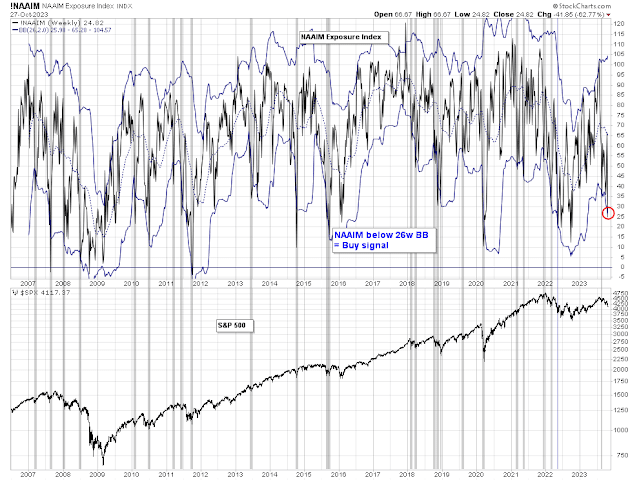

Mid-week market update: I told you so. As I recently pointed out, psychology had become too stressed to the downside, which opened the door to a relief rally. The NAAIM Exposure Index, which measures the sentiment of RIAs who manage individual investors’ funds, fell sharply last week and below its 26-week Bollinger Band. Historically, theses signals have resolved in a tactical rally in stock prices.

Sometimes the anticipation can be worse than the event itself. Coming into the weekend, the market was focused on three sources of possible stress: geopolitical tensions from the Israel-Hamas war, excess supply putting upward pressure on Treasury yields, and Fed policy. Here’s how those fears have resolved themselves.

The sum of all fears

Ripe for a rally

We have exhausted selling, both systematic and fundamental, while downside hedges too are deep in-the-money [and] at risk of being taken-down and monetized, which could set off some reversal flow.

I would like to add a note about the disclosure of my trading account after discussions with some readers. I disclose the direction of my trading exposure to indicate any potential conflicts. I use leveraged ETFs because the account is a tax-deferred account that does not allow margin trading and my degree of exposure is a relatively small percentage of the account. It emphatically does not represent an endorsement that you should follow my use of these products to trade their own account. Leverage ETFs have a known decay problem that don’t make the suitable for anything other than short-term trading. You have to determine and be responsible for your own risk tolerance and pain thresholds. Your own mileage will and should vary.

“I told you so” is something that one seldom wants to hear in private life, but when a financial advisor speaks these words, it’s just wonderful. Thank you for the steady hand.

One thing that all this interest rate hiking has brought to the fore is ” when something is obvious, consider contrarian bets”. So the rates went way up, mortgages went way up, did house prices crash? Did the market go in the toilet?

I’m not saying these things won’t happen, but maybe people were too early because it was so obvious and if sentiment is lopsided then things get pushed the other way.

GME was an obvious short, that got squeezed terribly.

We have lived with rates in the 5s for years, bought and sold houses too.

It takes time for debt to have it’s impact. When you want to refi and you can’t is something that will be spread out over years for those companies wanting to do it. Repairing a balance sheet or paying off debt takes years or decades.

Something nasty is likely coming but maybe not until 2025.

So while the music plays, they will dance, it’s what they do.

There is a quote from 1928…which I forget…where the speaker was very bearish. In 1929, he said the same thing about the market being overpriced.

This is why TA can be complimentary to Fundamentals. Try to get both right.

How much of a bounce we get is unknown. We could go to All Time Highs. It’s where the money flows that counts.