The latest BoA Global Manager Survey is a dramatic illustration of market anxiety. In July, 18% of respondents believed that a U.S. recession was the biggest tail risk. That figure surged to 39% in the August survey, which was taken August 2–8 right at the height of the market panic.

During the market panic, the market went from pricing in a soft landing to rising odds of a hard landing. About two weeks later, the consensus has shifted back to a soft landing, which should be friendly to risk assets.

Back to Goldilocks

As for growth, the Atlanta Fed’s nowcast of Q3 GDP stands at 2.0%, which is hardly recessionary.

More importantly for equity investors, forward 12-month EPS estimates are still rising.

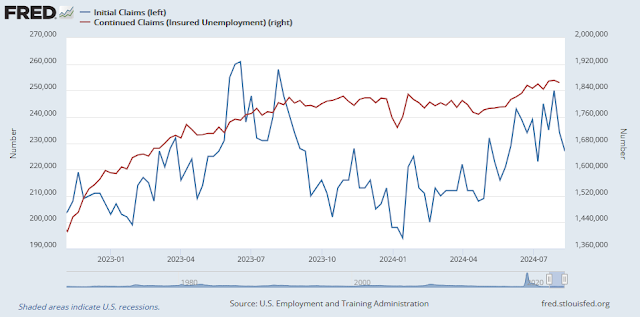

Investors may recall the roots of the growth scare. It began with a higher-than-expected initial jobless claims print, followed by a disappointing July Payroll Report. Since then, both initial and continuing claims have moderated.

Since the onset of the growth scare, a number of data points have appeared that are supportive of continuing growth. As an example, the Cass Freight Index, which measures the North American freight market, ticked up after four months of weakness.

Small business confidence increased, which is an important barometer of the economy as small businesses have little bargaining power. Both the soft and hard data components rose. To be sure, the surge in soft confidence may be attributable to (then) optimism about Trump’s electoral prospects in the wake of his assassination attempt. Nevertheless, I find it constructive that both components showed increases.

The Transcript, which monitors earnings calls, summarized the state of the U.S. economy as undergoing moderating growth:

The stock market was the elephant in the room on earnings calls last week. After the recent volatility, many analysts were asking CEOs if they had seen a change in the environment and whether a recession was forthcoming. Most CEOs said that there has not been a change, but some were slightly more cautious. Even though there hasn’t been a change, consumers are still fatigued and segments that had been strong, like travel and restaurants, are reporting more softness. The industrial economy has already been in a recession for 4-5 quarters. But with interest rates likely to come down, that may be closer to the end than the beginning.

Putting it all together, we have an economy that’s showing decelerating, but not recessionary, growth, and the start of a rate cutting cycle. Even though forward P/E valuations are somewhat elevated compared to historical norms, this should not be a concern as interest rates fall and EPS growth continues.

Key risks

There are two key risks to the Goldilocks bullish scenario. The first is the continuing growth malaise in China, which is exporting deflation to the rest of the world. Despite its efforts at target stimulus, credit growth has stagnated.

Chinese economic weakness can be seen in the slump in iron ore prices, which looks like it has more room to run.

Another key risk to consider is rising geopolitical tensions that could spike energy costs. Russia, a major energy exporter, is already engaged in a war. Iran is on the verge of retaliating against Israel for two assassinations that could spark a regional conflict and disrupt the oil market. The oil market has barely reacted to these potential risks and the 52-week rate of change is negative, which is positive for U.S. consumer confidence. But consumer confidence could take a hit if oil prices spike, which could spark another round of growth scares and rattle financial markets.

Any long term investment decision made today cannot be divorced from politics. Both Trump and Harris have agendas that will ignite inflation. Did anybody say GOLD? It made an all time high.

My personal bias is yet leaning more towards slow or no growth. If you notice, copper and semi-conductor index have had very minor rallies of the lows. If they are accurate “tells” about the state of the economy, I would be leery about looking for a soft landing.

All things considered now it is back to AI/Tech. Hard to imagine any real growth in other areas for the foreseeable future. It would take a while to get out of the crippling inflation of the last 3.5 years.