Much has happened since my last global market review. Investors saw a bond market tantrum, followed by a down yield reversal and a risk-on rally in asset prices. Willie Delwiche at Hi Mount Research put the equity price surge into perspective when he observed that 94% of global markets in the MSCI All-Country World Index (ACWI) had exceeded their 50 dma. This is a sign of strong global breadth that shouldn’t be ignored.

Drilling down, let’s take a quick trip around the world to spot investing opportunities.

U.S. growth has been dominant

Starting with the U.S., as it represents about 60% of capitalization within ACWI, growth has become the dominant leadership. Two of the three growth sectors in the S&P 500 have exhibited strong relative strength. I am inclined to stay with the current U.S. growth leadership until the December to early January time frame as hedge funds and other investors will likely be engaged in a beta chase for returns into year-end.

The growth investing style isn’t just dominant in the U.S., but in the non-U.S. developed markets as well. Growth began its outperformance against value stocks both within and outside the U.S. in early October.

By contrast, here is the relative performance of U.S. value and cyclical sectors, which can be best described as pedestrian.

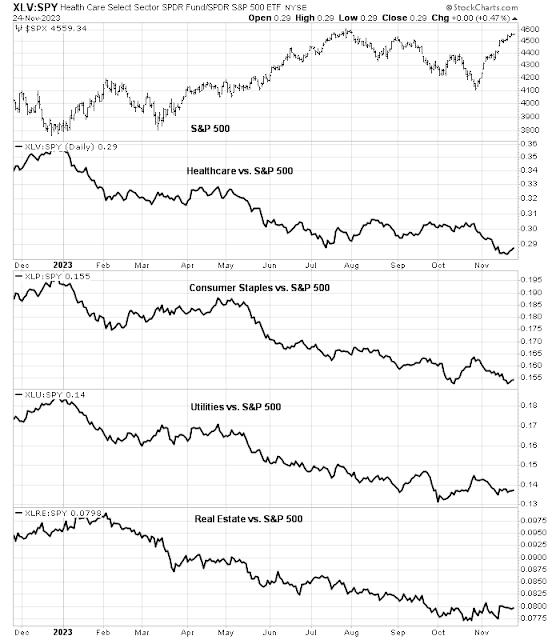

For completeness, here is the relative performance of defensive sectors in the S&P 500. It is not surprising that these sectors are showing no signs of leadership in the face of a strong equity rally.

Emerging Non-U.S. leadership

Turning our focus outside the U.S., the accompanying chart of the relative performance of different regions is revealing. While U.S. equities are leading, their outperformance is starting to flatten out. The two regions that show promise as emerging leadership are Europe (middle panel, black line) and emerging markets ex-China (bottom panel, black line). Both are exhibiting saucer-shaped bases which are set-ups for possible new leadership.

European relative performance is more advanced. An analysis of relative returns of selected eurozone markets shows relative strength by France, Italy and Greece (yes, that Greece).

Across the English Channel, U.K. markets are showing signs of relative weakness. Large-cap U.K. stocks have been highly correlated to energy due to the heavy energy weight in the large-cap British market. Small caps, which are more reflective of the U.K. economy, are still weak.

Asia and Emerging Markets

Pivoting to Asia, the relative performance of the equity markets of China and her major Asian trading partners can be best described as unexciting.

However, the chart of the major emerging markets ex-China is starting to reveal some opportunities. While China’s relative performance (top panel, dotted red line) has been in a relative downtrend, EM ex-China (top panel, black line) is starting to flatten out and possibly turn up. The analysis of the top four countries in the index, which make up 68.6% of index weight, shows that the sources of relative strength are appearing in all countries except South Korea.

- Global equities are surging, led by growth stocks. I am inclined to stay with the current leadership until year-end as hedge funds are likely to engage in a beta chase for performance.

- U.S. stocks are still the leaders, especially the megacap growth stocks.

- Set-ups for a new leadership are emerging in Europe and EM ex-China. I am inclined to wait until early 2024 to re-evaluate the evolution of leadership before making any decisions on rotation. Historically, Q1 in an election year tends to be choppy and move sideways.

4 thoughts on “How a global leadership review reveals opportunities”

Comments are closed.

I am getting highly pessimistic about anything outperforming the S&P 500 or US total market indices (VTI or ITOT), based on last decade of performance. When growth becomes scarce, as one expects in 2024, money should find its way into “growth” names, or so it seems i.e technology.

It seems that we may well be seeing a paradigm shift, away from diversification. Pretty much everything that has been written about diversification has not worked in the past decade, more so in the last five years, give or take. A decade or longer underperformance of European and EM equities has a reason and that is these markets seem to not reward investors. Once burnt, twice shy!

This is Pareto Rule undergoing a fundamental change, from 80/20 to 90/10 and possibly even more extreme. I am a lot more convinced than a year ago. The trigger is the report in which OpenAI researchers have come up with a model which can solve most of not-too-complicated math equations. This is the inflection point, as a cliche, for human civilization. It is just the first step to human technological advancement reaching escape velocity. The implication is beyond any wildest imagination. Stay with US megacap tech companies for the future and believe in US as a country no matter what you read over the Internet. The gap is getting bigger exponentially.

Very different topic – Interesting TWIST this week in gold miners indexes just as bullion is breaking over $2,000 and U.S. dollar is very weak.

See my comment here: https://twitter.com/HumbleStudent/status/1728399393869508878