In the wake of Biden’s subpar debate performance and the assassination attempt on Trump, the prediction markets’ odds of a Trump victory in November have substantially risen. Equally important is Wall Street’s reaction, which has investors sitting up to take notice of the implications of a second Trump Administration in 2025.

Despite the real-time information from the betting markets, financial markets haven’t fully discounted the possibility of a Trump win. Here’s how you can take advantage of that arbitrage opportunity.

Trump 2.0 macro effects

Donald Trump sat down with

Bloomberg Businessweek for a wide ranging interview. Here are the key points, covering the Fed, trade and tax policy.

Starting with the Fed, Trump said that he would allow Fed Chair Jerome Powell to serve out his term, which ends in May 2026, but “if I thought he was doing the right thing”. The

Financial Times also reported that Trump warned the Fed to avoid cutting interest rates before the election. While the headline that he wouldn’t fire Powell was designed to calm markets, the qualification of “doing the right thing” and attempts to strong arm current monetary policy could create instability.

These comments puts the Fed in a difficult position. The markets is putting the odds of a September rate cut as a virtual certainty in the wake of softer-than-expected inflation data. The September cut would be followed by further cuts in November and December. Fed officials will need to push back against that dovish interpretation if they don’t want to surprise the markets.

On trade, Trump called for new China tariffs at a rate of between 60% and 100%, and would impose a 10% tariff on imports from other countries. A new economics paper modeled the effects of a 10% across the board tariffs on imports and 60% on China. It concluded “across-the-board tariffs do not protect manufacturing jobs because the cost of imported intermediate goods increases, raising costs in manufacturing production” and “the world economy can adjust to U.S. trade wars, diverting trade around the U.S.”

Goldman Sachs chief economist Jan Hatzius stated at the ECB’s Sintra conference that a 10% tariff could spark trade war retaliation which raises the U.S. inflation by 1.1% and forces the Fed to into five quarter-point rate hikes.

In addition, Trump’s threat to restrict immigration and deport undocumented workers will act as a supply shock to the labour market. This will put additional upward pressure on wages and push inflation upwards.

On taxes, Trump told Bloomberg that he aims to cut corporate taxes to 15%, though he admitted that objective may be overly challenging and he would accept a 20% rate “for its simplicity. He will also extend the 2017 Tax Cuts and Jobs Act.

On one hand, this should provide a fiscal boost to the economy. On the other hand, it will add to the fiscal deficit. A

study of the effects of 2017 legislation found that the reduced corporate tax rates did increase domestic investment by 20% and investment by foreign firms substantially. However, the tax cuts did not pay for themselves and raised the deficit by an extra $100 billion per year.

In short, Trump’s plans are inflationary. A

WSJ survey of economists found that 56% believed inflation would be higher under another Trump term than under a Biden term. In particular, any attempt to interfere with Federal Reserve independence could send financial shockwaves around the world in light of the reserve currency status of the USD.

On the other hand, Trump voiced his desire for a lower USD in the interview.

I think manufacturing is a big deal, and everybody that runs for office says you’ll never manufacture again. We have currency problems, as you know. Currency. When I was president, I fought very strongly and hard with President Xi and with Shinzo Abe… So we have a big currency problem because the depth of the currency now in terms of strong dollar/weak yen, weak yuan, is massive.

A government that strong arms the Fed to lower rates in the face of inflationary pressures would have the unwelcome effect of tanking the greenback as confidence on its status is eroded.

Discounting Trump 2.0

While the Bloomberg Businessweek interview and details from the Republican platform reveal the intentions of a Trump Administration, investors need to understand the new administration’s actual plan of action.

The easiest policy to implement would be the extension of the 2017 tax cuts. The BoA Global Fund Manager Survey found that the policy areas most affected by a Trump win would be trade, followed by immigration.

Global managers also believe that a sweep, which would likely be a Republican seep in light of the electoral outlook, would be inflationary that resolves in higher bond yields.

What about the stock market? Reasonable people can disagree on the growth outlook under Trump 2.0, but it is undeniable that investors face more challenging valuations today compared to Trump 1.0. When Trump first took office, the S&P 500 was trading at a forward P/E of 16, compared to over 21 today. Stock prices could face additional headwinds if bond yields were to rise, which would also put downward pressure on valuation.

How is the market reacting to all this?

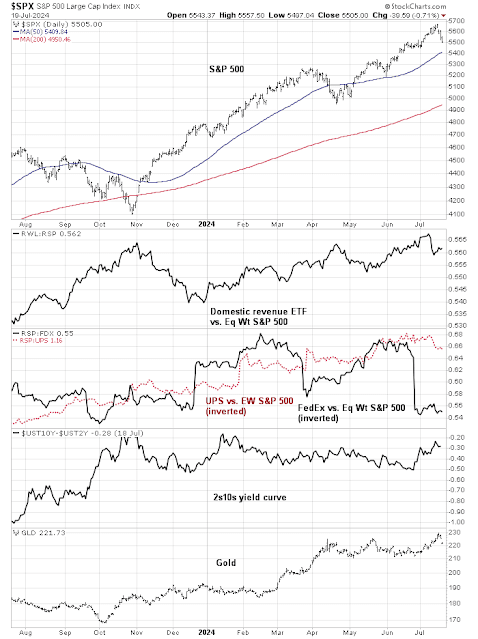

It’s been a bit of a mixed bag. The accompanying charts show the performance of different Trump market factors. Each of the charts is designed that a rising line denotes rising odds of a Trump win. The trade-related factors, such as the relative performance of companies with domestic revenue, and logistics shipping giants FedEx and UPS, show little reaction. By contrast, the yield curve and gold prices are signaling higher inflationary expectations.

The Republican platform has promised a policy of “drill, baby, drill” of energy independence, which should benefit energy stocks. The energy sector has lagged the market and it would be a prime beneficiary should Trump win the White House.

Another Trump trade that should perform well is financial stocks, which should benefit from deregulation and lower taxes. Watch for few barriers to consolidation in the banking sector, which should benefit regional banks. The sector recently staged a convincing upside breakout on an absolute basis, but remains range-bound relative to the S&P 500 (second panel), though relative breadth appears constructive (bottom two panels).

By contrast, the technology sector may be at risk under a Trump White House. Trump expressed his skepticism about defending Taiwan against China in the Bloomberg Businessweek interview: “I mean, how stupid are we? They took all of our chip business. They’re immensely wealthy. I don’t think we’re any different from an insurance policy. Why are we doing this?”

The shares of TSMC skidded -3.6% after those remarks. The Semiconductor Index, which has been an AI bellwether, is testing a key area of absolute support (top panel) and violated relative support (bottom panel).

In conclusion, the betting odds on a Trump victory in November have risen substantially, but the markets haven’t fully discounted such an outcome. Investors who want to position for Trump 2.0 should seek long inflation exposure (long gold/short bonds) and short globalization (long domestic producers/short transportation and logistics). Regardless of the growth outlook, equity returns may be more challenging as Trump 2.0 will see the S&P 500 at more lofty multiples than the P/E ratio of Trump 1.0. At a sector level, look for better performance in energy and financials, while technology may be under some pressure.

As in Trump 1.0, many investors and traders will be disoriented and in fear, all because of his errant and wayward mouth. That will create many trading opportunities as the last go-around. Stay flexible like Napoleon Bonaparte with a basic plan and ready to pivot.