Mid-week market update: Sell in May? June swoon? Not so far! As the SPX convincingly staged an upside breakout above the 2740 resistance level, the bull case is easy to make. We have seen fresh all-time highs this week from the following:

- NASDAQ Composite

- Russell 2000 small caps

- NYSE Advance-Decline Line

- NASDAQ Advance-Decline Line

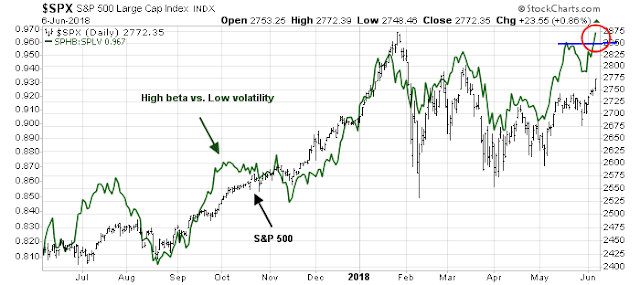

I probably forgot a few, but you get the idea. In addition, the metrics of risk appetite, such as the ratio of high beta to low volatility stocks, is exhibiting a positive divergence.

Hold the celebrations! While I have been bullish throughout this corrective episode, I am very aware that the bulls still have some short-term challenges to overcome.

A bulls’ party

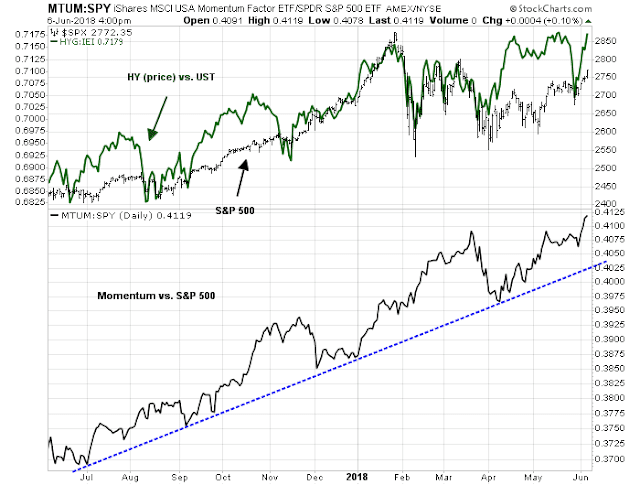

It`s hard not to be bullish. risk appetite indicators such as the relative performance of junk bonds, and price momentum, are pointing higher.

Moreover, sentiment has not reached excessively bullish levels. The Fear and Greed Index is displaying positive momentum, but readings are still in neutral territory. These conditions leave room for stock prices to rise further before becoming overbought.

In the short run, the CBOE equity-only put/call ratio has flashed a number of low extremes, indicating complacency. However, I prefer to focus on the longer term normalized average, which is not at a sell signal level yet.

What about the unfilled gaps below as the market rallied? Could the market weaken to fill those gaps? Rob Hanna at Quantifiable Edges studied what happens when the market rallies to fresh highs while leaving two unfilled gaps in its path (N=47). If history is any guide, positive price momentum has overcome the mean reversion factor of the unfilled gaps.

The challenge for the bulls

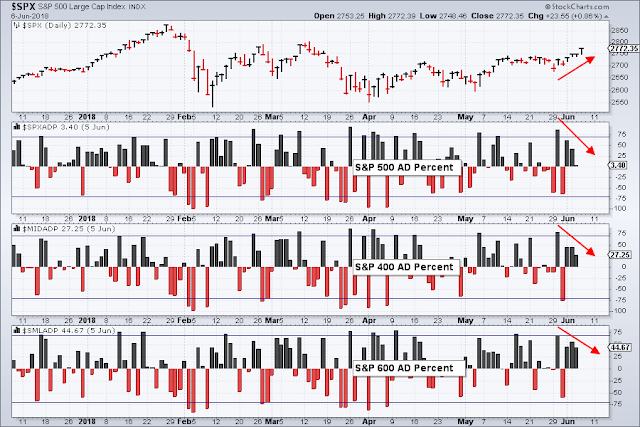

Still, there are a couple of short-term worrisome developments beneath the surface. First, breadth momentum, as measured by A-D percent, has been weakening across all market cap bands even as the market ground upwards. Can prices continue to advance even as breadth momentum peters out?

In addition, the market is testing the upper end of a a classic bearish rising wedge. If the market should break down out of that formation, the first logical support would be the 2740 area, with further downside risk down to about 2720. However, an upside breakout would invalidate that potential negative development.

In short, the market needs to exhibit evidence of momentum acceleration in order for this rally to continue.

For now, I am giving the bull case the benefit of the doubt. My inner trader remains bullishly positioned. He is aware of these challenges and he is calibrating his risk control accordingly.

Disclosure: Long SPXL, TNA