Mid-week market update: Is this a case of buy the rumor and sell the news? We’ve had the news of a debt ceiling deal and it appears that the bill will have enough votes to pass the House today. But where’s the relief rally?

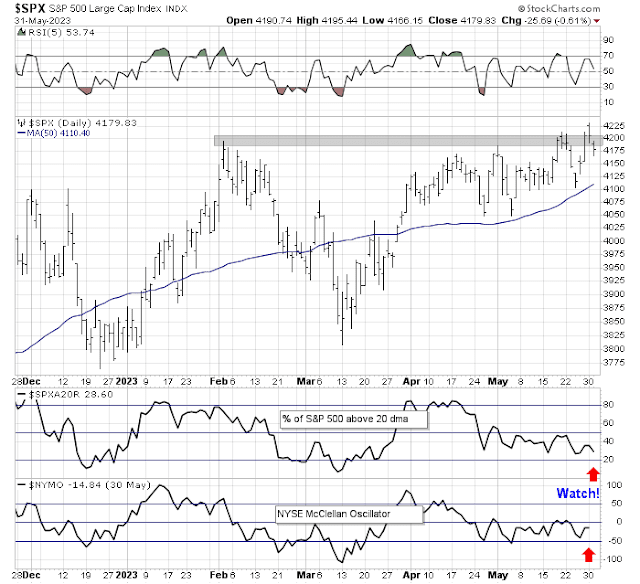

The S&P 500 continues to struggle with resistance at the 4180-4200 level. A decisive upside breakout would see the next resistance at 4300-4310, but the relief rally seems to be fizzling,

All is not lost for the bulls. Hedge fund position is bullish. Systematic hedge funds have been buying and there is room for positions to rise should a FOMO stampede develop. Discretionary hedge funds are very short and they may be forced to cover should stock prices advance.

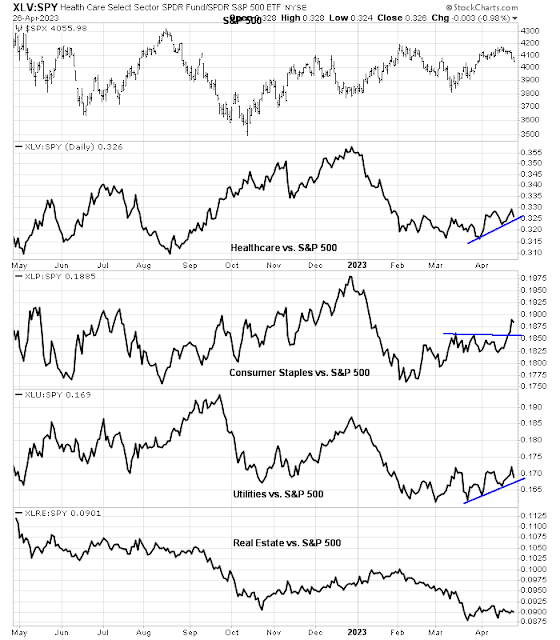

The relative performance of defensive sectors is extremely weak, indicating that bulls still have control of the tape.

As well, regional banks have stabilized at a relative support level. That’s one tail-risk off the table.

Bear case

On the other hand, breadth is extremely weak. Even as the S&P 500 rose to a new recovery high, the equal-weighted S&P 500, the mid-cap S&P 400, and the small-cap Russell 2000 are all weak.

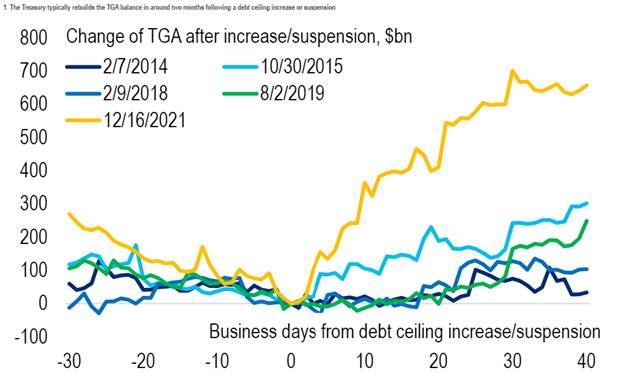

When the debt ceiling bill becomes law, expect Treasury to replenish the levels of the Treasury General Account (TGA), which is the checking account held at the Fed. At last report, TGA was a minuscule $62 billion. This will drain liquidity from the financial markets and create headwinds for the price of risk assets like stocks.

If history is any guide, TGA levels always rebound after an increase in the debt ceiling. The magnitude of increase depends on the magnitude of the drawdowns leading up to the event. As current TGA levels are extremely low, expect TGA to rise significantly in the near future.

Before the bears become overly excited, be aware that bad breadth cuts both ways. The percentage of S&P 500 stocks above their 20 dma and the NYSE McClellan Oscillator are all nearing oversold levels. This suggest that the immediate downside support can be found at the 50 dma of the S&P 500, which is about the 4100 area.

In other words, don’t expect the market to crash from these levels.

I think it’s when there is an unexpected event that the big moves happen. The debt ceiling is well known, as was the Fed hiking rates. Bearish surprise could be a big bank, some event like Softbank taking a dirt nap, zombie contagion, something like that, but what could be a bullish surprise? We seem to be stuck in this range until something happens.

If one believes in liquidity cycles, the path of least resistence is upwards and onwards based on history.

Whilst this will not be straight line (like anything else), looking / watching for evidence that dis-approve this base case scenario.