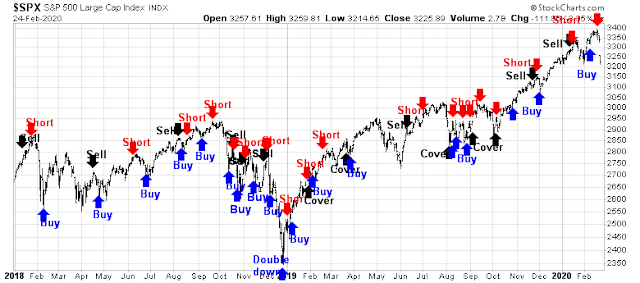

I should thank my lucky starts. i turned bearish last Wednesday (see Why this time is (sort of) different) and tactically shorted the market just as equities topped out, followed by today’s -3% downdraft.

As today proceeded, I fielded several inquiries from readers with versions of the same question, “Nice call last week. Is it time to buy, or are you covering your short?”

Where is the fear?

The short answer, is no. First of all, there were just too many people who seemed eager to either buy outright, or take profits in their bearish positions.

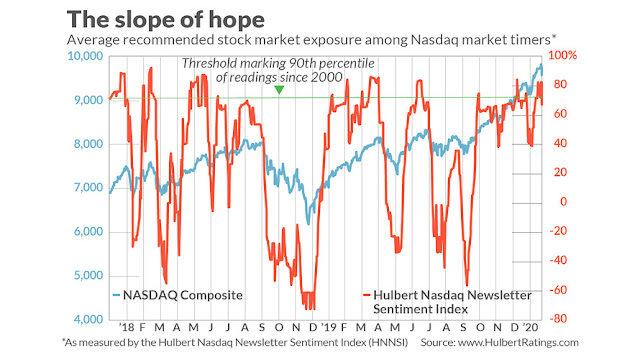

Mark Hulbert published an article this morning and by observing that his Hulbert Nasdaq Newsletter Sentiment Index had retreated from an over 90th percentile bullish reading to the 83rd percentile. That’s constructive, but hardly the sign of all-out capitulation.

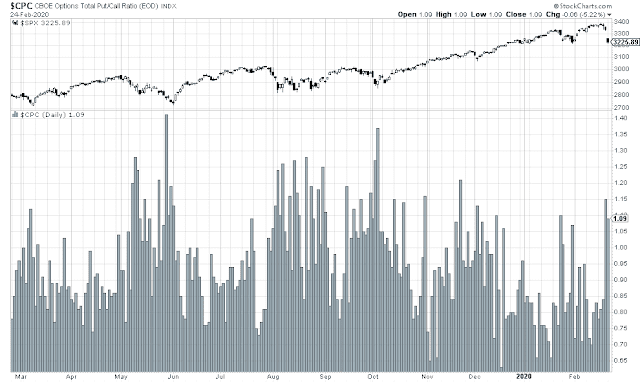

Option sentiment has also been very restrained during today’s sell-off. The CBOE put/call ratio rose to 1.09. While the reading is on the high side by historical standards, it seems unusual for a day when the stock market was down over -3%.

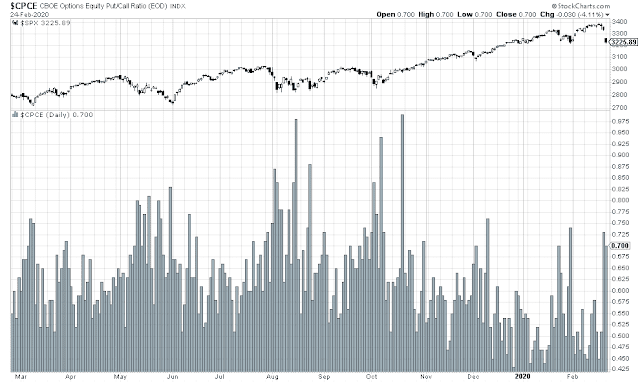

Similarly, the equity-only put/call ratio was only 0.70.

The Fear and Greed Index closed today at 29, which is useful as it shows a retreat in bullishness. Historically, the index has not made a durable bottom until it fell below 20.

Where is the fear?

A short-term bounce

As I write these words, overnight equity futures are strongly positive, and it appears that a bounce is under way. Short-term breadth is oversold, and a brief relief rally is no surprise.

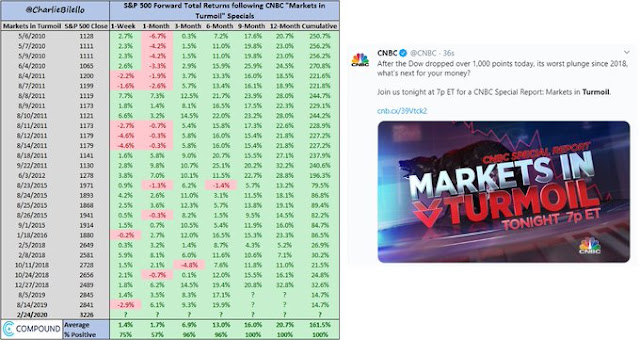

CNBC is also running a “Markets in Turmoil” program, which has historically been a contrarian bullish indicator (h/t Charles Bilello).

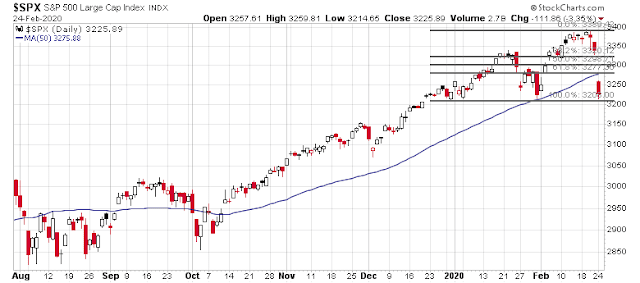

The first logical resistance can be found at the 50 dma at about 3275. In the current volatile environment, it would be no surprise to see the rally stall at either Fibonacci retracement levels of 3300 or 3325. As well, there is an enormous gap between 3275 and 3325 that could be filled.

I conclude from an analysis of sentiment that this correction is not over yet. Any rally should be regarded as an opportunity to lighten up positions for investment oriented accounts, or to short into for more aggressive trading accounts.

My inner trader remains short the market.

Disclosure: Long SPXU

De-globalization is the most powerful theme in the world.

https://thereformedbroker.com/2020/02/24/deglobalization-is-the-most-powerful-theme-in-the-world/

Demand for capital (to rebuild North American supply chains) will ultimately lead to a rise in the real rate of interest.

“to rebuild North American supply chains”. Interesting idea!

Instead of 19 times forward P/E one can now buy the S&P 500 at 18 times projected earnings. Assuming, of course, that the current earnings estimates remain in place, which is…ahem…optimistic. Europe is not going to lock down 60 million people like China did until they really have to.

Another great call!

I knew Cam would make the right call at the right time. Thanks, Cam. Just wish I had been able to take a larger short position. That’s on me.

BTW, the Dow Industrials are approaching their 200 day MA. The S&P, not so much.

Awesome call, Cam!

A -8% hit to the SPX is enough for me to reverse my stance and begin scaling into a few longs. Probably early – but that’s the way I see it.

I had to put my short position back on. I’m not comfortable with this weak rally.