As I write these words, there is pandemonium in the markets. ES futures are down about 4%. My 16 year-old (Canadian) daughter received an offer of marriage over the internet from an American.

I recognize that a lot of people view a Trump presidency with horror, but it’s time to assess the investment implications of these electoral results. Arguably, fear levels have already spiked and any panic selling could be viewed as a buying opportunity for stocks. As the chart below shows, the CBOE put/call ratio (middle panel) spiked to 1.48 yesterday and the VIX term structure inverted. These are readings consistent with short-term bottoms rather than the start of a sustained bear leg.

So let’s take a deep breath and review the bull and bear case for equities under a Trump administration.

The first 100 days

There are two major causes of sustained equity bear markets:

- War or rebellion that results in the permanent loss of capital

- Recession

As equity futures are deeply in the red, let’s first consider these possibilities, starting with Trump’s first 100 days. There are several accounts of Donald Trump’s priorities in his first 100 days. As examples, see NBC, the WSJ, and The Telegraph. The common threads that are likely to spook the markets are:

- Trade: Trump has vowed to cancel American participation in TPP. In addition, he announced that he intends to re-negotiate NAFTA. Undoubtedly, China will be labeled a “currency manipulator” and Washington will slap tariffs on all sorts of Chinese imports.

- Foreign policy: The chill in trade will extend to foreign policy as America will become more isolationist. No longer can NATO and other allies count on America’s military help if countries don’t “pay their way”.

Trade slowdown = Recession?

On the first issue of trade, the key question for investor is whether a slowdown in global trade under a Trump administration be enough to spark a recession.

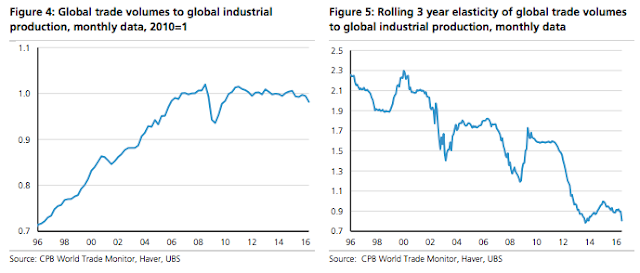

Notwithstanding the chilling effects of Trump’s protectionist policies, global trade has already been slowing down. FT Alphaville highlighted research from UBS showing that global trade volumes have been flat for much of this decade (left chart). Not only that, the “beta of trade growth to industrial output” has been falling (right chart).

A recent study by the European Central Bank revealed the reasons for the slowdown:

The change in the global income elasticity of trade between the pre-crisis period and more recent years is found to be mainly driven by two developments. One source of change arises from compositional effects, such as the shift of growth in trade and economic activity towards economies with lower trade intensity, and changes in the composition of aggregate demand factors towards less trade-intensive components. These shifts are not necessarily structural and could reverse in part over the medium term. The other source of change relates to structural factors that are altering the fundamental relationship between trade and economic activity, such as the degree of trade liberalisation and the reliance on global value chains (GVCs). These tend to be slow-moving changes reflecting fundamental shifts in the economy. The main difference between these two sources is that the latter fundamentally changes the relationship between trade and economic activity at the level of individual countries or demand components, while the former changes the global income elasticity of trade by shifting the weight of activity among countries or demand.

In other words, the world had already picked the low hanging fruit of globalization. Greater globalization policies were in effect mining lower and lower grade ore.

The markets will undoubtedly react in a knee-jerk fashion to the prospect of greater American protectionism, but if the benefits of globalization are already mostly played out, will it matter that much?

Rising risk premium

Trump’s isolationist foreign policy instincts could be a greater cause for concern. If US allies cannot unconditionally rely on American military help, then the markets will start to price in a higher possibility of conflict in global flash points such as the Baltic states (Estonia, Lithuania, and Latvia) and the South China Sea.

As this Credit Suisse historical study of asset returns shows, war can be devastating to asset prices if they lead to the permanent loss of capital. In those instances, you would be lucky to escape with your life and the value of your savings might be the least of your worries.

The bull case

There are silver linings to this dark cloud overhanging the markets. First of all, you can forget a December rate hike. The Fed is unlikely to raise interest rates in the face of market volatility and uncertainty. The Yellen Put still lives.

In addition, the effects of Donald Trump’s fiscal policy of tax cuts and spending, such as the Wall, will be enormously expansionary. As the Republicans have control of both the House and Senate, a Trump administration should not relatively little trouble getting his proposals passed.

Expect a big shot of fiscal stimulus to the American economy.

Should Trump carry through with his desire to replace Janet Yellen as Fed chair when her term expires on February 3, 2018, the replacement would likely be even more dovish than Yellen and head an even more accommodative Federal Reserve. If that were to occur, then the circumstances are ripe for the next grand experiment in economics, namely “helicopter money” as described by Ben Bernanke in a Brookings Institute essay:

Money-financed fiscal programs (MFFPs), known colloquially as helicopter drops, are very unlikely to be needed in the United States in the foreseeable future. They also present a number of practical challenges of implementation, including integrating them into operational monetary frameworks and assuring appropriate governance and coordination between the legislature and the central bank. However, under certain extreme circumstances—sharply deficient aggregate demand, exhausted monetary policy, and unwillingness of the legislature to use debt-financed fiscal policies—such programs may be the best available alternative. It would be premature to rule them out.

The idea is not totally without merit. Bloomberg reported that Bernanke was an advocate for the idea in a meeting with the Japanese in July 2016.

Don’t panic

What should investors do? It’s hard to give advice without knowing the specific circumstances of any investor. If you were to ask my inner investor, he would likely say that if you haven’t raised cash, you should probably either raise cash or de-risk your asset allocation back to the investment policy weight as the Trend Model has moved from a risk-on reading to neutral. The market action in the past week indicates that many investors or their advisers have already done some hedging so further selling may not be necessary. Undoubtedly the market will experience substantial volatility in the days ahead, but don’t panic and evaluate the risk and reward in the market in light of the bull and bear cases that I have outlined.

My inner trader will probably see his long equity positions get stopped out when the market opens. He will be watching for whether the bears can take control of the tape, or if technical and sentiment readings are at an extreme before making further commitments.

Is the Trading Model still long (arrow up). Did the Trend Model go neutral as of this post. It was Bullish 11/6/16.

Technically the trading model wouldn’t change until we had actual trading and actual prices. However it is likely to go short on a mechanical basis. I would be wary of such a signal given the already high fear levels exhibited by the option market.

I disagree re. December rate hike…unless volatility picks up markedly, the main election uncertainty is out of the way. You have correctly explained that incoming data were fine, why delay yet another time ?

Cam, didn’t I say more selling was coming? My model has anticipated the need for a flush. However, we may very well have made a low (or due to make a low today). Once my smart money indicators turn around from not believing in the rally into buying this dip, we should start a durable rally.

Changsen, highly appreciate your comments. I agree with you that Cam is slightly biased to a bullish side.

Cam, could you share what your stops are?

Let this episode be a lesson to me about making changes in model readings before the market opens. The model reading changes were based on S&P 500 futures being down 3-4% overnight.

My stops were not hit in the regular session. It seems the market has decided that the glass is half full.

The Trend Model remains at a risk-on reading as of noon Wednesday.

The Bio-Technology index is going to go up substantially. Other than that I would just step aside. Sometimes (not always) the overnight after market lows get tested. The market can see sharp moves both up and down as the President selects his cabinet. For now it looks like dollar down, bonds down and gold up.

Cam,

Could you please comment on 10 year US Treasuries? Do you think a bear market for treasuries is coming? If so, what’s the impact on stock market? Thank you as always.

That depends on whether the market believes in the fiscal stimulus-reflationary growth scenario (bond bearish), or the rising trade barriers causing a recession scenario (bond bullish). For now, the yield curve is steepening, which is a vote in favor of the growth scenario.

That could change in the next day, or next week. I would wait until the dust settles first.

Cam,

May I thank you for being as open minded as you are. You are one of a very few financial bloggers I read that actually thought and wrote about a Trump win. Bloggers like Ritholtz just trotted out big analysts, Nate Silver, NY Times etc who simply scoffed at the possibility.

Your thinking is a pleasure to read even for a SuperNovice.

Oh my God. I was having technical difficulties.

Cam, Just wanted to point out a trivial typo.

In “The Bull Case”

“….a Trump administration should not relatively little trouble getting his proposals passed.”

Probably you meant “should have”. Feel free to delete this comment if/when fixed as it will then be useless.

As always, thanks for the calm analysis.

d-_-b