Further to my last post (see Watch the reaction, not just the Fed), I got a number of questions that asked if there are any factors or nuances from the FOMC statement or subsequent press conference to watch for.

Firstly, I reiterate my point that the reaction to the Fed is far more important to the future direction of stock prices than the Fed statement itself. I expect that the Fed will try very hard to remain apolitical and refuse to react to any possible changes in fiscal policy until they are actually announced. Nevertheless, I will be watching if the committee makes any references to:

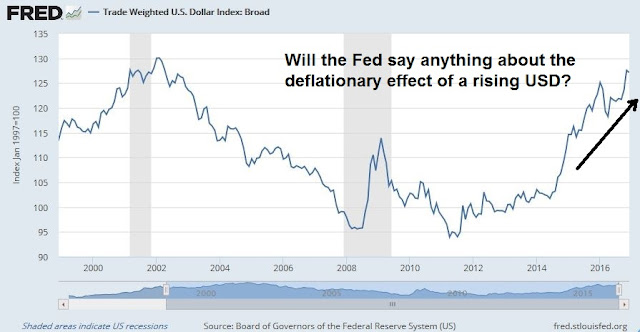

- The strength of the US Dollar; and

- Any possible changes in the projected path of inflation.

How the Fed views these factors will influence affect the pace of interest rate normalization in 2017.

What about the USD?

A rising currency has a natural deflationary effect, because imports become cheaper, which puts downward pressure on inflation. The recent bout of USD strength has a similar effect of tightening monetary policy.

If the FOMC statement makes a reference to the strength in the greenback, interpret it as dovish.

Wither inflation?

The chart below shows the number of instances in a trailing 12-month window when the annualized monthly increase in core PCE exceeds the Fed’s inflation target of 2%. In the past, the Fed has embarked on a tightening cycle when the number of instances has reached 6. The current reading is 5, which is close, but not yet.

How the Fed views the development of inflation develops will be a critical input in the future path of monetary policy. Here, the picture is mixed. As the chart below shows, market based inflationary expectations metrics have been rising, but survey based data has remained steady.

Higher inflationary expectations will put more pressure on the Fed to have a hawkish tilt, while steady inflationary expectations can give the Fed cover to remain dovish and adopt a wait and see attitude.