This is a cautionary tale about the importance of return objectives and risk control. Regular readers know that while my trading model has not be perfect, it has been quite good for swing trading purposes.

So far in the month of October, my main trading account is up 7.1%, while the SPY is -7.1%. I don’t write this to brag, but to illustrate a point. A secondary account that trades the exact same signals, but uses a more aggressive leverage ratio, underperformed at 5.2%.

This brings up my point about defining return objectives and risk control.

Short is not the opposite of long

Let’s start with the basics. A short position is not the opposite of a long position. David Merkel at Alphe Blog correctly pointed out the key differences:

I hate to short, because timing is crucial, and the upside is capped, where the downside is theoretically unlimited. It is really a hard area to get right.

Last note, I didn’t say it in the article, and I haven’t said it in a while, remember that being short is not the opposite of being long — it is the opposite of being leveraged long. If you just hold stocks, bonds, and cash, no one can ever force you out of your trade. The moment you borrow money to buy assets, or sell short, under bad conditions the margin desk can force you to liquidate positions — and it could be at the worst possible moment. Virtually every market bottom and top has some level of forced liquidations going on of investors that took on too much risk.

Short sellers also have an extra portfolio construction problem when it comes to the dynamics of position sizing. If you are right in your short decision, you have to short more stock as the stock goes down in order to maintain that position`s percentage weight in the portfolio. This issue is especially acute when managing long-short, or equity market-neutral, portfolios. Otherwise, the sizes of the long and short positions will be off balance.

Bear markets are more volatile

Short-sellers who take a directional, rather than hedged bet, face a different problem. If you make a directional bet that a stock or an index will fall, you will benefit if the market is undergoing a bear phase.

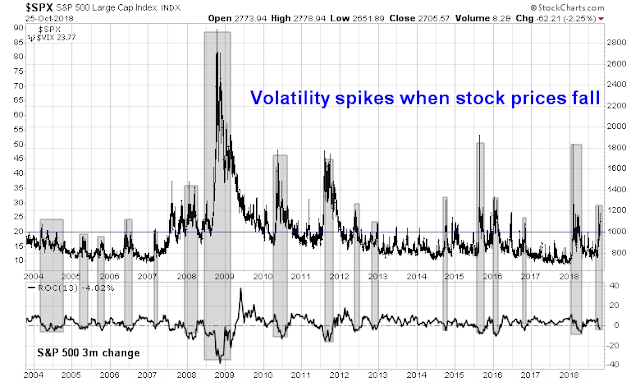

The follow observation may sound obvious, but bear markets are more volatile than bull markets. The chart below shows volatility, as measured by the VIX Index, has tended to spike when returns fall (bottom panel).

It was the higher volatility effect during bear phases that accounted for the lower return of the account that used a higher leverage. Even though the buy and sell decisions were mostly correct, the combination of slightly bad timing of a day or two early at inflection points, and the dynamic leverage varying trading system of the more aggressive account resulted in subpar returns.

This episode illustrates an important lesson for investors. Portfolio managers have two main decisions to make. What do you buy and sell, and how much do you buy and sell?

Both accounts had the same buy and sell decisions, but varied on positions sizing and timing. The main account took smaller positions, changed position sizes based decisions to either average down, or to selectively take partial profits. The more aggressive account took bigger initial positions, and found that when it came time to add to them, it was already at its maximum position size.

Sometimes less is more.

Lessons learned

My recent experience has led to several key takeaways:

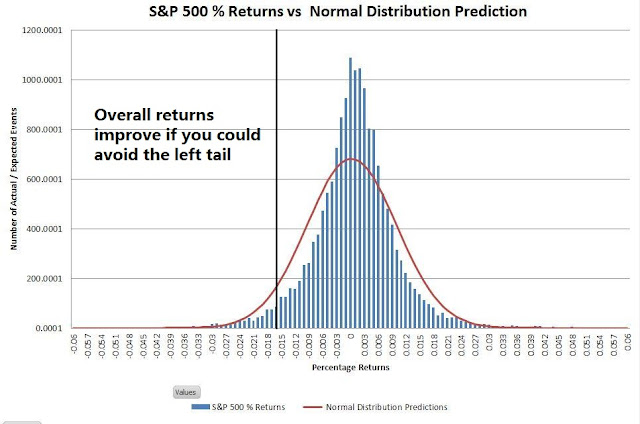

- Know your returns objectives: Investors need to know that outside of war and rebellion that cause the permanent loss of capital, equities perform well and a long equity position will yield superior returns in the long run. Under such conditions, investors can improve portfolio performance merely by sidestepping bear markets. In other words, some people don`t have to short the market. Holding cash, or an uncorrelated asset class like bonds, may be enough. You don’t have to be a hero and unnecessarily stick your neck out. It depends on your return objectives.

- Bear markets are more volatile: If you want to short the market, understand that even if you are right, the environment will be more volatile. Reduce your position sizes accordingly.

- Counter-trend position are riskier than trend positions: Traders can realize good profits on calling the primary trend. Counter-trend moves, by contract, tend to be more brief and therefore riskier. Adjust counter-trend positions in accordance risk levels.

Live and learn. I have re-aligned the risk management practices of the second underperforming account to conform with those of the first account.

How do both look on the year?

The second account doesn`t have a full year`s history yet.

Cam, that was a genius call yesterday afternoon. Congratulations.

You may have spoken too soon. Two hours later, the S&P futures are down below the open of the day… Wow.

As I pointed out before, it`s not unusual to see the market chop around for a few days after a Trifecta buy signal.

Allen, he got the call correct. Many were able (myself included) to partially peal off long positions today.

Indeed, the call and Cam are awesome. I was quite surprised by the drop AH. Live and learn I guess.

If this is just “chopping around” after the buy signal, today should be another opportunity to get long. Futures at 2664 as I’m writing.

But I’m wondering whether the trading model should have turned bearish again when SPX hit the trendline on the hourly chart ~2720 yesterday.

Friends

“Trading models” are fickle, as Cam has pointed out. Watch for capitulation type market action, where margin clerks force liquidation. Let us see if this happens today (Friday), after 1 pm. Watching VIX index (or TRIN), crack in the 30s and 40s. Some of the bigger pull backs have happened on Mondays, not Friday (Black Monday). A 1000-2000 point rapid decline in the Dow like in February would be good to shovel cash in the market. 2530 was the intraday bottom in February (the market closed that day at 2550); I do not remember the exact date. -300 points from the peak (-10%) on S&P 500 is where we are today at 2650. -600 points takes down to -20% or 2350.

Margin clerks got their act together right of the gate, with a 500 point loss on the Dow in the first couple of hours of trading. There was a lull, thereafter, with waves of selling. VIX index cracked up to 28 (nothing special); TRIN remains subdued for now.

This is twilight zone (1-53 pm EST). Let us see, how much more selling there is left by end of the day today and if Monday brings bigger sell off. We will be in the last week of October, with potential to close below the venerable 200 DMA.

Tuesdays are usually “turnaround Tuesdays”, but not sure this time, as Tuesday is not the last day of October. For now, we are just at -10%, market is basing around 2650, give or take. Need more fear.

Right on cue, after a teaser, -160 ten minutes ago, on DOW, we are now -400. Margin clerks have started. Spot VIX is only 26.65. Need more fear.

Let us see if we print -1000 on the Dow today.

3 PM EST

Since Oct 17th we are trading in a downtrend channel which indicates that we should be losing about 20 SPX points per day.

Cam

Thanks for summarizing “Lessons learned”.

Her is what I would add to the bell curve of returns on the S&P 500 : On an average day, $&P 500 trades between +/-1%. Close to 98.5% values are +/-2%. I think this data is from Professor Shiller’s book Irrational exuberance, if I remember correctly.

I am curious what instrument you are trading for a more aggressive leverage. Thanks,

I bought today at 2630 on ES, we may test there area again before a relieve bounce to 2750 area and then final dump

My believe is that the market is not done with FAANG stocks yet, FB reporting on Tuesday and Apple on Thursday. The disappointing guidance from GOOG and AMZN leave the FAANGs vulnerable and confidence in those stocks has still not really been tested. While disappointing FB numbers may lead to short-term volatility, but is somewhat baked in, an AAPL miss may lead to bulls throwing in the towel. I simply believe that AAPL results are of such importance that any directional bets on the indices at this point in time remain “dicey”.