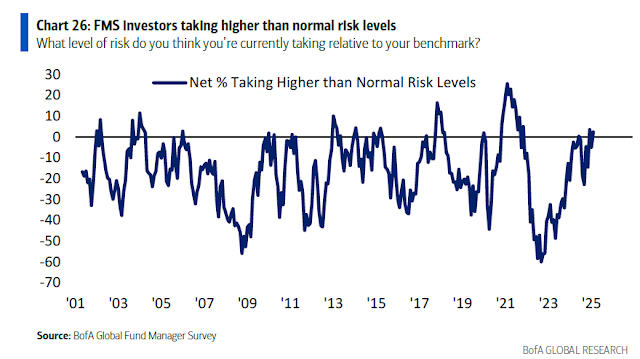

Mid-week market update: The results of the latest sentiment surveys argue that this is a time for caution. The BoA Global Fund Manager Survey shows cash at a 15-year low.

The institutions are all-in on risk. Who’s left to buy?

A Charles Schwab survey of client accounts show that cash levels are near historical lows. If institutions and retail are all-in, who’s left to buy?

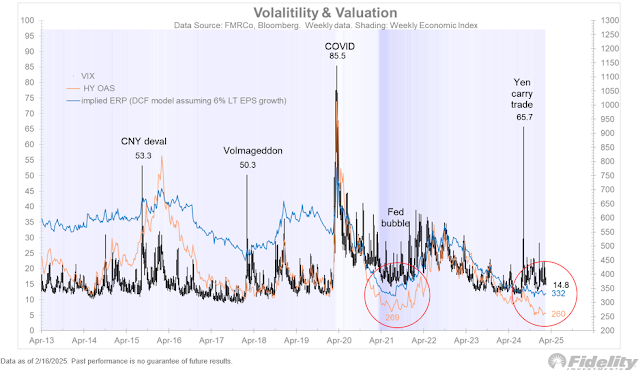

Following election day, [price] discovery went vertical, but by now the pro-growth story has been priced in, while some of the potential negatives are being ignored (the CPI report and tariffs being two examples). As a result, sentiment is bullish, credit spreads are narrow, the equity risk premium (ERP) is in the 10th decile, and the VIX is at 15. The market appears to be priced for success.

Keep in mind that these are only “this will not end well” warnings, which are condition indicators and not trading indicators. Over in the bond market, junk bond yields are low, but show no signs of stress. While this may be an accident waiting to happen, we have no idea of what the accident might be.

The BoA Global Fund Manager Survey shows that risk appetite is elevated, but readings are not wildly overbought. Stock prices could go higher from here.

With positioning so bullish, the greatest risk to the market occurs when sentiment starts to reverse from an extreme, which is the pattern traced out by Callum Thomas’ Euphoriameter.

In the short run, my anticipated price reversal hasn’t happened yet. The S&P 500 made another marginal new all-time high today, but breadth participation continues to be weak. At a minimum, I am not inclined to chase this rally.