Does that mean you should continue to bet on growth investing or are value stocks about to have their day? Here an analytical framework to think about the value/growth paradigm.

The DA in EBITDA

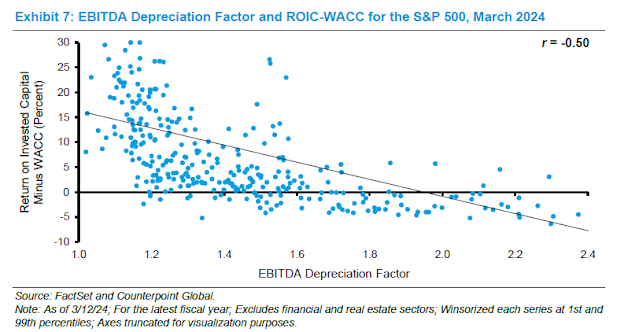

Michael Mauboussin recently published an article that’s a master class on valuation techniques, focusing mainly on the P/E and EV/EBITDA multiples. One of the key points that he made is that not all EV/EBITDA multiples are the same. Investors need to distinguish between the EBIT and the DA in EBITDA. That’s because the DA in EBITDA is a proxy for the maintenance capital needed to maintain a company’s business. All else being equal, you should prefer a lower DA because it offers a higher free cash flow to investors.

In plain English, these results mean that, all else being equal, asset-light companies with lower DA should trade at a higher multiple than asset-heavy companies. It just happens that in the last 20 years, the asset-light companies have been the growth stocks. They tended to be platform companies that engage in little or no manufacturing and rely mainly on intellectual capital to generate cash flow.

Mauboussin advised investors to focus on the DA in EBITDA in order to maximize the FCF available to investors. There is an additional detail in analyzing EBIT. Ian Hartnett of Absolute Strategy Research pointed out that EBIT margins tend to be higher in large-cap companies.

Putting it all together, the secret of past investing success has been an exposure to large-cap growth for its innovation and intellectual property, as well as its strong margins because of scale.

The cyclical opportunity

In the short run, however, value has outperformed growth across all market cap bands and internationally. That’s because the market consensus has pivoted from a soft landing to a no landing scenario of continued economic growth, even as inflation stays elevated and the Fed maintains its higher-for-longer interest rate policy.

Investment implications

Under the current circumstances, what should the equity investor do?

Callum Thomas pointed out that non-U.S. markets have a much higher cyclical exposure compared to the U.S., so it makes sense to raise non-U.S. exposure.

I prefer Europe and Japan, in that order, for cyclical exposure while avoiding emerging markets. European stocks have been in a choppy relative uptrend since last October, and should benefit from a global cyclical rebound. Japanese stocks recently achieved fresh all-time highs in local currency terms, but uncertainty over BOJ policy has weakened the Japanese Yen, which makes Japanese equity exposure problematic for unhedged foreign investors. The relative hawkishness of Fed policy is likely to put a bid on the USD, and USD strength presents significant risks to emerging market exposure, which I would avoid.

Timing the turn

While I am advocating a tactical overweight position in cyclicals and value stocks, how can investors time the turn back to growth?

More sophisticated investors with detailed quantitative tools can look for signs of changes in price and fundamental momentum, as measured by EPS estimate revision, to spot shifts in investment regime changes. If estimate revisions for value stocks begin to falter, and revisions for growth stocks are stock, that would be a signal to pivot from value to growth.

What no recession or stagflation? The inverted yield and Friday’s economic numbers does show the economy slowing rapidly. David Rosenberg might ultimately be right.

Technically speaking, I would watch the semi-conductor index and the transportation index.. In my book both are leading indicators of the economy. Both seem to have topped out.

I hear you and this might be the time Value works best including Europe as a Value play. In the Mauldin conference last week a guru was asked his worst error. He said owning Europe because it was cheaper.

America is fully and maybe foolishly/dangerously embracing A.I. while Europe is leary. Note that all cloud companies had huge sales gains in earnings calls. That is A.I. not family photos. Also big tech announced big cap ex. That is A.I. chips and data centers and by the way sales of Nvidia.

A.I. makes asset light companies more efficient reducing costs. Think software and A.I. Copilots. Asset heavy companies less so. Value companies have a problem in inflationary times with higher wages and input cost increases. Growth companies are laying off people as they get more efficient with A.I.

I’ve become a believer in the transformative nature of A.I. in so many areas. Maybe banking a Value sector will do great. A branch near me just closed. Dimon is embracing A.I. Maybe we should look at that type of Value that benefits from A.I.

I am in momentum that will shift to whatever wins. We are in unprecedented times after the Sea Change.

Price momentum is flagging. See the relative returns of MTUM and other momentum ETFs.

Ken is right about what’s to come in the future, unprecedented. The first thing investors should to is ditching the old outdated classification of value, growth and cyclical. The only constant left is staples. US lost a big portion of industrial and material sectors during globalization. It is making a comeback with new types of operation, very heavy in IT and IP contents. And the old leftovers are too making fundamental shift of how operation is run. It is becoming increasingly difficult to just lump them in the old cyclicals. For example, a startup from Australia, Earth AI. This company has a very bright future and it will transform mining fundamentally, because of heavy use of data science and AI tools.

Another example is Anduril from Costa Mesa, CA. This is a very young defense company specialized in autonomous systems, e.g. drones. It is beating out old stalwarts like Lockheed Martin in bidding for DoD contracts because of much cheaper pricing. It is in essence a platform software company, with investors from Palantir and SpaceX. So you get the drift. This is just another example of what the future will look like with AI algos and data science.

The summary of all the reports I read in detail or just glanced, with some AI algo help, is that everything is going thru rethinking. This is fundamentally different from what we have in the past. The past is all about tool advancement.

All we need is a stable environment provided by govs who should be restrained in irresponsible fiscal policy abuse. Let the game theory play out without gov handicap. It will be a very surprising new era. Stay invested. Things are going at the speed of electrons. Your fingers would not be as fast. And the mental aggravation will take a toll on you.

How do you invest in such companies?