Correlation isn’t causation, but the USD Index has shown a close inverse correlation to the S&P 500. The relationship partly ended when the S&P 500 surged on AI mania. However, small-cap stocks, which are less subject to the enthusiasm over the AI revolution, maintained their inverse correlation.

The USD Index is approaching a key resistance level. Assuming the inverse correlation were to continue, what are the bear and bear cases for the USD, and consequently U.S. equities?

Fiscal dominance is USD bullish

Did anyone notice that even as the European Central Bank raised rates by a quarter-point last week, the EURUSD exchange rate fell? All else being equal, the exchange rate should rise because the interest rate differential between the euro and the dollar has narrowed. So what’s not equal?

The inflation threat

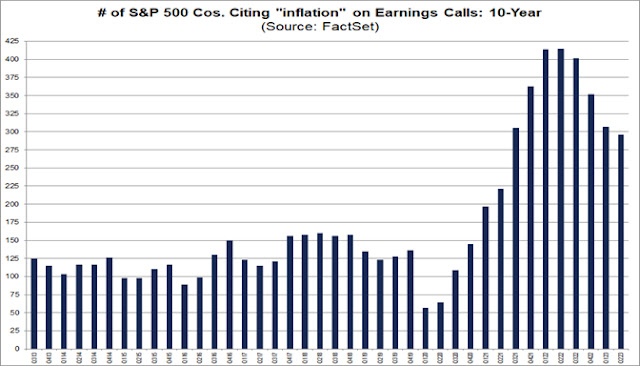

However, FactSet reported that the number of companies citing “inflation” on their earnings calls had fallen, but the rate of decline was decelerating.

Disinflation should be good news, but the Citi Inflation Surprise Index seems to be edging up everywhere around the world. What’s going on?

One major component of core services CPI is shelter, which has been strong because of how shelter inflation is calculated. Forward-looking indicators of rent have shown rapid deceleration. The Fed has taken notice and now focuses on its super-core CPI, which is services ex-shelter. This component has decelerated, but it’s stabilizing at a much higher level than the Fed’s 2% target.

This brings us to the risks to inflation, which appear in the form of higher energy prices and potentially higher wages. The decision by Saudi Arabia and Russia to cut oil production has boosted Brent prices to $90. As the accompanying chart shows, the annual rate of change (bottom panel) is turning positive from negative, which has eliminated a tailwind to the disinflationary trend in headline CPI. Should higher energy prices continue, they will put upward pressure on consumer inflation, which will provide ammunition for the hawks at the Fed.

The NFIB small business survey is insightful in this regard. The survey can be insightful as small businesses have little bargaining power and they are useful barometers of the economy. The latest survey of compensation trends shows a stabilization of increases and possible re-acceleration.

The key risk is a scenario of stabilization in services CPI, rising energy prices and wage pressures combine to put upward pressure on the Fed Funds rate. The market is discounting no further rate hikes and cuts that begin next May. A higher-for-longer rate regime would be USD bullish and equity bearish.

Yen strength ≠ Equity bullish

As well, investors shouldn’t ignore the effects of the Bank of Japan’s (BoJ) signals of possible monetary tightening. Reuters reported that “Bank of Japan Governor Kazuo Ueda said the central bank could end its negative interest rate policy when achievement of its 2% inflation target is in sight, the Yomiuri newspaper reported on Saturday, signalling possible interest rate hikes.” As a consequence, even the 10-year JGB rate has risen well above the 50-basis-point yield curve control rate. bit the Yen rallied and pulled back.

JPY strength means USD weakness. While a retreat in the greenback should be equity bullish, a strengthening Yen may be a sign of funds repatriation, which would be equity bearish Japan has been a significant supplier of global liquidity. Should the BoJ switch a monetary easing regime to more neutral or even monetary tightening, this should reduce the flow of global liquidity, which would be negative for global risk appetite (see my previous discussion in The TARA risk from Japan).

In conclusion, the USD has historically been inversely correlated with U.S. equity prices. A number of risks are appearing to put upward pressure on the USD, namely the expectations of more fiscal room in the U.S. compared to other major economies will pressure other central banks to ease sooner than the Fed, and upward pressure on inflation. In addition, the possible reversal of the BoJ’s easy monetary policy, while Yen bullish and Dollar bearish, is bearish for global risk appetite.

5 thoughts on “How the USD could sink the S&P 500”

Comments are closed.

You state:

The U.S. has been more resilient so far. This may force other central banks such as the ECB to cut first, which narrows the rate differential and puts upward pressure on the USD.

If ECB cuts rates, it should widen the rate differential, thus putting upward pressure on USD.

Even if BoJ raises rates, the differential should still be lucrative enough for the carry trade. Maybe it has an affect on the margin.

I think the effects of rate tightening are coursing through the economy and are the ruling reason. It will slow down the economy and thus the inflation.

No one can predict the when and how much impact it will have. But it will.

Earnings and rates are the two major factors on equity valuations. I think a thorough analysis of earnings trajectory is much needed.

If the BOJ pivots to a more hawkish policy, the rate of liquidity that Japan supplies to the rest of the world will dwindle and possibly reverse. This will be risk appetite negative.

Europe is descending into stagflation as the economy goes over a cliff while inflation stays sticky. The weakness in the economy is the key to the Euro falling relative to the US economy’s resilience. Fed Futures Rates in the US are rising in 2024 and onward relative to 2023, in other words flattening in a ‘higher for longer’ way. That means the dollar says ‘stronger for longer’ too.

Last year when dollar strength led to lower stock markets, that could have been signaling US stronger economy that would lead to higher interest rates (remember the fears of Europe economic war related weakness). Now higher dollar shows economic strength (no recession) with rates peaking. That is so much better than Europe’s rates peaking with the economy going over a cliff with limited fiscal support available.

It’s the ECONOMY. U.S. dollar strength is risk-on friendly.

Germany is at a crossroads. Its business model needs a big adjustment. But it does not look like that Germany has the will or capability to make it happen. Overall Europe is not a place to look for growth. The baggage from several fronts are just too heavy.

US, on the other hand, is going the way of France. If UAW strikes lead to the demanded concessions from the big 3 management. Then it is game over for these companies. And the ramification will be far and wide.

Currently, with each additional hike, the fed would fuel further inflation instead of impeding it, due to shelter cost inflation.