Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “

Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post,

Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The

Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found

here.

My inner trader uses a

trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly

here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)

- Trend Model signal: Neutral (Last changed from “bullish” on 15-Nov-2024)

- Trading model: Neutral (Last changed from “bullish” on 17-Jan-2025)

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Which index should you believe?

It is said that there is nothing is more bullish than higher prices, but this time may be different. Even as the S&P 500 staged an upside breakout from a wedge formation and it’s on the verge of testing overhead resistance, the equal-weighed S&P 500, which gives higher weight to the smaller stocks in the index, is barely holding at the 50 dma. The mid-cap S&P 400 and the small-cap Russell 2000 are trading below their respective 50 dma.

Which index should you believe? These manifestations of weak breadth makes me nervous that the latest rally may represent a last hurrah for the bulls.

MarketWatch reported that Goldman Sachs strategies Scott Rubner attributed the price strength to a retail buying stampede, but added, “This is the last bullish email that I will send for Q1 2025 as the flow demand dynamics are quickly changing, and we are approaching negative seasonals.”

In addition to the negative breadth divergence, I am seeing other divergences everywhere.

Negative divergences

Consider the weekly chart of the S&P 500. Even though the index is advancing in a well-defined channel, the 5-week RSI is exhibiting a series of lower highs, which is an indication of weak momentum.

It’s also highly unusual to see the S&P 500 challenging the new highs while the percentage of S&P 500 stocks above their 200 dma fall to 60%. In the past, similar losses of price momentum have been signals of market corrections.

Equity risk appetite indicators are also flashing negative divergences. Both the consumer discretionary to consumer staples ratio and the high beta to low volatility ratio are flashing negative divergences.

The relative performance of defensive sectors are all either bottoming or turning up, which is a warning that the bears may be about to take control of the tape.

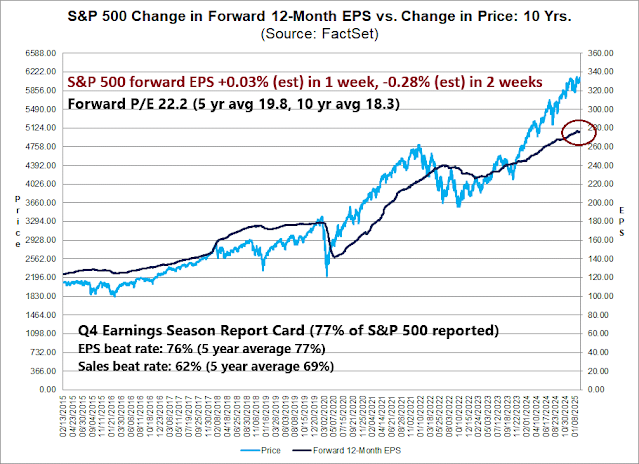

Q4 earnings season is mostly over. Both the EPS and sales beat rates are below average. Forward EPS revisions are stalling. Revisions were flat over one week and negative over two weeks, which is indicative of weak fundamental momentum.

Another worrisome development is the violation of the S&P 500 December lows in early January. Ryan Detrick of Carson Investment Research found that market returns have been subpar in such instance, though they don’t signal outright bear markets.

Waiting for the bearish catalyst

Putting it all together, the technical structure of the stock market points to an impending correction. I just don’t know the nature of the bearish catalyst. The most likely culprit is a negative reaction to Trump trade war news.

On one hand, the USD weakened in February, indicating that the market believes that Trump is either bluffing on his tariff threats or using tariffs as a negotiation tool as the latest announcements contained no specific timetable for implementation. On the other hand, Trump factors show that companies with domestic revenues are outperforming, indicating tariff anxiety, as well as rising inflation expectations from tariff implementation. In addition, the

Washington Examiner reported that the Trump Administration is penciling up to $1 trillion in additional revenues from reciprocal tariffs, which amounts to a gargantuan sales tax increase as 2024 goods imports was $3.3 trillion.

In conclusion, even as the S&P 500 tests overhead resistance at its all-time high, I am seeing negative divergences everywhere. I interpret this as a market poised for a corrective pullback. The most likely bearish catalyst is a negative reaction to a Trump trade war announcement. Market internals show that investors are discounting both rising trade war tensions and inflation expectations.

Hello Cam, I hope you are well! IF you had to guesstimate, would you forecast this interpretation of divergences to be the start of a typical 5 to 10% correction or a beginning to a cyclical bear?

Thanks

I’ve done a study of investment areas from the Presidential Election date to the Inauguration and then the Inauguration Day to now.

Very different picture. From the election, International markets were very weak along with their currencies. From the inauguration a total flip-flop with them strong. Only Tech heavy NASDAQ 100 is strong in America. The other American areas are poor post-inauguration.

Does this mean investors were too worried about Trump tariffs coming at the huge levels of his campaign and now see a lesser amount after inauguration?

But we don’t know the final picture. It could be anything. Current relief by international and American investors could turn negative when the full tariff story is told.

The biggest tariff country, India has seen its stock market the weakest and Modi’s visit to the White House didn’t help.

BTW read an interesting article about peace in Ukraine could have cheap Russian natural gas imports reinstated pushing out American LNG to cause a glut in America. Nasty for the energy stocks.

In other words, nobody knows. Short-term is all about positioning, and pros are required to front-run based on their analysis and expection. For non-pros when in doubt doing nothing is always better than doing something/anything. The market trend is getting more and more less volatile overall because the flow is now dominated by pasive/index investing. And there are flows regularly into markets because of retirement accounts. The other source of flow is home office. It is a big source and they tend to be more conservative like Buffet style.

Overall the world from now on is going to be very different. Wholesale globalization is over. America is heavily in debt. China is heavily in debt. Just about every country is seriously in debt. It is a reshuffling period of indeterminate length and largely unknown ramifications. Agressive export-driven countries like China will be met with retaliation. It is simply a matter of national survival.

For technical analysis, some indicators are becoming less reliable. So I just sit and watch and try to make sense of what’s happening.

Well, I think few will argue that the market these last 2 years has done remarkably well, actually since the Covid lows it has close to tripled.

This makes me think of how the bear should be, a steep terrifying plunge. The bear should not be a sideways move, unless you look at 35 years of the Nikkei as a sideways move, or the Dow from 1929 to 1955 as a sideways move.

What we don’t know is when. Maybe we melt up to insane levels before the crash. Maybe it won’t happen for years, but it will happen.

It will happen because at some point big money will move elsewhere.

Holding on to big winners is hard during the shaking out of the weaker hands. Buffett has done well in part because he buys when the price is good , he buys on fundamentals and holds based on fundamentals.

Personally I think value is to be found in things we use like food, commodities, energy. Will something replace I-phones, pc’s , Microsoft office, Netflix, bitcoin? Maybe but what will replace copper wiring, steel , aluminum, etc. Somebody may disrupt toasters, but whatever ceramic or composite it is made of will need an energy source and distribution to toast your bread, and I bet copper will be involved.

When you look at commodities compared to the S&P, they are cheap, definitely as a group not exciting yet. That’s a bit like the system of buying the “dogs of the dow”, and when things are cheap they are boring and can stay cheap for a long time.

If you can find a good commodity or staples based stock with a decent yield in a good jurisdiction, buy it, accept the yield and forget about it for 20 years. Like Buffett when his coke dividends were more than what he paid. Or buy something like NFLX and plan to get your money back by 2225, unless you really believe someone will pay you a lot more for it within the next few years. We are all gamblers.