The recent market rally has been led by a resurgence in large-cap NASDAQ stocks. This leadership has become overly extended, as evidenced by the rising divergence between their relative performance and the 10-year Treasury yield. A detailed factor and sector performance analysis reveals an underlying trend in favor of cyclical exposure.

Growth leadership

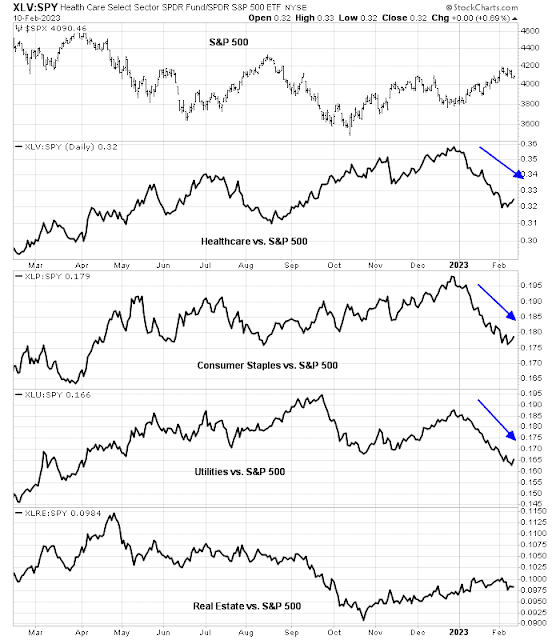

Make no mistake, the latest rally is a bullish revival. The only question is the nature of the leadership. A review of relative performance shows defensive sectors to all in relative downtrends, with the exception of real estate, indicating that the bulls have control of the tape.

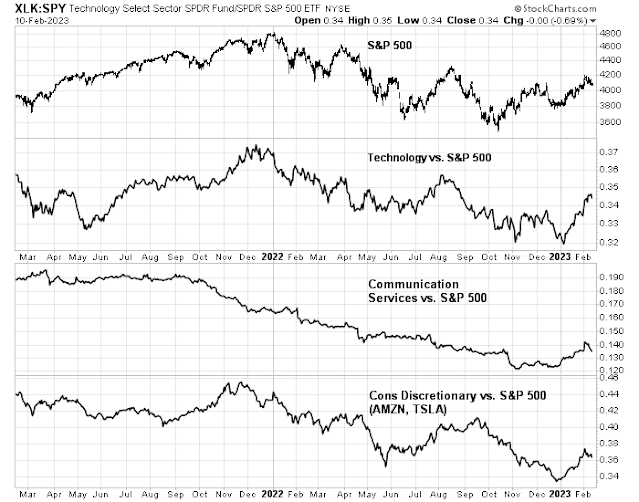

The relative performance of growth sectors have all rebounded strongly in 2023.

By contrast, value sector leadership have faded, with the exception of the cyclically sensitive equal-weighted consumer discretionary stocks.

Signs of cyclical strength

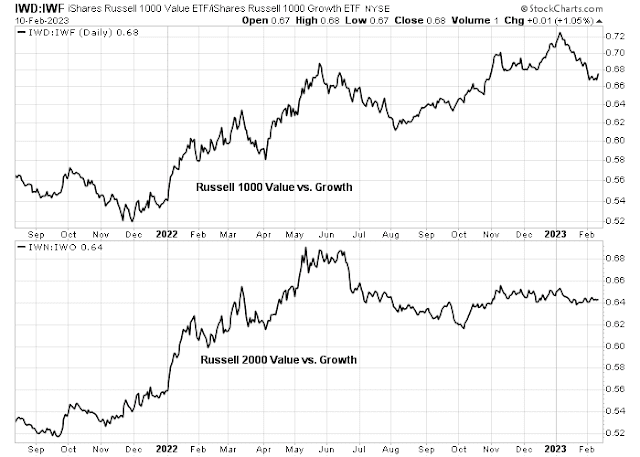

A review of the value/growth relationship by market cap tells a different story. While growth has been dominant against value among large caps in 2023, they were largely flat among small caps. In other words, the growth rebound has been concentrated in a narrow leadership of just a few FANG+ names.

A more detailed analysis shows a picture of underlying strength among cyclical stocks. The relative performance of key selected cyclical industries are strong.

A review of the difference in relative performance between large and small cap industrial stocks tells a similar story. While large cap industrial relative returns sagged in 2023, the small cap industrial stocks remain in a relative uptrend.

A similar pattern of small cap relative strength can be seen in the materials sector.

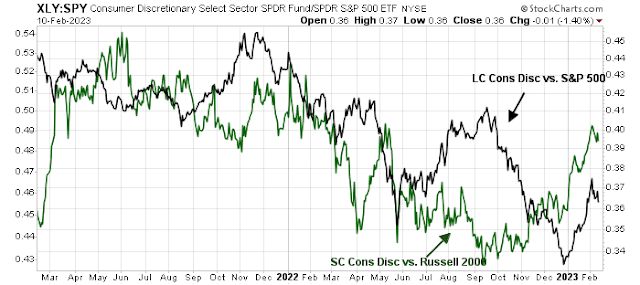

Consumer discretionary is another cyclically sensitive sector. In this case, both large and small caps are exhibiting positive relative strength.

In conclusion, the recent rebound in the US equity market has been led by a narrow leadership of large-cap growth stocks. The relative breadth of NASDAQ 100 stocks (bottom two panels) are weak. A more detailed analysis shows underlying strength in cyclical sectors and industries, which is where investors should concentrate their exposure.

Last week the December 2023 Fed Funds Futures soared 0.5% to 5% a new high. That is a likely growth rally killer.

Sorry to argue fuindamentals here (grin) If all the cyclicals are rallying, this suggests a cyclical upswing no? Tech usually does well in a cyclical upswing.

Does NOT necessarily apply to the large cap techs. They all have problems of their own. But the whole “unprofitable tech” and the tech parts of ARKK would seem to fit the “cyclical” bill.

Wondering if you have had a look at that or the GS or MS “non profitable tech indexes GSXUNPTC MSXXUPT. The individual stocks have been behaving well lately – often going up on fairly tepid earnings results.

This is a case of the technials clashing with the fundamentals. My base case is still a rally now and another bearish episode later this year.

Remember the “Party now, pay later” post?

We could be looking at a rare double-dip recession here.

Agree with the 1980-82 analogue. Thanks.

Cam, could you give a few ETF examples that fit the small cap cyclical stock areas?

Thanks

Could you go into more detail about the double-dip recession scenario for the current era, thanks.