Now that the Trump team has moved into the West Wing of the White House, investors still one big Trump policy question mark that overhang the market. Who will Trump appoint to the two vacant governor seats at the Federal Reserve?

CNBC reported that David Nason is a leading contender for a board seat, but he is rumored to be considered for a regulatory role. Such an appointment gives us no hints about the likely future direction of monetary policy and who might replace Janet Yellen, should Trump choose not to re-appoint her as Fed chair in 2018.

Bloomberg reported that the latest rumor mill has the leading candidates for Fed chair, namely Glenn Hubbard, John Taylor, and Kevin Warsh, advocating a tighter monetary policy than the current Fed:

Potential candidates to head the Federal Reserve in 2018 suggested that monetary policy would be tighter if they were in charge.

Speaking at the annual American Economic Association meeting that ended Sunday, Glenn Hubbard of Columbia University, along with Stanford University’s John Taylor and Kevin Warsh, criticized the central bank for trying to do too much to help an economy struggling with problems that monetary policy can’t solve.

“The Federal Reserve is a little behind the curve” in raising interest rates, Taylor, a Treasury undersecretary for international affairs under the last Republican president, said Saturday during a panel discussion in Chicago.

Hubbard, who headed the Council of Economic Advisers under Bush, said he agreed with what he perceives as Trump’s stance that the U.S. has depended too much on the Fed to support the economy in recent years.

Is that what Trump really wants? There is a battle going on for the hearts and minds of the Federal Reserve. The outcome will have profound implications for the direction of monetary policy, the likely trajectory of economic growth for President Trump’s next four years, and the stock market.

War at the Fed

Current members of the FOMC have pushed back against proposals by the hard money crowd to impose a rules based approach to setting interest rates. Neel Kashkari, president of the Minneapolis Fed, shot back that using a Taylor Rule to set interest rates would have kept millions out of work:

In December, I wrote an op-ed in the Wall Street Journal explaining that forcing the Federal Open Market Committee (FOMC) to mechanically follow a rule, such as the Taylor rule, to set interest rates can cause tremendous harm to the economy and the American people. My staff at the Minneapolis Fed estimates that if the FOMC had followed the Taylor rule over the past five years, 2.5 million more Americans would be out of work today. That’s enough to fill the seats at all 31 NFL stadiums simultaneously, almost 6,000 more people out of work in every congressional district.

Janet Yellen objected in a more gentle way in a speech made on January 19, 2017:

To sum up, simple policy rules can serve as useful benchmarks to help assess how monetary policy should be adjusted over time. However, their prescriptions must be interpreted carefully, both because estimates of some of their key inputs can vary significantly and because the rules often do not take into account important considerations and information pertaining to the outlook. For these reasons, the rules should not be followed mechanically, since doing so could have adverse consequences for the economy.

Hawkish Fed = USD bullish

Everything else being equal, a hawkish Fed would tend to put greater upward pressure on the US Dollar, which would be contrary to Trump’s trade policy objectives. I pointed out that Trump had already expressed his preference for a weak USD (see Weaken the USD to Make America Great Again). Therefore it makes no sense for him to appoint a hard money economist to be Fed chair and steer monetary policy.

If the Trump administration were to turn away from the likes of John Taylor, who would be a more likely Fed chair? For this exercise, let`s peg the Yellen Fed`s monetary policy as the neutral position. Janet Yellen has said that she expects to continue raising rates in 2017. In a January 18, 2017 speech, Janet Yellen made it clear that her dovish tilt has limits.

In a nutshell, the Fed’s goal is to promote financial conditions conducive to maximum employment and price stability. And I have offered broad-brush definitions of each of those objectives. So where is the economy now, in relationship to them? The short answer is, we think it’s close…

Nevertheless, as the economy approaches our objectives, it makes sense to gradually reduce the level of monetary policy support. Changes in monetary policy take time to work their way into the economy. Waiting too long to begin moving toward the neutral rate could risk a nasty surprise down the road–either too much inflation, financial instability, or both. In that scenario, we could be forced to raise interest rates rapidly, which in turn could push the economy into a new recession.

She expects to raise rates “a few times a year” until the end of 2019, when Fed Funds gets to the neutral rate of 3%:

Now, many of you would love to know exactly when the next rate increase is coming and how high rates will rise. The simple truth is, I can’t tell you because it will depend on how the economy actually evolves over coming months. The economy is vast and vastly complex, and its path can take surprising twists and turns. What I can tell you is what we expect–along with a very large caveat that our interest rate expectations will change as our outlook for the economy changes. That said, as of last month, I and most of my colleagues–the other members of the Fed Board in Washington and the presidents of the 12 regional Federal Reserve Banks–were expecting to increase our federal funds rate target a few times a year until, by the end of 2019, it is close to our estimate of its longer-run neutral rate of 3 percent.

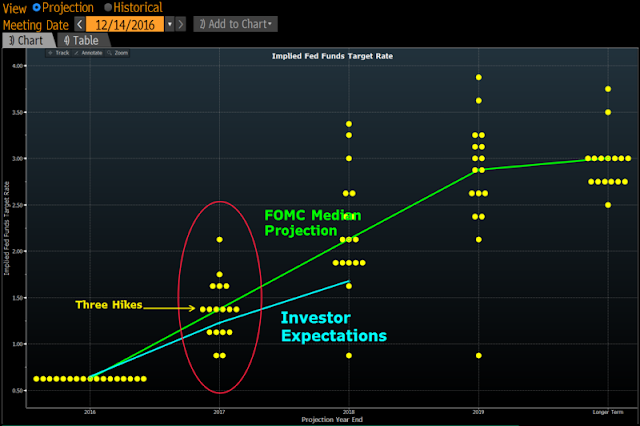

Forgive me if I am parsing this incorrectly, but if “a couple” is two, then doesn’t “a few” mean more than two? It sounds like Yellen is signaling that she expects at least three rate hikes in 2017. Indeed, Bloomberg reported that former Fed governor Laurence Meyers deduced that Yellen is forecasting three rate hikes on the “dot plot” for 2017:

Meyer is playing a game of elimination popular among investors and economists that revolves around the so-called dot plot. That’s a graphic layout that the Fed publishes every three months to show where policy makers think interest rates should go if their forecasts for the economy prove accurate. The quarterly rate projections don’t identify the author of each forecast, which is represented by a dot on a chart…

Atlanta Fed President Dennis Lockhart told reporters on Jan. 9 that he had forecast two hikes this year. His Chicago counterpart Charles Evans suggested he’s also looking at two, saying on Jan. 6 that a couple of moves were “not an unreasonable expectation.” Next, Governor Daniel Tarullo, who in the past has advocated a decidedly cautious approach to raising rates, also got ranked at two hikes by several economists.

With a single two-hiker remaining, there is one more firm clue: In December, in the run-up to the FOMC meeting, the board of directors at the Minneapolis Fed was alone among the regional banks when it voted against increasing the so-called discount rate, which establishes interest rates for direct loans from the Fed. They did so to support the labor market and allow inflation to rise, according to minutes published on Jan. 10.

A reserve bank’s position on the discount rate typically reflects its president’s view with respect to the benchmark federal funds rate, suggesting Minneapolis Fed President Neel Kashkari isn’t hawkish enough to forecast more than two hikes this year on the dot plot.

If that’s correct, Yellen and New York Fed President William Dudley are among the six policy makers forecasting three hikes in 2017.

Wow! Three 2017 rate hikes for a reputed dove like Janet Yellen. Trump won’t like that!

Even doves have limits

What about Lael Brainard? Even though Brainard supported Hillary Clinton in the election and was rumored to be in the running for the post of Treasury Secretary in a Clinton administration, could the ȕber-dove Lael Brainard be a candidate for Fed chair?

In a recent speech made on January 17, 2017, Brainard made it clear that even doves have limits when faced with an expansionary fiscal policy. Fiscal policy that provide only a temporary boost to demand (read: tax cuts) spur inflation, especially when the economy is running near capacity, as it is now:

Focusing first on policies that affect only aggregate demand, temporary demand-based fiscal expansions can speed recovery when the economy is some distance from full employment and target inflation, particularly if conventional monetary policy is constrained by the effective lower bound. But when the economy is either close to or at full employment and inflation is converging to or at its target, additional fiscal demand will more likely result in inflationary pressures. Thus, fiscal expansions that affect only aggregate demand and are enacted when the economy is near full employment and 2 percent inflation are relatively less likely to sustainably boost economic activity and relatively more likely to be accompanied by increases in interest rates.

These kinds of fiscal policies are actually counterproductive, as the government has to incur debt without a corresponding boost to long-term growth. In addition, the Fed is weakened because it has little ammunition to fight the next downturn:

Policies that persistently raise aggregate demand alone can lift the neutral rate, but that may come at substantial cost. Because these policies do not affect the economy’s long-term growth potential but do result in persistent fiscal deficits, they can lead to substantial increases in the debt-to-GDP ratio. The greater space for monetary policy to respond to adverse shocks provided by a higher neutral rate comes at the expense of reducing the space for fiscal policy to stabilize the economy in the event of future adverse shocks.

At the end of her speech, she did sound a dovish tone by giving a nod to her thesis that the Fed has to consider the global implications of its policy:

Against this uncertain backdrop, monetary policy will continue to be guided by actual and expected progress toward our goals, the level of the neutral rate, and the balance of risks. A gradual approach will remain appropriate as long as inflationary pressures remain muted, the economy remains short of our objectives, the neutral rate remains low, and downside risks from abroad remain, although this will depend on the fiscal trajectory, as it evolves, and its uncertain effects on the economy and financial markets.

Will that be enough for Trump looking for a dovish Fed chair? Probably not.

The rise of inflation

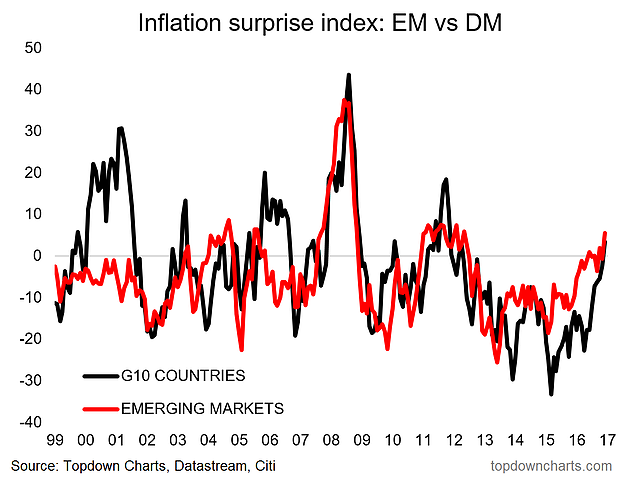

Regardless of who Trump appoints to the Federal Reserve’s board of governors, or to next Fed chair, the inescapable fact is inflation is rising. As one of the Federal Reserve’s mandate is to fight inflation, monetary policy will become tighter. This chart from Callum Thomas of Top Down Charts shows that not only are the inflationary pressures building, they are global in nature.

Indeed, BIS recently put out a paper entitled The globalisation of inflation: the growing importance of global value chains. The authors concluded that the globalization of manufacturing has also globalized inflation dynamics, which makes it more difficult for central banks to control inflation locally. The conclusions of this paper is supportive of Lael Brainard’s thesis that the Fed needs to pay greater attention to the global effects of US monetary policy. Here is the abstract of the BIS paper:

Greater international economic interconnectedness over recent decades has been changing inflation dynamics. This paper presents evidence that the expansion of global value chains (GVCs), ie cross-border trade in intermediate goods and services, is an important channel through which global economic slack influences domestic inflation. In particular, we document the extent to which the growth in GVCs explains the established empirical correlation between global economic slack and national inflation rates, both across countries and over time. Accounting for the role of GVCs, we also find that the conventional trade-based measures of openness used in previous studies are poor proxies for this transmission channel. The results support the hypothesis that as GVCs expand, direct and indirect competition among economies increases, making domestic inflation more sensitive to the global output gap. This can affect the trade-offs that central banks face when managing inflation.

Kyle Bass believes that financial markets are at the beginning of a major tectonic shift towards inflation from deflation:

Texan hedge fund manager J. Kyle Bass, the founder of Hayman Capital, says that global markets are at the “beginning of a tectonic shift.”

“Today, global markets are at the beginning of a tectonic shift from deflationary expectations to reflationary expectations. What happens to economies at maximum leverage when interest rates begin to rise? Reconciling the potent strengths of the world’s largest economies with their inherent weaknesses has revealed various investable anomalies. The enormity of the apparent disequilibrium is breathtaking, making today a tremendous time to invest,” Bass wrote in a year-end letter to investors seen by Yahoo Finance.

If Trump wants a dovish Fed, and if he decides to pack the board with like minded appointees who are willing to tilt towards an easier monetary policy (and therefore a weaker USD), a major war will likely erupt within the FOMC on policy, especially when well-known doves like Brainard and Yellen have become more hawkish.

Three steps and a stumble?

Under the scenario I outlined, the three steps and a stumble rule, where the market tops or corrects after three consecutive rate hikes, will inevitably come into play. But it’s probably too early too panic. Jim Paulsen of Wells Capital Management observed that equity markets typically don’t pull back in the face of rising yields until market psychology changes from disinflation to inflation:

Charts 5 and 6 illustrate how important the relationship portrayed by this correlation has been for stocks in recent years and when the recent rise in bond yields might finally cause a correction in the stock market. Specifically, it suggest the stock market may continue to rise despite higher yields until the correlation switches from positive to negative. That is, higher interest rates may not restrain the stock market until the primary investor anxiety shifts from deflation to inflation.

As shown, since the late-1990s, the stock market has suffered either a correction or a bear market each time the stock-bond correlation has declined below zero (i.e., each time investor mindsets have switched from deflation to inflation concerns). The 2000 collapse occurred after the correlation turned negative in late-1999, the 2007-2008 collapse happened after the correlation dropped below zero in the second half of 2006 and the correlation again fell below zero at the end of 2013 followed by two separate 10% corrections and an essentially flat stock market during the ensuing couple years.

The risk stock investors face in 2017 from rising bond yields may have less to do with how much they rise or how high they are, as it does with the surrounding attitude of investors concerning inflation/deflation as yields rise. Currently, the consensus investor mindset is viewing the recent rise in yields as a positive for the economy and the stock market (as suggested by a strong positive correlation in the last year from Chart 5). Fears of deflation and anxieties surrounding another potential crisis are diminishing as commodity prices recover, as U.S. and global economic growth improve, as the Federal Reserve finally begins to normalize monetary policy and as the interest rate structure around the globe moves back above zero.

It sounds like that “three steps and a stumble” is a late 2017 investment story. Tactically, I would hesitate about getting overly defensive just yet. The bond market is currently poised for a counter-trend rally as large speculator, or hedge funds, remain in a crowded short in both the 10-year note and the long bond (chart via Hedgopia).

Bloomberg also pointed out that while the fast money, or hedge funds, are in a crowded long in the bond market, the patient and big money institutions are extremely long. In the end, big money fund flows have tended to overwhelm the fast money.

Leveraged funds that use borrowed money to boost returns see even more losses ahead. As of Jan. 10, their short positions — futures that pay off if five-year notes lose value — exceeded longs by a record 1.1 million contracts, data compiled by the U.S. Commodity Futures Trading Commission show.

While it’s been the winning strategy over the past several months, institutional buyers are undaunted. Not only did they boost their long positions for five-year notes to an all-time high this month, but they’ve also stepped up bullish bets on 10- and 30-year Treasuries as well. (Most recent data as of Jan. 17 showed a slight pullback in both institutional net longs and leveraged net shorts.)

When real-money investors do go all-in, they tend to overwhelm the fast-money crowd because of their sheer size.

In the end, “real money always wins,” said Tom di Galoma, the managing director of government trading and strategy at Seaport Global Holdings. “Speculators tend to get taken out. We’ve seen this occur several times in the last 10 to 15 years, where everybody thinks rates are too low.”

By all means and enjoy the party, but don’t go overboard and be selective with your risk appetite.

Cam you are amazing with your multidisciplinary approach. Amazing.

amen brother.

Here is a link to a great new research paper by Robert Shiller entitled ‘Narrative Economics’.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2896857

It has great relevance to the stock market on how narratives come on to the scene and eventually peak. There is certainly Trump narratives in force now. It’s fascinating how Shiller quantifies the spread of the impact.

This explains the technical phenomena of the ‘good overbought’ stock market when a new narrative hits the markets. The markets can stay overbought and traders who sell too early miss the big move.

The stronger and more surprising the new narrative, the longer the ‘good overbought’ cycle can last as the narrative spreads throughout the investor population. That thinking is how I will use the Shiller research.

I’d love to hear readers ideas on the Trump narratives affecting stock markets. My thinking is “Trump is a disrupter that will boost American business.” “Trump will end the Old World Order and that leads to great international uncertainty.” ‘Trump is a dumb spend and borrow politician that will derail the bond market.”

The pro-business narrative is here and now while the others are future concerns. He is rolling out pro-business policies daily, hell even hourly. We stay ‘good overbought’ as long as that narrative can keep spreading to new investors willing to buy into the concept. Ray Dalio wrote “The switch from the policies of Obama to Trump may be as profound as the UK’s shift to Thatcherism in the late 1970’s or china’s embrace of capitalism in the 1980’s” New investors are coming to this reality every day. They are holding their noses regarding his abrasive personal style and buying.

There can be no greater contrast than the difference between Democrat Elizabeth Warren overseeing the banking and securities industries if Hillary won and Trump’s former Goldman Sachs group now in charge. That narrative will be reinforced often going forward. I will stay very overweight in banks, brokers and asset managers. I bought Blackrock BX yesterday for example to add to Goldman Sachs, Morgan Stanley and Charles Schwab. I use the bank ETF KBE for trading.

Many folks thought he would be bogged down by Congress or that campaign promises would be forgotten like previous newly-elected Presidents. His whirlwind signing of major promises is dispelling that thought. He is using pro-business action to drown out the women’s movement protests.

Kashkari’s analysis of the Taylor rule was faulty as subsequent op-ed’s pointed out. Two obvious issues: (a) they assumed the economy jumped into the Taylor rule as opposed to having been in it far longer than 5 years and (b) they took the economist crutch of “if all else is held equal then …” when of course a higher interest rate would cause changes throughout the economy.

Neither the Federal Reserve nor the Fed Chair will voluntarily give up the economic and political power aggravated over the past decades. No bureaucracy will. Expecting the Fed to miraculously curb its expansionist appetites in favor of fiscal and regulatory policy is looking for unicorns in Detroit.

Threats by Brainard to jump interest rates if fiscal policy becomes expansionary are a response to the threat such policies have towards that Fed/Fed Chair power. The idea that changes in fiscal policy – read spending initiatives – will ONLY result in greater deficits because they don’t change long term growth potential is bizarre. It is as if Brainard really believes fiscal policy changes have only simplistic binary outcomes. While most Democrats (and some Republicans) like to think this way a permanent change to the tax code and regulatory burden results in a series of cascading changes throughout the economy that could overwhelm the potential deficit.

The mindset of the Federal Reserve Governors is unsettling. Their refusal to move interest rates to neutral and to dislodge their $4 Trillion in assets shows that a proper monetary policy for the US is not their objective. Apparently their objective is to maintain their preeminence in economic policy and power regardless of the ever widening harm done to the US economy. This is further buttressed by the idea that US monetary policy is also required to consider global reactions. This yokes the US economy to the worst aspects of the global economy. Should US monetary policy be yoked to Greece?

The BIS paper notwithstanding – that GVC’s disperse inflation across countries – it is also quite possible that they have simply discovered a correlation not a causation. Given that every major country on earth has been on a monetary policy expansionistic tear for years it is hardly surprising that inflation now seems to be rising in those same nations. Milton Friedman’s famous dictum, inflation is always and everywhere a monetary phenomenon is still accurate. If we are all running a race in the hot sun is it surprising that we all start to sweat? Is it the competition between runners or the hot sun or both?

Trump has nominated a number of cabinet secretaries who publicly disagree with him on various matters. Why then would it be unusual for Trump to want a weaker USD while simultaneously promoting a monetary hawk to the Fed? Frankly, it would seem to be the more rational choice.

Thanks Jeff. Well put.

GVCs can’t be dispersing inflation since imported goods price indexes have been running negative YOY for years. Goods deflate and the rest of the CPI inflates particularly healthcare and housing. Those are domestic inflation drivers.