Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “

Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post,

Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The

Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found

here.

My inner trader uses a

trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly

here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)

- Trend Model signal: Neutral (Last changed from “bullish” on 15-Nov-2024)

- Trading model: Neutral (Last changed from “bullish” on 03-Dec-2024)

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Stubborn inflation

Investors heard some good news and bad news from the inflation reports last week. The good news is monetary policy is still too tight. The Fed Funds rate (black line) is too high compared to core inflation metrics and need to fall. The bad news is inflation progress to the Fed’s 2% appears to be stalling. Inflation is facing a last-mile problem of getting to 2%.

This environment is setting up conditions for a hawkish rate cut at the December FOMC meeting. While the Fed is widely expected to cut rates by a quarter-point, it is also likely to signal a slower pace of future cuts.

The last-mile inflation problem

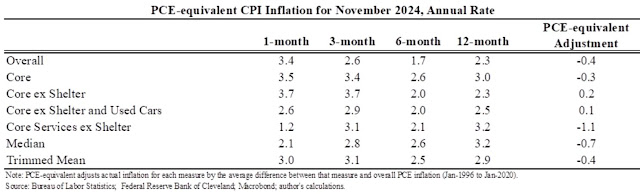

Inflation seems to be facing a last-mile problem of reaching the Fed’s 2% target. Markets breathed a sigh of relief last week when November core CPI came in at market expectations, but it took a risk-off tone when PPI came in slightly hotter than consensus. With both CPI and PPI reported, estimating November core PCE, which is the Fed’s preferred inflation metric, is relatively easy as the weights and components of PCE are known. The Cleveland Fed’s nowcast of monthly November core PCE is 0.26%, which is roughly unchanged from October. This makes three consecutive months that disinflationary progress in core CPI and core PCE has stalled.

Diffusion indices of inflation are heating up. Viraj Patel observed that inflation breadth, as measured by the percentage of CPI baskets running at inflation above 2.5%, rose sharply in November.

Jason Furman also pointed out that the CPI-based Ecumenical Underlying Inflation Measure, which includes the median of seven different inflation metrics, rose from 2.2% in August to 2.6% in November.

While the Fed is widely expected to cut rates by a quarter-point at the December FOMC meeting, the market now expects a far gentler pace of cuts in 2025. It is now discounting only two quarter-point cuts next year, which may set up potential conflicts with the Trump White House.

If Powell were to signal such a hawkish pivot, will it rattle the market’s risk appetite?

A small-cap honeymoon?

Here is what I am watching for clues of market risk appetite.

Small-cap stocks often enjoy an electoral honeymoon upon the election of a new president, as hopes for the new administration ramp up into Inauguration, only to be sobered by the realities of governing. Here is the price pattern of the Russell 2000 in 2016 when Trump first won office.

Here is the Russell 2000 in 2020 when Biden won.

While small-caps are supposed to rally into year-end and beyond this year, somebody forgot to tell them. If risk appetite were to continue to expand, I would like to see small-caps outperform.

That said, 2024 is an unusual year inasmuch as the stock market exhibited strong gains, which limits the potential for year-end tax loss selling that tends to have an outsized effect on smaller stocks. Instead, we saw price momentum reversion last week, when winning stocks were sold and losing stocks were bought. The price momentum reversion effect can probably be explained by hedge funds squaring and flattening their books in December after a successful year.

Until the unwind is over, it will be difficult to ascertain risk appetite. I am seeing some early signs of stabilization, which is a prerequisite to a year-end rally.

Constructive for a year-end rally

I am constructive on the short-term outlook for a year-end rally. Overall risk appetite indicators, such as the relative performance of junk bonds and the ratio of high beta to low volatility stocks, are supportive of a further equity advance. My base case is an equity rally into year-end, but I would like to see confirmation from better relative performance of high-beta small-cap stocks.

Estimate revisions are positive, which is an indication of positive fundamental momentum.

Banking system liquidity has ticked up. The U.S. Treasury will likely have to begin extraordinary measures to maintain liquidity ahead of the expiry of the continuing resolution to fund the government in January. This will provide a temporary boost to banking liquidity, which is a tailwind for stock prices.

A review of the returns of value and growth shows that value has rebounded against growth in all market cap bands and internationally, except for U.S. large caps. The narrowness of the large cap growth dominance may be a sign that small caps will also outperform into year-end.

After the S&P 500 consolidated sideways after its upper Bollinger Band ride, it is oversold on the NYSE McClellan Oscillator and percentage of S&P 500 stocks above their 20 dma. Of the five similar episodes in the past year, four resolved in bullish rebounds.

In conclusion, the continued lack of disinflationary progress in the November CPI and PPI reports is setting up conditions for a hawkish rate cut at the December meeting. While the Fed will undoubtedly cut by a quarter-point, it could signal a slower pace of cuts in 2025.

The big question is how this affects overall risk appetite. Elections of a new president often sets up a honeymoon period characterized by small-cap outperformance, which has been somewhat lacking this year. As well, indicators of risk appetite have been buffeted by a probable period of hedge fund profit taking by the sale of price momentum winners and short covering of losers. My base case is a rally into year-end, but I would like to see confirmation from better relative performance of high-beta small-cap stocks.

Interest rates are too high for small companies to expand business plans meaningfully. That’s where Trump and Powell might get into disaggreement. The overall competitive environment is not very friendly to small companies where inflation is everywhere. A lot of regulations need to go and some incentive from gov might be needed. The labor market is in low hire/low layoff mode, basically too stagnant to absorb all these new college graduates. Something needs to happen to improve the overall picuture. Meanwhile US large caps will continue to outerperform.