The latest University of Michigan sentiment survey is out, consumer sentiment surged in the wake of Trump’s victory.

A similar improvement in sentiment can be seen in the New York Fed’s consumer survey.

In the wake of Trump’s win, it was no surprise that the partisan lean in sentiment flipped. Republicans are far more optimistic and Democrats are more pessimistic. However, consumer sentiment of independents edged up.

High expectations

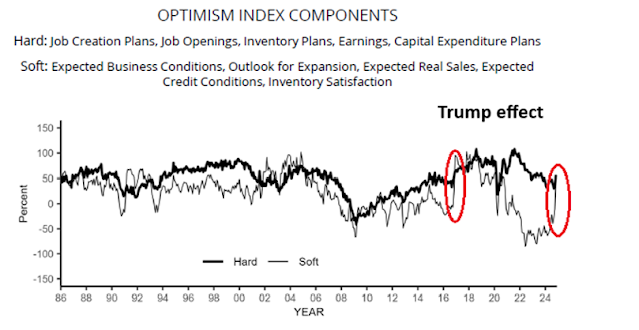

The partisan lean in sentiment is highly visible in the NFIB small business sentiment survey. NFIB small business members tend to be small-c conservative and lean Republican. The latest survey, which was taken just after the election, shows a surge in soft expectations-based sentiment while hard sentiment barely budged. A similar surge in soft sentiment can be seen in after Trump’s first win.

A similar pattern can be seen in the sales survey, which tells the story that “sales are steady but Trump will make everything right”.

The prospect of a Trump honeymoon was also embraced by the investing public, though bullishness was already in evidence even before the election. The Goldman Sachs Social Media Economic Sentiment has surged to levels not seen since 2019.

Flows into U.S. equities in November were the highest since 2000, the NASDAQ bubble peak.

The reading of Callum Thomas’ Euphoriameter, a composite sentiment indicator, is now off the charts.

Things you don’t see at market bottoms

Long-time readers may recall that I began a series during the summer of 2017 called. “Things You Don’t See at Market Bottoms”. At the time, I wrote that I wasn’t calling for a top, but excessively frothy sentiment was a warning for investors. The market didn’t top until early 2018.

It’s happening again.

The market became very excited when Roaring Kitty, the trader who sparked the meme stock explosion in GameStop, tweeted a cryptic message, which began a stampede into AI-plays.

Another sign of market froth can be found in the resurgence of memecoin mania.

Crypto News reported that the coin LUIGI, which was inspired by the arrest of Luigi Mangione, who was arrested in connection with the murder of UnitedHealthcare CEO Brian Thompson, soared to a market cap of $60 million.

Interactive Broker founder Thomas Peterffy posted the following tweet warning about the current stock market and credit conditions, which he later deleted.

These are things you don’t see at market bottoms. I would caution, however, excessively bullish sentiment is a condition indicator and not a trading signal. Frothiness is only a warning, and investors should monitor market conditions for technical breaks, which are not evident (see my recent publication

2025 Outlook: Cautious, But Not Bearish).The forward P/E of the S&P 500 is very elevated, but forward P/E ratios are not very predictive of returns on a one-year horizon, though they can be predictive at longer time frames. Investors should be prepared for historically subpar returns in the long run, and watch market conditions for downside breaks before positioning their portfolios defensively.

Tactically, I would monitor if market technical and sentiment conditions progress in January. The Republican-controlled House will have a razor-thin two seat majority whose first task is to pass a continuing resolution to fund the federal government. That’s when the hopes of the honeymoon give way to the realities of governing. How the Republicans deal with those initial budget challenges could distract the new Trump Administration from its other signature pro-growth initiatives, such as deregulation and the extension of the TCJA tax cuts.

One thing I have struggled with is confirmation bias. It is how we fool ourselves. We believe what we want to believe.

So, I think that there is a mass confirmation bias going on that Trump will “fix” things, because people want that to be true. “Make my problems go away!”

It might be more like trying to do “speed Jenga” near the end when things get tippy, or remodeling a castle of cards.

You can hack a million jobs out of the gov’t workforce but where do they get jobs?

Perhaps this is a case of “be careful of what you wish for, you might just get it”

I think we will look back and the top will be obvious.

Hey Cam, can you play Santa and give me a gift? No, nothing like a free subscription, but a comparison of the Japanese bubble of the 80s with the present bubble. They did similar things with interest rates, and of course real estate went nuts, and the nikkei went crazy. The thing which makes history rhyme is the human behavior so there could be parallels. No use for timing of course.

Peterffy makes a lot of sense and the way IB is operating is very different from other brokers. The speed of liquidation at IB is lightning fast at real time. It is a 24hr operation and is trading around the world. Margin requirement is calculated at real time. Some gun ho guys got liquidated while they were sleeping. There are no phone calls. Their margin interest is way lower than other brokers and usually at 15% loan maintenance requirement. It is suitable for disciplined and knowledgable traders/investors. Many experienced pros use IB service. Everything there is very math-oriented. I really like their execution and API design.