog. “He said ‘If you give me 15 grand, I will make you a fleet of robot dogs and guard your property right now.’”

And he started thinking about the 1960s sitcom “The Jetsons,” and his conclusion was that yes, technology will eventually mean a robot does our dishes and laundry. “It’s not like the consumer is going to be buying it. The consumer is probably going to be renting it,” which will spawn companies that provide those as a service, he said.Van Geelen offered a list of large cap companies that could be beneficiaries of the emerging robot trend, namely Tesla, Deere & Co., Nokia, Hyundai, and XPeng. I would note that over half the list are non-U.S. stocks.

A Rising Tide Lifts All Boats

In conclusion, in the absence of recessions, stock markets tend to rise. Technical analyst Willie Delwiche pointed out that the MSCI All-Country World Index (ACWI) finished May at a new all-time high. Over half the countries in the world reached new highs as well, which are constructive bullish signs.

I am embracing the “Sell America” trade because of a combination of deteriorating U.S. fiscal position and the trade war policy pivot that’s contributing to falling confidence in the USD and USD assets. A rising tide lifts all boats, but not all boats will rise equally.

The key risk to my “Sell America” thesis is whether the U.S. can sustain its technology dominance in the next investment cycle.

2 thoughts on “Why “Sell America” isn’t equity bearish”

Comments are closed.

“Because you can”

This is what allows things to happen.

Having a world reserve currency allows congress to spend and spend more and more.

Japan did yield curve control because it could and eventually was it’s own bond market.

When interest payments become too burdensome, we might see the Fed buying all the bonds and keeping the debt burden suppressed…it just doesn’t look good, but it can be done. The bond vigilantes can’t do much about that. The central bank can print and buy.

But for the private sector is a different story. The spread between treasuries and loans to companies, mortgages etc could widen.

Why has the treasury shifted more and more to shorter duration? Does that make it easier to transition to lower treasury rates?

But if borrowing costs rise, what will this do for jobs? The jobs the robots can’t do yet.

Still, people project out that interest costs can rise to where they exceed gov’t revenues….with a gov’t that can fix rates for its debt….really? The question is how to place a bet on that.

Japan had low inflation even though it kept rates near zero…oldest population demographic, for many years surplus balance of trade, but the yen went down.

This all argues for the USD to go down, but relative to what? When do we get the next eurozone crisis?

I like gold but I don’t trust that 1933 can’t happen again, and also just because for 5000 years people have valued it, doesn’t mean that cannot change.

Well, if one wants to build all those robots and data centers, one needs materials and energy. Is fertilizer passee? You can bet on cyber security, but who wins that race?

Don’t forget what the market is doing, recessions hit the commodity space.

If you look at trends in East Asia where sinlge-person housholds are skyrocketing and extrapolate, the robots market is not in the trational areas. The humanoid companion robots maket is going to explode. Perhaps it is a good trend.