Preface: Explaining our market timing models

- Ultimate market timing model: Sell equities

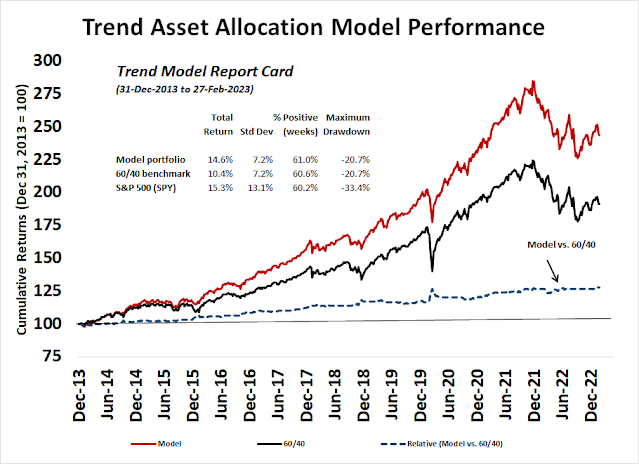

- Trend Model signal: Neutral

- Trading model: Neutral*/li>

Update schedule: I generally update model readings on my site on weekends. I am also on Twitter at @humblestudent and on Mastodon at @humblestudent@toot.community. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

A ZBT buy signal

How should investors interpret this buy signal? At first glance, it appears to be an excitingly bullish development, or a “what’s the credit limit on my VISA card” buy, but I have doubts.

Analyzing the ZBT

was higher a year later. In four of the six instances, the market kept rising after the signal and never looked back. The two “failure”, which saw the S&P 500 pull back after the buy signal. Will this market immediately launch itself to new highs or will the rally fizzle like it did in 2004 and in 2016?

What about valuation? The accompanying chart shows the S&P 500 forward P/E at the time of the six out-of-sample ZBT buy signals, along with the 10-year Treasury yield as an indication of the relative attractiveness of stocks compared to bonds. I can make the following observations:

- Most ZBT buy signals occurred when the forward P/E dropped suddenly and then recovered (a V-shaped rebound), which is not the case today,

- The S&P 500 current forward P/E of 18.1 is higher than any of the other P/Es seen during past ZBT buy signals.

- Past buy signals were triggered in environments of more

attractive cheaper valuations of stocks compared to bonds. Even

though forward P/E of the other ZBT buy signals were lower than what it

is today, the other buy signals occurred in environments when the

10-year Treasury was lower than it is today, with one exception. - In the one exception in 2004 when the 10-year Treasury yield was higher, the S&P 500 forward P/E was still lower than it is today. Even then, the 2004 buy signal fizzled by trading sideways for several months before rising to fresh highs. The price action can be seen as a P/E de-rating before rising again.

In short, the latest ZBT breadth thrust signal has been triggered when the stock market is the most expensive in history compared to other buy signals. The combination of a lack of valuation support and uncertainty over Fed policy leads me to believe that the immediate upside to the latest buy signal is likely to be limited. While the S&P 500 will probably be higher a year from now, the more likely path for stock prices is a pullback in a choppy setting before the market can reach fresh highs.

Technicians need to be prepared to be disappointed.

Home on the range

Despite the rally experienced by the U.S. equities and the ZBT buy signal, the S&P 500 remains in a trading range. Initial support can be found at the falling trend line at about 3800, with secondary support at the 200 wma at about 3750. Initial resistance is at about 4080, which the index broke through, and secondary resistance at 4150. With the market already overbought, as measured by the NYSE McClellan Oscillator, expect choppiness and turbulence until the index can break out, either to the upside or downside.

Uncertainty from bond and factor analysis

Other assets confirm the range-bound nature of this market. As an example, the bond market is unhelpful in determining the trend in risk appetite as bond prices are also range-bound. The 7-10 Year Treasury ETF (IEF) staged a failed upside breakout and retreated back into a range between 94.50 and 100. The International Sovereign Bond ETF (IGOV), which is priced in USD and has a similar duration, or interest rate sensitivity, as IEF, is lagging IEF. The poor relative performance of IGOV is surprising as the USD has been weak for most of March, which should provide a boost to IGOV returns.

The analysis of the commonly used four Fama-French equity return risk factors, which are price momentum, quality, size and value and growth, also offer few clues to market direction. One possible hint can be seen in the recent positive but choppy returns to quality, which is often a characteristic found during past equity bears.

Mixed Sector Internals

An analysis of the returns of style and sector internals also show a mixed picture. While it’s true that investors have gravitated toward large-cap growth during the recent banking crisis, most of the outperformance can be found in technology. The other two growth sectors show little signs of leadership.

By contrast, the relative performance of value sectors, which are cyclically sensitive, have been challenging.

In conclusion, I believe that despite the potential excitement generated by the ZBT buy signal, the U.S. equity market remains in a holding pattern. Investors should wait for more definitive signs of market direction from either factor returns or market internals before turning overly bullish or bearish. Investors will see the March Jobs Report next week, followed by the start of Q1 earnings season, which may provide better guidance to near-term market direction.

https://privatebank.jpmorgan.com/gl/en/insights/investing/a-shift-in-market-leadership

Good post.

Yesterday’s post talked about secular bear market for the dollar and it’s implications for investors. We also see the yield curve shift down with some steepening.

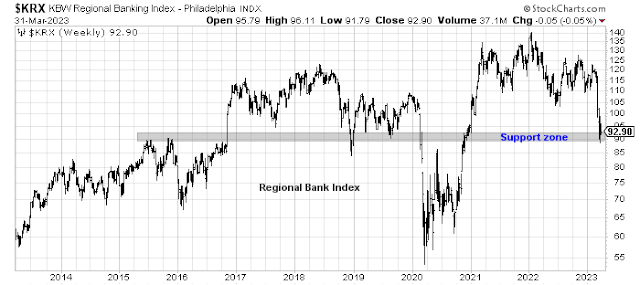

Credit is tighter across the banking system. MMF and money center banks are beneficiaries of deposit outflows but they are not the lenders to medium/small businesses.

Having laid the predicate, does it not stand to reason that large companies that are cash rich, have significant overseas revenues and can grow the business will benefit in such an environment? For example, the large mega cap tech stocks?

Wouldn’t a recession trump a rally in large cap mega caps? A drop in the $ is indicating a recession (amongst other indicators), and a recession would affect mega cap techs as well, is my interpretation.

Equities do suffer in a recession. Some more than others. Unless one is out of equities, I am raising the question about such equities having a tailwind.

Similarly 10 year treasuries rally – what happened in 2020 as well.

https://www.chase.com/personal/investments/learning-and-insights/article/tmt-march-thirty-one-twenty-three?jp_cmp=pw/ContentSharedViaAdvisorChannel/ema/OFTtemplate03312023/NA

I know that I am too skeptical about things, but since a lot of this is a confidence game and speaking out of both sides of the mouth, what might they do for this economy?

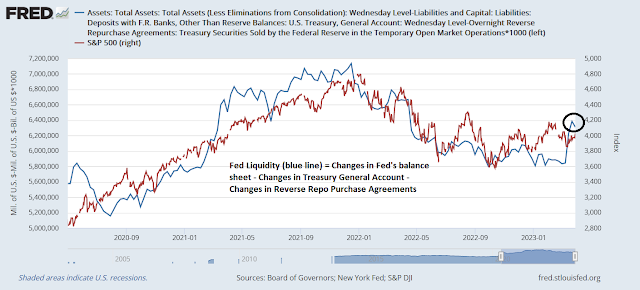

So they bailed out some banks, and maybe they bail out most banks. They are doing not QE, which may have the same effect as QE.

What about all those junk corporate bonds, they not supposed to buy them buy them, but that was tweaked (was it during covid?). But can they bail out the “systemic ” holders of those junk bonds?

Can they paper over all the crap that happens because of the recent unprecedented speed of rate increases, so that they can keep rates up to save face in the inflation fight.

For me, the distinction between what they do to save face, or keep the wheels on the economy until the next election is blurry.

I simply don’t believe them.

But all of these shenanigans most likely will lead to a weaker dollar, but not in a straight line.