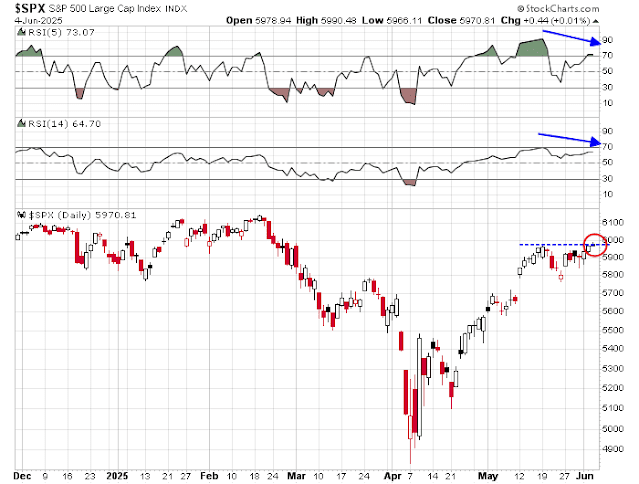

Mid-week market update: The S&P 500 has been a little stronger than I expected as it tests upside resistance. I would urge traders to exercise caution as the market is exhibiting negative RSI divergences. Even though these kinds of divergences can persist for a while, they nevertheless indicate limited upside potential.

A valuation roof

Jurrien Timmer at Fidelity argue for a range-bound market. Stock prices are bounded by a Trump Put on the downside and a valuation roof on the upside. I agree.

Valuation is elevated from a forward P/E perspective.

There is a bifurcation between the soft survey data and the hard economic data, but that may be changing. Today’s large miss in ADP private employment may be an early hard data warning of softness in the labour market. Yesterday’s JOLTS report showed that job openings had risen, but the all-important quits to layoffs ratio had plunged. I interpret this as a loss of confidence in the jobs market. Workers are hesitant to quit as layoffs rise.

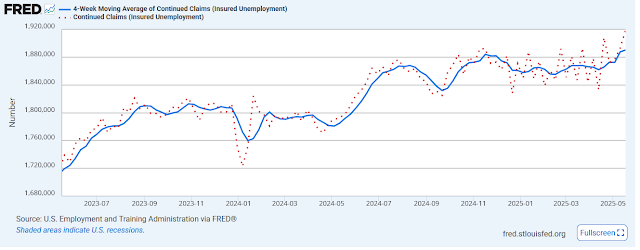

As well, the strength in continuing jobless claims is another sign that job seekers are encountering increasing difficulty finding new employment once they are jobless, which is another sign of a soft labour market. Be prepared for a miss in the May Nonfarm Payroll report due Friday.

Another source of concern from the soft data is the weakness in ISM non-manufacturing. Bank card surveys have shown that consumer spending has been resilient. While goods purchases may have been effort to front run tariffs, service spending is less tariff sensitive. The miss on the May ISM Non-manufacturing was therefore a surprise, especially when the reading fell below 50, which indicates contraction.

Narrow leadership

From a technical perspective, the latest attempt to stage an upside breakout has been accompanied by the narrow leadership of the Magnificent Seven.

A speculation on P/Es.

Way back when, P/Es were much lower, I remember when they were like 7 or 8.

Now they are much higher. Why?

Well the P is price, but price means dollars, and if dollars are losing value at an accelerating rate, then P/Es should rise.

Since Covid Federal deficits are accelerating. This might affect how fast the dollar loses value.

Think Weimar when prices in the stores were set 3 times a day, with insane rates of inflation. How does one set a P/E? If you have an E that will be increasing faster and faster, it’s no longer linear.

So maybe what used to be normal or high P/E is wrong.

You are right. I always rebase all numbes to gold price based to see how much and how fast USD loses its value. If you do that you gain a lot of insights with minimal effort and time. Sometimes I got lazy and don’t want to spend time on analyses. Then I just look at the rebased set of numbers. It clears a lot of clouds.