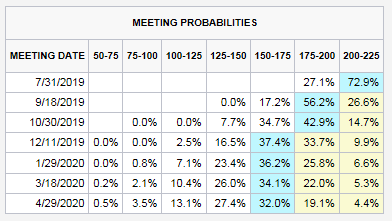

As we look ahead to the July FOMC meeting this week, market expectations of additional rate cuts have moderated. The market is discounting a 100% chance of a quarter-point cut this week. It also expects an additional quarter-point cut at the September meeting, and a third rate cut by year-end.

The better than expected Q2 GDP report just made the Fed’s job a lot more complicated.

Signs of economic strength

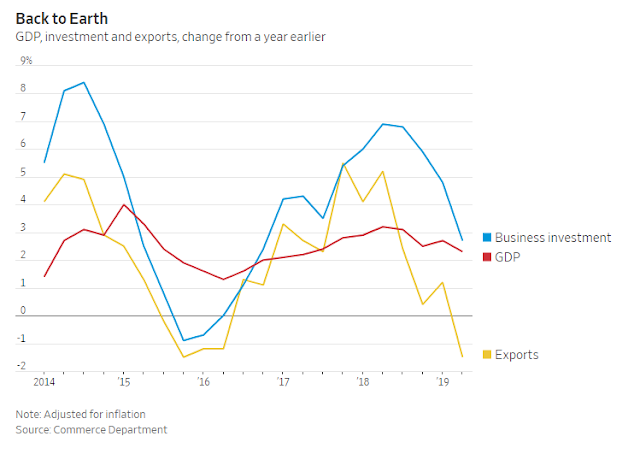

Q2 GDP came in above expectations at 2.1%. What`s more, real final sales to private domestic purchasers, which is a more stable measure of GDP growth, rose 3.2%. The latest FOMC median projections of 2019 GDP growth is 2.1%. GDP growth would have to slow to 1.4% to 1.6% for the remainder of 2019 to reach 2.1%. Watch if the Fed revises 2019 growth upwards. If the economy is that strong, why does it need to continue cutting rates?

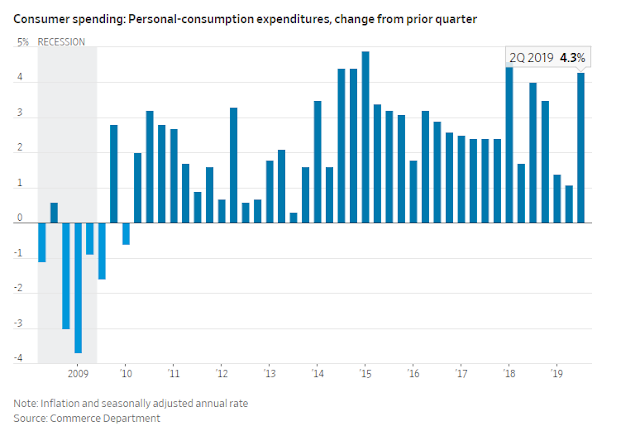

Consumer spending was on fire, personal consumer expenditures rose 4.3% in Q2.

On the other hand, the corporate sector was weak. The trade war hurt exports. Business confidence wobbled, and the uncertainty was reflected by lower business investments.

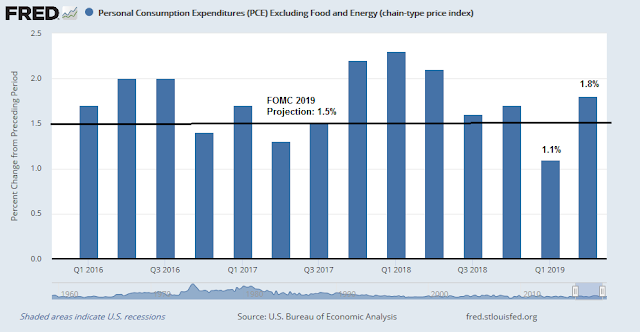

The hawks will focus on the higher growth rates. The doves will focus on the need for insurance in view of global uncertainty. In addition, inflation remains under control. FOMC’s 2019 median core PCE is projected to be 1.5%, which is slightly above the rates observed in Q1 and Q2.

The Fed has strongly signaled that it will cut by a quarter-point at its July meeting, and it is unlikely to disappoint. However, the case for additional easing is less clear. How much insurance does the Fed really need?

Watch the language on the outlook. Will the Fed revise its 2019 GDP growth projections upwards? Will the Fed start to edge away from more cuts, or will it pre-commit to any cut in September? How will it frame the narrative over future moves?

Do you feel lucky?

For equity investors, the FOMC meeting presents a high degree of risk. Stock prices depend mainly on two factors, the E in the P/E ratio, and the evolution of the P/E ratio itself.

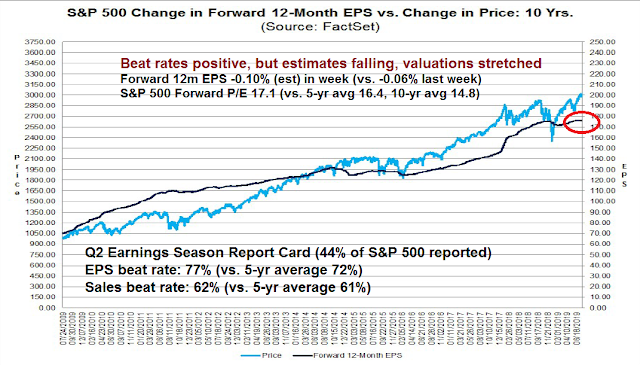

FactSet reported that the beat rates from Q2 earnings season are above average, but the forecast E is falling. Since forward earnings move roughly in lockstep with stock prices, flat to falling EPS estimates opens up downside risk for equities.

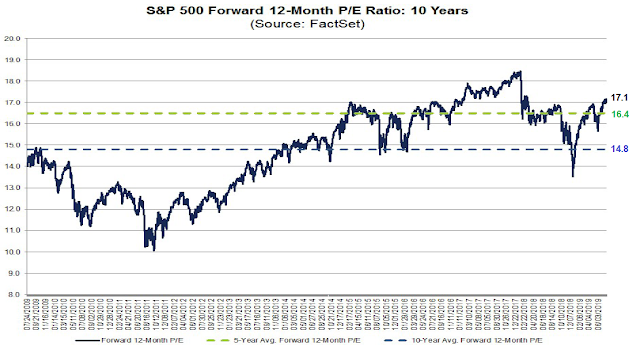

The P/E ratio presents another risk. The S&P 500 trades at a forward P/E of 17.1, which is elevated compared to its history. Further rate cuts will lower the discount rate of earnings, and therefore boost the P/E ratio.

When the market has lost one leg of support from a rising E, it needs the assurance of further rate cuts to hold prices up. That said, the Powell Fed has recently adopted a far more dovish course that my past projections.

Do you feel lucky?

This could be one of those buy the rumor sell the news times. There is a positive expectation for this FOMC so disappointment (or impatience) could cause a drop in the market.

I wonder though how this will affect the USD…will it cause a pop up if the language is not that of many rate cuts to come…compared to the euro…would this cause precious metals to drop….they have had a nice run up, a correction would not be unexpected

The Fed is clearly pressured into lowering rates. I winder by whom? Of course rates everywhere else are lower to negative,. The Fed simply cannot undo the harm of mutuall tariffs. when E starts declining so will P. The Fed cannot cause earnings to increase just through a few rate cuts. Trumpian economics will overwhelm the Fed’s actions. Perhaps he will reverse course when he realizes the damage this will do to his re-election prospects. He is at war with the world and the Dems. He cannot win them all. when the markets finalize realize this…

I am thinking that Powell will want to save face, so the initial response will probably have a hawkish undertone to the rate cut….if the data is supportive of not too much easing, then you would think the combo of saving powder for when you really need it and saving face. The market might have a hissy fit, but then of course it could just keep going up and pushing the shorts. I am standing aside for now until after Wednesday, except for some small bearish option positions on precious metals. Honestly the Fed is annoying, but the market will use any excuse to shake the tree. Recently we had this grinding up of TSLA on expectations of improving earnings, we all saw what happened, but what a grind up it did in June and July

maybe we see something similar if the market is not happy with FOMC