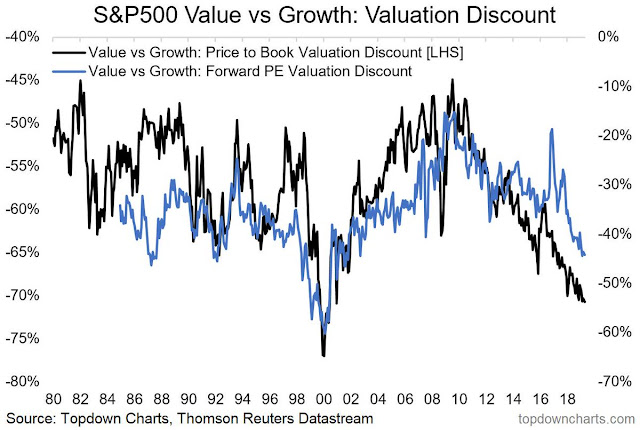

Value investing has taken it on the chin in the last decade, as the style has badly lagged the market. Callum Thomas documented how value discount has grown over the last decade. The discount has fallen to levels last seen at the height of the NASDAQ Bubble, when internet related stocks came crashing to earth, and value stocks outperformed.

Is this the time to buy Value? Here are a couple of suggestions of how to participate in the value style in a way that performed well despite the style headwinds of the last 10 years.

Give it to Warren

One way is to just give your money to Warren Buffett. While Buffett’s investing style is not value investing in the classic sense, the shares of Berkshire Hathaway has performed roughly in line with the market over the last 10 years. That’s quite an accomplishment in light of how the Russell 1000 Value Index lagged the market (green line). Moreover, Berkshire shares held up relatively well in the last two bear markets, and if history is any guide, they should provide some downside protection in the next major bearish episode.

A different kind of CAPE

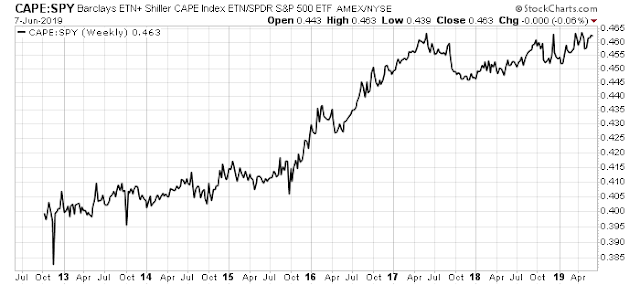

Another way of participating in the value style is the unique application of CAPE by Barclays CAPE ETN, which is described this way:

The investment seeks to replicate, net of expenses, the Shiller Barclays CAPE US Core Sector Index. The index seeks to provide a notional long exposure to the top four relatively undervalued U.S. equity sectors that also exhibit relatively strong price momentum.

The ETN only began life in 2012, so we don’t have the performance history over a full economic cycle. However, CAPE has managed to outperform during the 2015-2017 period, while keeping pace with the market the rest of the time. This is a remarkable record given the poor record of value investing during this period.