It was nine years ago today, Humble Student of the Markets was born. My first post at the time was entitled What exactly are hedge funds hedging? I went on to show that hedge fund returns were correlated with equity returns. That makes conceptual sense, because hedge funds are in the business of taking risk and equity risk is a major component of investing risk.

HFs are so 20th century…

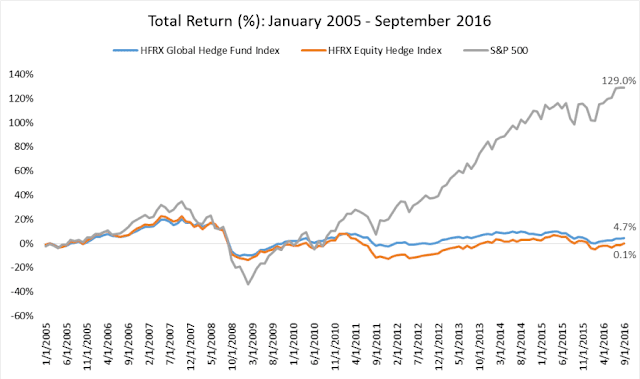

Nine years later, hedge funds have done even worse than what I showed in 2007. Charlie Bilello showed that their returns have flattened out. They are no longer correlated with equity returns.

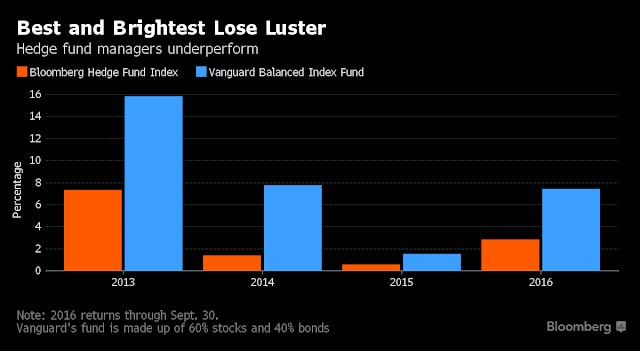

It could be argued that HFs are absolute return vehicles and therefore it is unfair to compare them against equities. Bloomberg showed that their performance against a balanced fund benchmark has been nothing to write home about either.

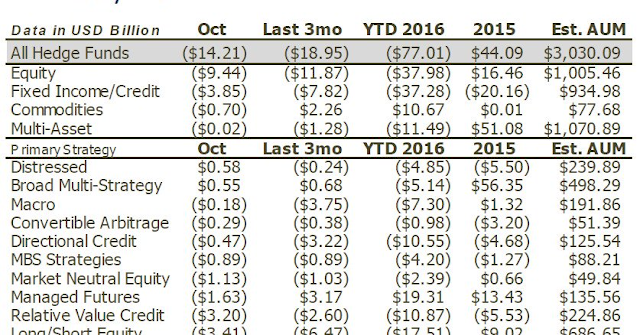

The market has reacted and the latest figures show that YTD hedge fund fund flows have turned negative. YTD redemptions are 77b as of October 2016.

Alpha is hard to find

My assertion back in 2007 that alpha is hard to find turned out to be correct. Many HF strategies, such as convertible arbitrage, long/short equity, event-driven, emerging markets, and so on, can be approximated by combinations of factors. In other words, you were paying for beta when you thought you were buying alpha. Since then, even those beta strategies have turned into…I don’t know what as aggregate HFRX Indices have flattened out over the last few years.

The field is getting far too crowded to extract significant alpha. Back in the early 1990’s, when swashbuckling managers like Julian Robertson and George Soros dominated the field, a billion dollar hedge fund was an enormous fund. Today, a fund with AUM that size just gets lost in the crowd.

Thanks always for your refreshing perspective, Cam.

Where is the money going that is coming out of so-called hedge funds?

a) that’s cause for a YUGE celebration in one year’s time

b) it shows that even a brilliant service such as HSotM needs time to gel

c) what’s the half-life of a hedgie’s brand? Do people still buy into them, expecting magic?

Anyhow, thanks!