Preface: Explaining our market timing models

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)

- Trend Model signal: Bullish (Last changed from “neutral” on 28-Jul-2023)

- Trading model: Bearish (Last changed from “neutral” on 15-Mar-2024)

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

A “good overbought” condition

Can the momentum continue into Q2?

A momentum market

Investors are experiencing a momentum-driven market. There are numerous historical studies of the bullish outcomes when stocks go on a strong bull run as this. The accompanying table from Steve Deppe is just one of many studies.

However, the jury is still out on whether the market is sufficiently overbought for the bulls to continue running. The market doesn’t achieve the status of a super-bull until the percentage of stocks above their 200 dma reaches 90% (top panel). Markets with percentages above 80% but below 90% are more prone to choppy and corrective actions that a super bull.

As a word warning to the momentum driven bulls, there are no guarantees. Here is a cautionary note from Urban Carmel that the market can correct in the near future.

Here are some of the challenges the bull faces in Q2.

The sentiment test

The market enters Q2 against a backdrop of extended sentiment. Sentiment models show a crowded long in bulls and a crowded short in bears. That said, overly bullish readings are a condition indicator that warn of a vulnerable market and it does not constitute an actionable sell signal. Nevertheless, sentiment reversals can resolve in short and sharp disorderly price reversals.

The Citi Panic-Euphoria Model is in euphoria territory, which is a warning of unsustainable gains. Bear in mind, however, that the fine print states that the time horizon for this model is one-year as euphoria readings “generate a better than 80% probability of stock prices being lower one-year later”.

Notwithstanding the chorus of valuation concerns over Trump Media & Technology Group (DJT), which recently IPO’d, IPO enthusiasm may be temporarily peaking. The relative performance of the IPO ETF reached resistance and it’s turning down. If IPO fervour can be used as a proxy for the market’s animal spirits, stock prices are due for a brief pullback.

The earnings season test

Another of the challenges is Q2 earnings season. The S&P 500 is trading at a forward P/E of 20.9, which is elevated and nearing nosebleed levels. If the bull run is to continue, forward EPS estimates need to rise to alleviate the extended valuation readings.

So far, Street estimates of forward 12-month earnings are rising, which is a constructive sign. The bull run will depend on continued fundamental momentum from Q2 earnings reports.

The QRA test

The Quarterly Refunding Announcement, scheduled for the end of April, could be a source of volatility. As a reminder, we pointed out that the U.S. Treasury is expected to issue far more coupon-bearing instruments compared to bills in Q2 versus Q1, and the increased supply has the potential to push up bond yields which puts downward pressure on stock prices (See Is Transitory Disinflation Here to Stay?).

Another little known factor that could depress bond prices further is a detail in the last Quarterly Refunding Announcement (QRA) which may not have received a lot of market attention. The U.S. Treasury projected a Q1 issuance schedule of $760 billion in paper, consisting of $420 billion in bills and $340 in coupon-bearing instruments (notes and bonds). What the market didn’t react to was the projected Q2 net issuance of $202 billion, consisting of a negative -$338 billion in bills and $540 billion in coupons.

Notwithstanding the supply effects of higher coupon issuance that could push up bond yields and pressure stock prices, reduced bill supply could affect banking liquidity in other ways. Historically, banking system liquidity (blue line) has been correlated with the S&P 500. Liquidity is a function of changes in the Fed’s balance sheet (quantitative tightening), the overnight report facility (ON RRP, black line) and the Treasury General Account (TGA).

The breadth test

So where does that leave us?

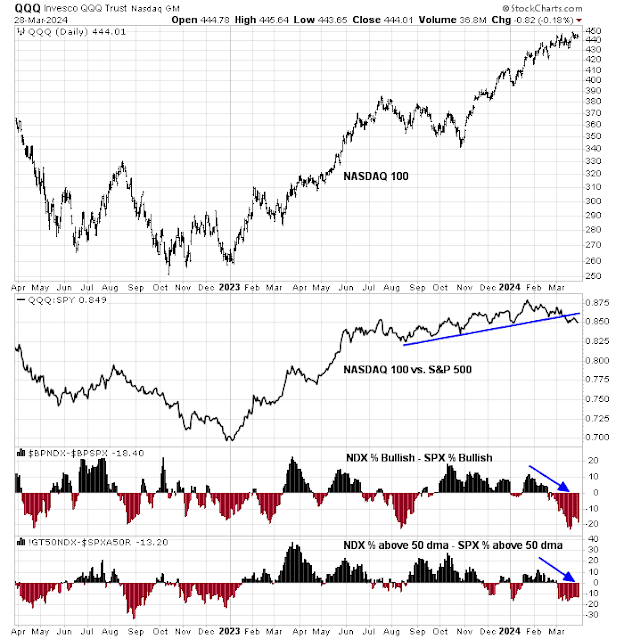

Equity investors are entering Q2 facing numerous challenges. Large-cap growth technology stocks, which had been the market leaders, are stumbling. The NASDAQ 100 has decisively violated a relative uptrend line and relative breadth indicators (bottom two panels) are weak.

Evidence of breadth deterioration can also be found in the differences in NYSE and NASDAQ 52-week highs-lows and percentage of stocks above their 50 dma. The good news is leadership has rotated to NYSE-listed names, which represents value and cyclically sensitive stocks. In short, the S&P 500 is undergoing a rotating correction.

An analysis of the relative performance of defensive sectors indicates that they are trying to stage relative breakouts, but their relative strength can’t be interpreted as definitive and investors have seen these kinds of fake-outs before.

Can the bullish market momentum continue? Equity price momentum in Q2 is dependent on continued fundamental momentum as measured by rising EPS estimates, a tame bond market response to higher Treasury coupon issuance and a possible liquidity squeeze, all against a backdrop of excessive bullish sentiment.

I would like to add a note about the disclosure of my trading account after discussions with some readers. I disclose the direction of my trading exposure to indicate any potential conflicts. I use leveraged ETFs because the account is a tax-deferred account that does not allow margin trading and my degree of exposure is a relatively small percentage of the account. It emphatically does not represent an endorsement that you should follow my use of these products to trade their own account. Leverage ETFs have a known decay problem that don’t make the suitable for anything other than short-term trading. You have to determine and be responsible for your own risk tolerance and pain thresholds. Your own mileage will and should vary.

Disclosure: Long SPXU

The trading model turned bearish on March 15, 2024 and not on March 25, 2024 as stated in today’s post.

Thanks