Ahead of the Second Gulf War, Secretary of Defense Donald Rumsfeld famously referred to “known knowns”, “known unknowns” and “unknown unknowns” when responding to a question about Iraqi weapons of mass destruction.

Fast forward to 2025, investors have to contend with a series of known unknowns and unknown unknowns as they consider their investment policy in an environment where global economic uncertainty has skyrocketed to an all-time high.

Here are some known unknowns to consider:

- What are the objectives of Trump’s negotiations and how far is he willing to go?

- When will the chaos subside enough that companies can plan and respond to the changes in tariff regimes?

- Will the U.S. economy fall into recession?

Here are some unknown unknowns to consider:

- Have the USD and Treasury securities permanently lost their position as safe havens?

- How much damage has been done to the post-World War II security and financial architecture?

The Negotiations Begin

The markets staged a relief rally on the news that “reciprocal tariffs” would be paused for 90 days for all countries except China and USMCA members Canada and Mexico as the U.S. negotiates with over 70 countries. Investors should expect elevated levels of volatility in light of the tight timeline. The WSJ reported that the main objective of the trade negotiations is to gather allies against China. Not only does the U.S. want to raise a tariff wall against China, the U.S. wants to prevent the diversion of Chinese exports to the U.S. through third countries.

It’s unclear whether the negotiation strategy will be successful. America’s allies are in shock over Trump’s initial moves against Canada and Mexico, his desire to annex Greenland, his tilt toward Russia in the Russo-Ukraine War, his characterization of the European Union as an organization designed to “screw us” and calling the U.S.-Japan relationship “one-sided” even as negotiations begin.

The attack on allies has produced the perverse effect of pushing them away from the U.S. and toward closer relations with China. Ursula von der Leyen, President of the European Commission, spoke with Chinese Premier Li Qiang about closer trade relations. Representatives from Japan, South Korea and China met and vowed to strengthen trade relations. Xi Jinping visited Vietnam as was warmly greeted as China and Vietnam signed over 40 trade deals.

The response shows the limitations of Trump’s negotiating style. Instead of the usual win-win negotiation tactics normally used in trade discussions, a

WSJ editorial characterized Trump’s win-lose approach creating fear to use as leverage: “Creating fear is his go-to strategy for inducing people to comply with his wishes. If threats don’t suffice, he moves against vulnerable individuals and institutions, making examples of them to terrify others into obedience.”

Such an approach doesn’t always work: “Although some smaller countries such as Vietnam are offering concessions to ward off the president’s tariffs, others — including giants such as China and Canada — have already responded with countermeasures, and the European Union also is preparing a firm response.”

In addition, recent events have revealed some of Trump’s pain points. The recent bond market tantrum forced Trump to soften his stance and seek an off ramp by rolling back and pausing “reciprocal tariffs” for 90 days. China’s ban on certain rare earth exports and its halt of Boeing aircraft deliveries will cause significant pain.

An Abysmal Outlook

As a consequence, companies are pausing their expansion and hiring plans in the face of the growing uncertainty. Blackrock CEO Larry Fink recently stated: “Most CEOs I talk to say we are probably in a recession right now. A couple of airline CEOs told me, and one CEO specifically said, ‘The airline industry is like a proverbial burden, a canary in a coal mine.’ I was told that the canary is sick already…I do believe we’re probably starting, if not already in, a recession.”

While some companies have declined to offer guidance during Q1 earnings season, it was remarkable that UAL offered guidance on its earnings report based on two scenarios, stable bookings and recession.

The soft survey data points to an abysmal outlook. The New York Fed’s survey of regional manufacturers show new orders at the lowest level of its entire history.

A detailed analysis of every component of the survey, such as new orders, shows that employment is going down, with the exception of prices (received, and paid) which are going up.

As Q1 earnings season begins, the Citi U.S. Earnings Revisions Index is deeply in the red.

The Recession Question

Against this backdrop of uncertainty, investors have to ponder the question of whether the U.S. economy will plunge into recession. Historically, non-recessionary bear markets tend to be shorter and experience milder drawdowns than recessionary bear markets.

I believe it’s too early to tell. Trump’s abrupt tariff announcement was an exogenous shock whose effects have yet to be fully felt by the economy. The soft survey data is plunging and the fall has the potential to create a negative feedback psychological loop. However, the hard data hasn’t meaningfully declined.

Early indications are not encouraging. The Citi U.S. Economic Surprise Index, which measures whether economic data is beating or missing expectations, resumed its decline after a brief upward reversal.

The latest University of Michigan survey of employment expectations has been weak, and readings in this survey have historically led the unemployment rate. The concerns over employment may lead to a market hyper-focus on the weekly initial jobless claims data, much in the manner the market focused on weekly money supply reports during the Volcker Fed’s tight money era of the early 1980s.

The latest BoA Global Fund Manager Survey shows that a recession is now the consensus call at 49%.

For a snapshot of the recession question, I turn to New Deal democrat, who has been monitoring the state of the economy using a series of coincident, short-leading and long-leading indicators. To make a long story short, he is relying on the hard data to make a recession call:

The long leading indicators remain neutral, despite the sharp un-inversion of parts of the yield curve, including a sharp “bear steepening” at the long end. Unless something significant changes, corporate profits are likely to tip the balance within several weeks.

The short leading indicators, which were positive only two weeks ago, are now negative, as commodities, financial stress, and gas usage have all turned negative, while stocks remain neutral despite their gyrations.

The coincident indicators remained positive, mainly because consumer spending has held up. There may be evidence of frontrunning tariffs in the sharp increase in rail traffic.

I anticipate that sharp reversals (and re-reversals) in Washington will continue to drive the news cycle. The new 40 year low in consumer confidence is very concerning, but in the past it has usually taken several quarters for that to manifest in actual consumer and producer retrenchment. As usual, the hard data will tell, and the high frequency data will tell first.

In a separate blog post, he elaborated on the weakness of the short leading indicators and why he isn’t on recession watch yet:

I would want to see some spreading out of weakness from the financial and interest rate data into the “hard” economic data before a ‘recession watch’ would be warranted.” The strength of the current hard data has been affected by consumers and companies purchases to front-run tariffs. Investors will need until the May–July time frame to assess the true picture after the pre-stocked inventory has been depleted.

The Unknown Unknowns

Finally, investors have to ponder the “unknown unknown” questions, which are:

- Have the USD and Treasury securities permanently lost their position as safe havens?

- How much damage has been done to the post-World War II security and financial architecture?

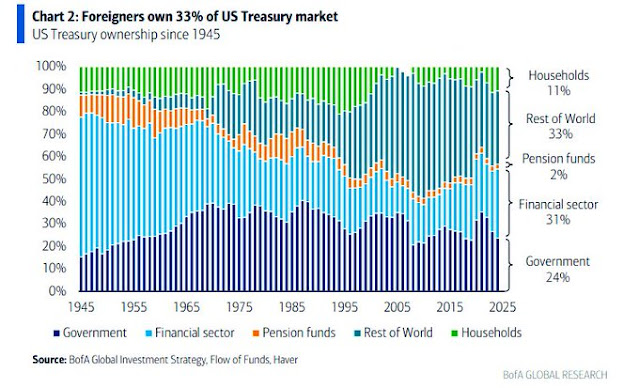

The recent bond market tantrum, which saw Treasury yields spike and a decline in the USD, was unusual inasmuch as investors have usually rushed into USD and Treasury assets as safe-haven trades during periods of market stress. The latest episode saw the opposite effect of a rush away from these assets.

What caused the bond market sell-off? A MarketWatch article reported that how Fidelity portfolio manager Mike Riddell rounded up and questioned the usual suspects:

I always thought that “unknown unknowns” were things where you couldn’t really ask the question because one could not focus on what to ask.

Although sci-fi has gone over many things, I would consider extra-terrestrials landing and taking over as an unknown unknown.

Maybe we need a category of “don’t know” and “really don’t know” but unknown unknowns is classier.

All this talk about loss of trust in the US dollar. Remember Nixon? Closing the gold window did not end the USD even though we abused it.

What is it about currency? It’s about people agreeing to use it and not expecting it to vanish overnight. Some things have been done overnight like seizing Russian treasury holdings, and dramatic tariff changes, but the legacy of USD denominated debt worldwide means that the USD will continue to be used in trade. How does one liquidate as USD debt to convert it to euros? My thinking is one has to buy USD with euros to pay off the debt which would make the USD go up in price, which would make the debt harder to pay off.

But we are in for volatility.

One of the things we overlook, or at least the media does is the binary nature of transactions.

So for example, last week the price of gold futures went up on higher than average volume. If I said it was because there was a lot of selling, many would call me stupid, but all those buyers needed sellers. The media won’t say that gold was up strongly because there were a lot of sellers, they will focus on one side. It is more about the balance between what price buyers are willing to pay and what sellers want to sell at.

So what if because of all the uncertainty the buying demand increased for gold. What if whoever sold the gold in USD wanted euros instead? This would depress the USD and raise the euro.

I’m not saying that this is what happened.

Also, who benefits from volatility is the writer of puts and calls. Is it just coincidence that we now have ODTE options where the premium is so high?

The lions are chasing the gazelles that are running around in panic until one makes a mistake, volatility Serengeti style.

Don’t buy on margin.

Cognative Bias is when we prefer an outcome and read things accordingly into evidence. The evidence above is that a Recessionary Bear Market falls 36.6% over a painful 16 months. Very nasty. We don’t want that so even though the evidence is overwhelming that the hard economic data will soon fall off the cliff the soft data is already exhibiting, we hope that the bear isn’t coming.

But the new orders data being at the lowest point in history is OBVIOUSLY showing the economy will be dropping off a cliff. Orders cause purchases and sales. Those are hard data coming for sure.

I believe one must honestly discount one’s own congnative bias to come up with the real outlook. With me, reality is a deep recession, possibly epically deep.

Here is a stat that surprised me. 70% of Walmart sales are of products made in China. I tried to plug that into a narrative as to what might that cause, and could only come up with ‘Holy Crap!”

and 80% of products sold on Amazon.com are made in China.

I hear China is starting to feel affects of the tariffs as well. I am sure Vietnam and China can improve their relationship but both are geared towards exports, primarily to US and Europe. They have to come to the table. Known but time is unknown.

I wish there would be a comprehensive evaluation.to fully understand the risks.

BTW, attended presentation by JPMorgan on Thursday. Base case currently is growth scare, no recession.

To me the “Knowns” are;

Trump calls himself “Tarriff Man” for a reason. It appears that he fundamentally believes that tariffs are the way to MAGA and Trump 2.0 has shown little hard evidence that he has changed his position on this. The only reason he recently “paused” on tariffs was because of the Bond market tantrum.

The “Unknowns” are ;

How hard is Trump prepared to go to achieve his objective? We will see over the next couple of months. However, for all his faults Trump has shown himself to be one who can withstand immense pressure so he will probably try to implement significant tariffs because to do otherwise will go against his underlying philosophy. This is his last chance to do it. It is now or never. He has already said to be prepared for some “pain” ahead (though I don’t recall him saying this during the election campaign).

For me, the known unknown is how Trump’s Liz Truss Moment would actually play out. Liz’s economic policy was central to her premiership; once abandoned, she had to go. It won’t happen like that for Trump.

It’s pretty obvious the market does not sanction Trump’s buffoonery, but what does that mean? He declares victory, abandon tariffs and hopes his party doesn’t get decimated in the Mid-Terms? Performative politics worked well enough for him in the first term — MAGA can’t really say what he actually did back then, but the main things for them is owning the Libs, anyway.

Or will he do what he has insinuated: default? That would be the unknown unknown. Quite unprecedented for the U.S., but conceivable, and would have the advantage he could declare a national emergency and halt the Mid-Terms.

His experience as a businessman is that if you’re big and powerful enough, people will invest in you even after multiple bankruptcies. It certainly follows the Perónist Argentina playbook, which to my mind has been pretty valid until now.