Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “

Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post,

Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The

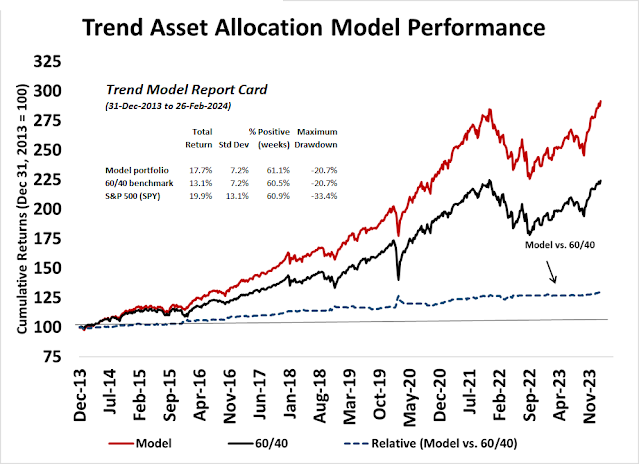

Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found

here.

My inner trader uses a

trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly

here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)

- Trend Model signal: Bullish (Last changed from “neutral” on 28-Jul-2023)

- Trading model: Bearish (Last changed from “neutral” on 15-Mar-2024)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

A convincing breakout at 2100

While GDX may be a little extended in the short run, I would like to point out the long-term potential in gold. Gold has staged a convincing upside breakout from a multi-month cup and handle formation. Moreover, the gold-to-S&P 500 ratio (bottom panel) is turning up from a multi-year saucer-shaped bottom, indicating the possible start of a new relative bull for gold over stocks. As well, the breakout has occurred with little fanfare as investors have been focused on AI and GLP-1 plays. This combination of breakout and lack of public participation suggests a substantial upside potential.

Estimating upside potential

Now that gold has staged a definitive upside breakout at 2100 to an all-time high, what’s the upside potential?

A historical analysis from

Nautilus Research shows that momentum begets more momentum. Strength in gold prices has historically led to more gains on a 6–12-month time frame.

From a different perspective, a point and figure chart of weekly gold prices with a 1% box and a 3-box reversal shows a measured objective of 2576. While point and figure charts are designed to only indicate direction and not time, weekly price charts typically have time horizons of 6–18 months.

A longer-term point and figure chart of monthly gold prices with a 5% box and 3-box reversal shows a measured objective of 3372,bearing in mind that monthly charts normally have time horizons of 3–5 years.

A stealth breakout

Not only has gold staged an upside breakout, the breakout was accomplished in the face of public skepticism, which is contrarian bullish. Even as gold prices reached all-time highs, the gold ETF GLD experienced fund outflows.

Over in the futures trading pit, we can observe two things about the latest Commitment of Traders report on large speculator, or hedge fund, positioning in gold. Contrarians will observe that readings are nowhere near a crowded long. Momentum traders will observe that the lack of heavy buying suggests further potential upside should a bullish stampede develop.

Outlook for gold mining stocks

As for the gold mining stocks, traders should start to exercise some caution in the short term, but I remain long-term bullish on the shares.

The gold mining ETF GDX has surged in a short period and its 14-day RSI is approaching overbought territory. In the past, similar overbought readings have either led to pullbacks or a higher price high with a negative RSI divergence, which resolved in a pullback. However, I am longer-term bullish as GDX remains cheap when compared to gold.

However, investors should be cautious about using the gold miner-to-gold ratio as a long-term determination of value for mining stocks. This ratio has gone through periods of stability, followed by a substantial multi-year downdraft.

A decline in the gold miner-to-gold ratio doesn’t always mean the mining stocks are cheap on a relative basis. That’s because gold mining stocks can be conceptually modeled as a series of call options stretching into the future on gold, with the strike price as the cost of extraction and the terms being the expected mine life.

The decline in the ratio can be explained this way. As older mines with low production costs become played out, mining companies have replaced them with new mines with high production costs. The modeled value of the mining company will fall as the strike price of the call options rise.

In the short run, the ratio is at the bottom of its historical range, which suggests better relative value. However, investors need to understand the evolution of the cost structure of the gold mining industry before jumping to a long-term conclusion that mining stocks are cheap.

A good place to hide

In the short run, the stock market may be about to undergo a pullback. The market-leading NASDAQ 100 ETF QQQ is violating rising absolute and relative trend lines, which is a signal of weakness.

As well, the S&P 500 Intermediate Term Breadth Oscillator (ITBM) flashed a sell signal when its .14-day RSI recycled from overbought to neutral. This is a tactical sign that the market is losing momentum and the bears are seizing control of the tape.

In addition, investors will be closely watching both the Fed decision and the BOJ decision in the coming week. The outcomes of both decisions are asymmetrically bearish in which a a neutral decision is neutral, and a hawkish decision would elicit a risk-off response.

The Fed will publish a new Summary of Economic Projections after the meeting, and the “dot plot” could easily see the median projected rate cuts fall to two in 2024 given the recent string of hotter than expected inflation data.

The BOJ’s decision next week is one of the few that’s expected to be live. Nikkei Asia reported that the BOJ is ready to end its negative rate policy as inflationary pressures rise. Such a decision may include ending support of the stock market by stopping its purchase of ETFs and REITs. This would put upward pressure on the Yen, but it would be negative for Japanese stocks. As Japan has been a sizable supplier of global liquidity, the BOJ decision could have considerable ripple effects around the world.Despite my caution about the extended nature of the GDX advance, gold stocks are currently exhibiting a negative correlation with the S&P 500, which makes it a good diversifying asset in the case of stock market weakness.

In conclusion, gold prices have staged a convincing long-term upside breakout against a backdrop of skepticism, which is contrarian bullish. Point and figure charts indicate a measured objective of 2576 over a probable 6–18-month time horizon and a measured objective of 3372 over a probable 3–5-year time frame. As well, gold mining stocks are cheap relative to gold and could offer even more upside potential on an intermediate- and long-term basis.

Subscribers received an email alert that my inner trader had initiated a short position in the S&P 500. The usual disclaimers apply to my trading positions.

I would like to add a note about the disclosure of my trading account after discussions with some readers. I disclose the direction of my trading exposure to indicate any potential conflicts. I use leveraged ETFs because the account is a tax-deferred account that does not allow margin trading and my degree of exposure is a relatively small percentage of the account. It emphatically does not represent an endorsement that you should follow my use of these products to trade their own account. Leverage ETFs have a known decay problem that don’t make the suitable for anything other than short-term trading. You have to determine and be responsible for your own risk tolerance and pain thresholds. Your own mileage will and should vary.

Disclosure: Long GDX, SPXU

Regarding Japan, as BOJ raises rates, the Japanese money parked overseas would return home. In addition, there have been structural governance reforms. Japanese etf DXJ is up roughly 18% YTD.

I am wondering if it is more productive to short QQQ than SPX?

Thanks

Ravindra, IMO both SPY and QQQ are heavy on AI names. QQQ is usually more volatile so that might make a better short-term trading short. Intermediate term I consider SPY to have more junky stocks (which is why I prefer QUAL as my core ETF), so I’d suggest SPY as a short in that time-frame. Hope that adds clarity. Best, Chuck

Much appreciated! Take care