Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “

Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post,

Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The

Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found

here.

My inner trader uses a

trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly

here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)

- Trend Model signal: Bullish (Last changed from “neutral” on 11-Oct-2024)

- Trading model: Bullish (Last changed from “neutral” on 15-Oct-2024)

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

A cloudy crystal ball

As a quantitative equity manager, I employed diversified and uncorrelated groups of factors to pick stocks, including technical analysis, earnings expectations, valuation, growth and growth at a reasonable price. During my tenure, different markets would experience external shocks, such as financial crises (Asian Crisis) and natural disasters (Fukushim). The quantitative factor response playbook would always follow the same script.

It begins with a price shock as everyone scrambles to assess the market implications. During this period, none of the stock picking factors worked because of the new information that isn’t reflected in the factors.

As the market begins to settle down, technical analysis factors would show alpha. This would be followed by estimate revision. That’s because company analysts don’t revise their earnings estimates until they can quantify the effects of the shock. This would be followed by the fundamental factors, such as value and growth. As an example, I flattened all my positions in an equity market-neutral portfolio in the wake of 9/11 as I knew I would only be trading on noise until there was greater clarity on fundamentals.

While the Trump victory doesn’t qualify as a disaster in the manner of Fukushima or 9/11, it does represent a discontinuous external shock to market expectations whose effects are difficult to quantify. While the direction of policy changes are known, the magnitude of their effects are difficult to estimate without knowing the exact details.

It is in that spirit I would assert the only guidance investors can rely on are market price signals, or technical analysis. That’s why it’s difficult to predict how the markets are likely to behave under the Trump Administration before he takes office.

My crystal ball is cloudy beyond a few weeks, but I can still take a look at the price response to the news.

A factor leadership review

The factor response has been surprisingly mixed. Among the Trump factors that I outlined in the past, only the relative performance of domestic companies and inflationary expectations are rising. The shares of Trump Media & Technology Group (DJT) surprisingly fell.

Among the value and cyclically sensitive sectors, the relative performance of financials and industrials surged but fell back. Energy, which should benefit from a “drill, baby, drill” policy, saw a very muted response.

The relative performance of growth sectors was similarly unenthusiastic with the exception of a pop in consumer discretionary stocks (thanks to heavyweights Amazon and Tesla).

To be sure, the weakness in the relative performance of defensive sectors is a signal that the surge in stock prices may have further to run.

Momentum, momentum!

I pointed out last week that the term structure of the VIX was inverted going into the election, indicating a high level of market anxiety. The subsequent market rally reflects a positioning unwind of over-hedged positions. The no-surprise FOMC decision also provided a tailwind for stock prices in the short run.

Jason Goepfert at SentimenTrader studied the history of 1% gaps after elections. While the sample size is extremely small (n=2), exhibitions of strong positive price momentum after elections is a promising sign for the bulls.

U.S. equities have surged in relative performance from a global perspective. They have the potential to rise further into year-end supported by performance chasing and buybacks after the end of the quarterly reporting blackout window.

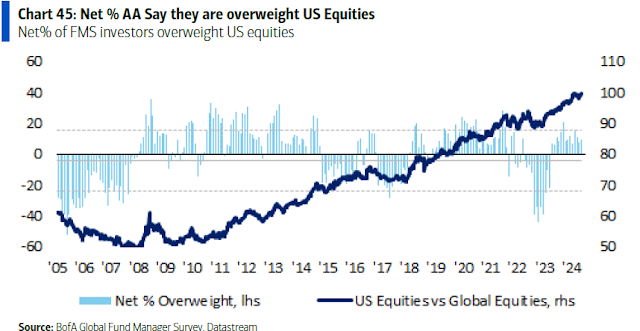

Three factors are supportive of this tactical bull case. The first is the expectation of corporate tax cuts. As well, the BoA Global Fund Manager Survey shows that global managers are not excessively overweight the U.S., which can be supportive of a FOMO-driven performance chase.

In addition, the U.S. Treasury is expected to draw down its Treasury General Account (TGA) at the Fed as an extraordinary measure as the Administration negotiates with Congress ahead of the January debt ceiling deadline. Drawdowns of TGA has the effect of injecting liquidity into the banking systems, which is positive for equity prices.

Tactically, the S&P 500 is currently testing the top of a rising trend line. Don’t be surprised if it consolidates at these levels and cool off in the next few days. That doesn’t mean it will significantly decline from here because of the reasons already mentioned. The index hasn’t stopped rising when it reached trend line resistance during advances in the past 12 months.

That said, I expect further gains once any consolidation or pullback is complete. Sentiment readings are not excessively bullish, which allows more room for stock prices to run.

Awaiting clarity

I would expect the stock market to rally into January and consolidate or pullback just before Inauguration Day. That’s when many of the unknowns of the Trump Administration’s initiatives are better defined. As a reminder, the three key planks of Trump’s platform are:

- Tariffs

- Immigration restrictions

- Extensions of the 2017 tax cuts

Trump can accomplish the objectives in the first two with executive orders, but he needs Congress to enact the tax cut extensions. The market is waiting for answers on many questions.

- Tariffs: What levels will be set at? Will there be a phase-in period? How much retaliation will there be?

- Immigration: It is said that Trump is planning mass round-ups and deportations on the day he takes office. If millions are being rounded up, where will the resources come from? What happens if the countries the deportees are sent to won’t accept them? Where will the government put the detainees awaiting deportation? How much will the operation cost? What are the effects on labour market and how will the Fed react to growing its growing tightness?

- Tax Cut Extension: While the odds favour a Republican sweep, it’s not known whether the Republicans will control the House of Representatives. For investors, the key issue will be how the bond market vigilantes react to the skyrocketing deficit from the tax cut extension. Will we see a Liz Truss moment in the Treasury market?

For now, the technical action of the stock market is dominant. Look for an equity rally into January, followed a period of consolidation and pullback as markets assess the full impact the details and effects of Trump’s policies.

The S&P 500 is already trading at a forward P/E ratio of 22.2. Even a 5% advance in the index would push the P/E ratio to extreme levels and offer little valuation support should the details of Trump’s policies disappoint. By comparison, the market’s forward P/E was considerably lower when Trump first took office in 2017, which gave room for multiples to expand.

Party now, but be prepared for a possible hangover.

My inner trader remains long the S&P 500. The usual disclaimers apply to my trading positions.

I would like to add a note about the disclosure of my trading account after discussions with some readers. I disclose the direction of my trading exposure to indicate any potential conflicts. I use leveraged ETFs because the account is a tax-deferred account that does not allow margin trading and my degree of exposure is a relatively small percentage of the account. It emphatically does not represent an endorsement that you should follow my use of these products to trade their own account. Leverage ETFs have a known decay problem that don’t make the suitable for anything other than short-term trading. You have to determine and be responsible for your own risk tolerance and pain thresholds. Your own mileage will and should vary.

Disclosure: Long SPXL