Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Bullish

- Trading model: Bearish

Update schedule: I generally update model readings on my site on weekends. I am also on Twitter at @humblestudent and on Mastodon at @humblestudent@toot.community. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Can’t have a bull market without the bulls

Ever since I turned bullish on equities (see What the bull case looks like), I am seeing signs of a revival in sentiment. Contrarian sentiment analysis is useful, but if you believe this is the start of a new bull, sentiment needs to steadily improve. You can’t have a bull market without a steady revival of bullish sentiment. Indeed, the 4-week moving average of AAII bulls-bears and the NAAIM Exposure Index, which measure the sentiment of RIAs managing individual client funds, have bottomed turned up.

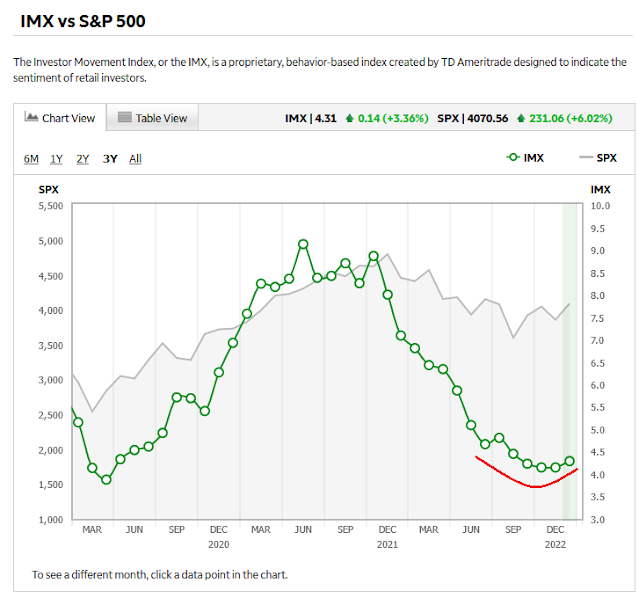

Similarly, the TD Ameritrade IMX, which measures the equity exposure of the firm’s clients, have also been making a bottom.

As well, Bloomberg reported money managers have cut their bearish equity exposures and they are now positioned more in line with historic norms. Readings are not extreme. The stock market can rise further if there are positive catalysts.

Willie Delwiche pointed out that recoveries after a prolonged bout of bearishness, which he measured as the number of weeks AAII bulls were below AAII bears, tend to be bullish.

Bullish rebound

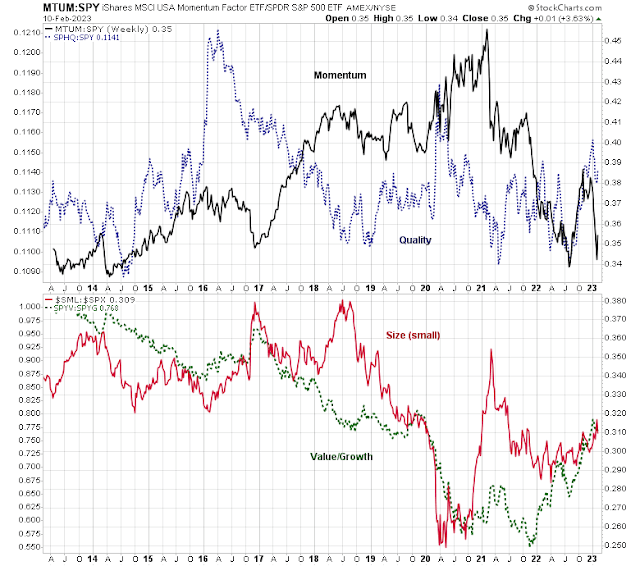

Other signs of a bullish revival can be seen in factor analysis and the technical structure of the market. A review of four major factors reveals the following:

- Underlying strength in small caps.

- A revival of value against growth, notwithstanding the recent growth rebound.

- High quality dominance in H2 2022, followed by a reversal in 2023.

- Uneven returns to price momentum.

Recessionary market bottoms are often characterized by a dash for junk, which are the characteristics seen in small cap strength and low quality rally of 2023. The value/growth reversal appears to be a secular change in leadership that can be seen when market leadership changes from bull to bear.

Cross Border Capital pointed out that the global liquidity cycle is bottoming. Rising liquidity should be positive for stock prices.

In addition, the broadly based Wilshire 5000 is on the verge of flashing a long-term buy signal. In the past, this model has served well to delineate bull and bear markets. A bullish signal occurs when the MACD histogram turns from negative to positive, which should occur within the next few months should the market advance continue. A sell signal occurs when the 14-month RSI exhibits a negative divergence.

Key risks

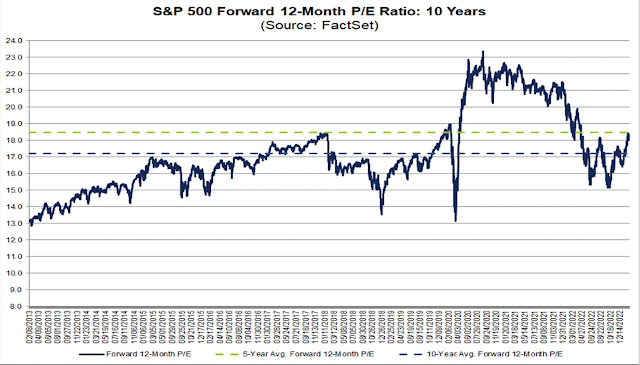

The bull case faces several risks. The first is valuation. The S&P 500 forward P/E is elevated by historical standards. That doesn’t mean the market can’t advance from current levels, but a gain of 15-20% would put valuation into extreme bubbly territory.

Other risks can be characterized as tail risks, which are relatively low probability events with high impact. The Economist highlighted Pakistan as a sovereign default candidate. A Pakistani default has the potential to ripple through the Chinese financial system because of the debts incurred from the Belt and Road Initiative. Such a default could cause a disorderly unwind that unduly affects China’s financial system.

Moreover, Zeynep Tufekci highlighted bird flu as another pandemic threat to global health in a NY Times OpEd. First, mammal to mammal transmission has been documented in the latest bird flu variant.

Alarmingly, it was recently reported that a mutant H5N1 strain was not only infecting minks at a fur farm in Spain but also most likely spreading among them, unprecedented among mammals. Even worse, the mink’s upper respiratory tract is exceptionally well suited to act as a conduit to humans, Thomas Peacock, a virologist who has studied avian influenza, told me.

More importantly, the latest H5N1 bird flu strain exposes vulnerabilities in the vaccine supply chain. Vaccines production depend mainly on egg production, but the hens that lay the eggs could be devastated by (you guessed it) bird flu.

Worryingly, all but one of the approved vaccines are produced by incubating each dose in an egg. The U.S. government keeps hundreds of thousands of chickens in secret farms with bodyguards. (It’s true!) But the bodyguards are presumably there to fend off terror attacks, not a virus. Relying on chickens to produce vaccines against a virus that has a 90 percent to 100 percent fatality rate among poultry has the makings of the most unfunny which-came-first, the-chicken-or-the-egg riddle.

The only company with an F.D.A.-approved non-egg-based H5N1 vaccine expects to be able to produce 150 million doses within six months of the declaration of a pandemic. But there are seven billion people in the world.

Short-term vulnerable

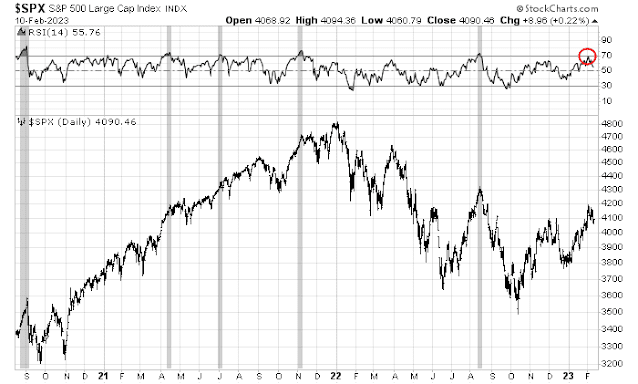

In the short-term, the market appears to be extended. The 14-day RSI reached an overbought level and retreated last week. Such events have usually resolved in either pullbacks or sideways consolidations in the past.

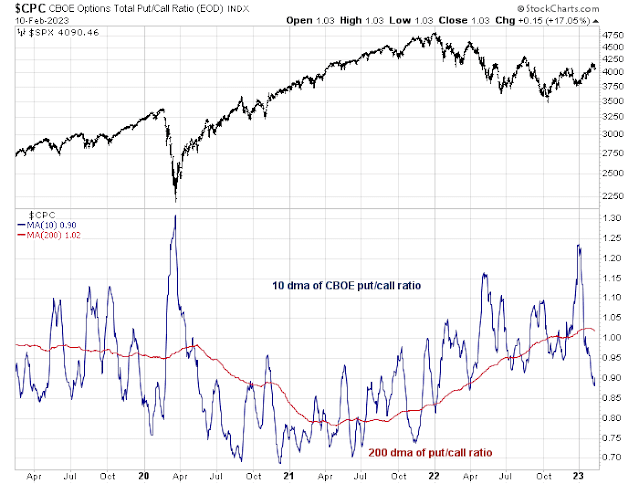

As well, the 10 dma of the put/call ratio has normalized from panic levels to readings indicating growing bullishness. While this doesn’t mean that the market will crash from here, it is a cautionary signal and a sign of rising headwinds for stock prices.

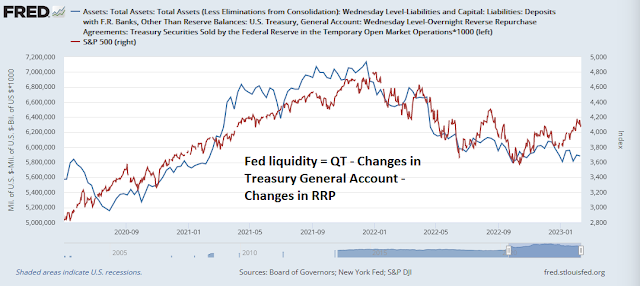

Another short-term risk factor can be seen in the development of Fed liquidity, which consists of quantitative tightening, less changes in the TGA and RRP. Fed liquidity has been highly correlated with the S&P 500 and a negative divergence is appearing between the two.

In conclusion, the signs of a bullish revival are becoming more evident in both the sentiment and technical data. However, valuation risk is elevated. The market is also extended in the short run and may be in need of a corrective or consolidation period.

My inner investor is bullishly positioned. My inner trader is tactically short the market in anticipation of near-term weakness. The usual caveats apply to my trading positions.

I would like to add a note about the disclosure of my trading account after discussions with some readers. I disclose the direction of my trading exposure to indicate any potential conflicts. I use leveraged ETFs because the account is a tax-deferred account that does not allow margin trading and my degree of exposure is a relatively small percentage of the account. It emphatically does not represent an endorsement that you should follow my use of these products to trade their own account. Leverage ETFs have a known decay problem that don’t make the suitable for anything other than short-term trading. You have to determine and be responsible for your own risk tolerance and pain thresholds. Your own mileage will and should vary.

Disclosure: Long SPXU

Where does money go?

When credit/debt is defaulted on money dies (is destroyed because someone is holding an empty bag so to speak)

But this multi-trillion stimulus of pandemic origin, where did it go? People spent a lot of it, but then it went to other hands, does it eventually pool and end up in equities? Spending money does not destroy it, it goes to someone else, so that stimulus money is still out there.

But inflation matters too. When you eat a hamburger, you don’t eat the price, you eat the burger, so in a way inflation destroys money. If it feels better say it destroys purchasing power, but it sounds the same to me.

I was thinking about the bond market and refis, and it occurred to me that zombie companies can kick the can down the road by buying back their debt which was priced when rates were so low because the bond price is down and taking on the new debt at a higher rate which should give some cash right now and zombie heaven is pushed back…they are still zombies…but to be honest, it depends on the duration of the bonds which I don’t know.

But until we get massive defaults the destruction of money is just postponed.

I fell while hiking yesterday, got a concussion, don’t remember most of yesterday, fortunately I was with my wife who took me to the ER…puts things in perspective. Today in cosmic irony I will watch people trying to concuss each other in the Super Bowl. No beer?

Sorry to hear about your fall. Hope you are over it in no time.

Your post is as lucid as your prior posts!!

Thank you for the thoughts.

I am a little strange I guess because I look at it as a wonderful experience.

First of all I did not break my neck or have a brain bleed.

I still have a headache and fuzzy in the head, but it was a novel experience. Something like this gives you a fresh look at life.

Everyone was real kind to me, even the ones I have no recollection of (my wife told me)

So no hiking today of course, bicycle tomorrow (with helmet).

So I was very lucky and this brush with potentially serious injury that did not happen emphasized the importance of family and friends.

As a retired physician with a nurse wife it reaffirmed to me that healthcare is a great career.

Bottom line, I’m lucky and grateful for everything.

I had a fall from a bicycle with a similar experience. Recovered fully! Pray you do the same.

Check the news. In Berkeley (We now call that city Berserkley) and Emeryville, car drivers are targeting people riding bikes. When the riders approach a car from behind the car door suddenly opens and riders would ram into the door and fell. There is a long simmering war between car drivers and bike riders in SF and East Bay cities. In SF it is especially problematic. It is a hilly city and a lot of bike riders are young folks with a me-first/me-only attitude.

Wow! That is evil.

I live in Huntington Beach and I can manage a 2 mile ride where there are bike lanes with low traffic and then I am on the beach path which is pedestrians and bikes only. I am always on the alert for someone carelessly opening a door even though the 2 mile ride only has a stretch of maybe 100 yards where cars can park.

I hike on weekends because there are too many people who don’t pay attention on the beach path.

I had a freak accident years ago where my bike flipped on a curb and I whacked my head, my helmet cracked and I know it prevented an injury. It was a Bell helmet I bought in the 70s for something like 50 bucks and wore for 40 years before it paid off.

We had a saying back in the 60s or so about priority on the road…”You can be dead right”

I don’t like the attitude people with a sense of entitlement but deliberately hurting is wrong.

What happened to “always be careful”?

Nice thing about the market is that there is no entitlement and whatever gains or losses you have are on you. It’s like being in the jungle. Complacency in the jungle? Yeah, that’s the VIX being really low.

Ingjiunn and yodoc2003,

I’m with you, I don’t have time in my schedule for a bad accident. As a teenager I rode my bicycle all over town, but now enough people seem so angry it doesn’t seem safe anymore. I keep it to trails or a stand in the basement with a trainer video. And hiking on the weekends.

The bear case is carried by economists that confidently believe a recession is absolutely coming that will lead to a lower low in the stock market. Historic precedent is with their case. So how can there be a bull market throughout 2023 as Cam and I forecast.

I believe when we look back at this year’s economy from the future, the key will be jobs. Something VERY unusual is happening in the jobs market that is very positive for the economy. Economists are confused about why jobs are so strong. It is unprecedented.

If you think the US jobs number for January was weird, the Canadian number was triply weird. The US and Canadian economies are very similar. The January Canadian jobs number was plus 150,000 jobs when experts predicted 15,000. The US economy is about ten times larger so this equates to a 1.5 million jobs number in America. Can you imagine a 1.5 million number last week instead of half a million?

Not only that but the December Canadian number was 100,000 or equivalent to a million in the US.

The Bank of Canada (Canada’s Fed) has gone into pause mode after raising rates last month. The real estate market is down 20% from its peak with mortgage rates up like in the US. Economists and the BOC all are calling for a recession and yet we are seeing blowout jobs numbers.

Here is what may be happening. I see that too many or even most Baby Boomers haven’t saved enough for retirement. They are coming back into the workforce or not leaving. Young workers need training with these experienced folks and companies keep both on the payroll.

Strong jobs equal consumer spending that keeps the economy out of a recession.

Prime age and 55+ labour force participation rate. Boomers don’t seem to re-entering the workforce

https://fred.stlouisfed.org/graph/?g=ZXrR

I CAN ONLY SEE AS FAR AS MY NOSE !!

This year I have traded profitably Long GDX, Long SPY,

Long QQQ and Short QQQ. Why do I point that out? Surely, not to advertise. Just to point out that in the last week money could have been made doing the opposite i.e short GDX, Short QQQ, Short interest rates (TLT).

For professional traders this is one of the most difficult markets. As long as there is a divergence of opinion between what the market thinks and what the Fed thinks volatility and short term moves are going to happen frequently.

Short term moves can always bloom into major moves. Presently, this is what I see : Long US dollar, long higher interest rates and Long volatility (VIX). All these are negative for the S&P 500 and the Nasdaq. If Tuesday CPI numbers are hot it will put a nail in the bullish case as the Fed will have no option to keep interest rates higher for longer

Philips Curve stops working. Many highly trained blind-folded dart throwers don’t know what to do and how to proceed, including our Fed. Granted their job is very difficult.

Ken, really ? Do you think we will avoid recession because of the latest great new jobs readings ? Employment is the most lagging indicator. We are at the late stage of this cycle. I share Cam’s opinion…second half of 2023 will be tough, both from macro perspective and from liquidity which by june will be artificially reinforced by TGA and chinese covid pivot.

The amount of data available to parse is immense. So are the number of economists, models and indicators. Macro situation is still quite uncertain.

There is conflicting data as well. Sentiment is improving but retail investors have pulled billions out of domestic equities in last six weeks (WSJ). Fed has raised rates dramatically but the employment remains strong. Junk stocks have rallied a lot in January. One would expect profitable, cash generating companies to do better if the economy is uncertain.

Maybe this is what happens at turning points but I think Fed still has the upper hand.

Yesterday I had mentioned that short term volatility is here to stay because of the divergence of opinion in the market (see previous note). Here is Jim Bianco’s take:

Jim Bianco biancoresearch.eth

@biancoresearch

In the last four full NYSE-only sessions, plus 45 minutes today, the S&P 500 has reversed back and forth at least 1% SEVEN times. Two of them have been at least 2%.

And tomorrow is CPI.

It is a 0DTE world. We just live in it.

Cam, a few examples of liquid small cap cyclical exposure ETFs would be helpful?

Thanks