In a past post (see Pax Americana or America First?), I showed how the combination of the unequal sharing of productivity gains and the inward looking America First policies were eroding US competitiveness, and raising the fragility of the post-WW II Pax Americana boom.

Even though the US and China appears to be locked into a Cold War 2.0, I would like to demonstrate how both countries appear to be locked into paths that will eventually stall their growth.

Andy Haldane’s about face

We begin the story with the Bank of England’s chief economist Andy Haldane, who recently made a remarkable speech to some students at Oxford. Haldane said that he had changed his mind about the drivers of economic growth:

I thought I understood the story of economic growth, its drivers and determinants. But recently I have changed my mind. I have a new story of growth. I think this story carries important implications for understanding the future challenges of technology and for devising the future policies and institutions necessary to meet them. That might require, among other things, a repurposing of successful institutions like this one, turning them from universities into multiversities.

The old neoclassical models weren’t good enough:

In the second half of the 18th century in the UK, ideas began sprouting like morning mushrooms. These ideas emerged seemingly spontaneously and roughly contemporaneously. They were also relatively closely clustered geographically. They included James Hargreaves’ spinning jenny in 1764, Richard Arkwright’s water frame in 1769 and James Watt’s steam engine in 1775.

In the fullness of time, these ideas began to revolutionise both industry and work. After a lengthy adoption lag, they spread across sectors and across regions. They migrated from being mere ideas to becoming “GPTs” or General Purpose Technologies.12 In the process, they generated waves of investment in new factories, machines, processes and infrastructures. There was, in the jargon, capital-deepening.

Neo-Classical theories of economic growth are very clear what would be expected to happen next.13 When an outward shift in the economy’s technological frontier is combined with higher levels of physical capital, the fuse is lit on higher productivity among companies, higher wages among workers and, ultimately, higher living standards among societies. So it was during the Golden Era.

Chart 2 plots productivity, wages and GDP per head in the UK since the Industrial Revolution. All three plateaued prior to 1750. Since then, all three have moved up in lockstep. Ideas and innovation have borne continuous fruit in higher productivity, pay and living standards. This fruit has been shared roughly equally between owners of companies (profits) and workers in companies (wages). We know that because labour’s share of the national income pie is similar today to 1750.

Here is the problem with those models. Why did other waves of innovation fail to transform societies?

You do not need to go that far back for examples of big ideas which had a transformative impact on industry and society. Immediately prior to the Industrial Revolution and running chronologically, these included the windmill in the 12th century, the mechanical clock in the 13th, the cannon in the 14th, the printing press in the 15th, the postal service in the 16th and the telescope and microscope in the 17th.

It will surprise no-one that waves of innovation, big and small, have been lapping the shores of society for the entirety of human civilisation. In other words, while ideas and innovation may well be a necessary condition for economic growth, the historical record suggests they may not themselves have been sufficient. Other forces appear to have been at play, translating these ideas into sustained growth in living standards.

Haldane came up with two ideas:

What might those forces be? I want to provide two different, but complementary, lenses on the growth story. The first focusses on a rather broader set of “capitals” – not just physical capital (plant and machines) but human (skills and expertise), intellectual (ideas and technologies), infrastructural (transport and legal systems), social (co-operation and trust) and institutional (national and civic, private and public) capital.

History suggests each of these capitals may have played an important supporting role in the story of growth. Ideas alone, without the support of one or more of these broader capitals, have historically run aground. For example, in the UK many of the foundations for growth after the Industrial Revolution were laid in the centuries preceding it. It was on this platform of “capitals”, plural, that ideas and innovation then built.

Take human capital. The most dramatic improvements in educational standards in the UK occurred prior to 1750 (Chart 3). So too did the largest improvements in measures of social, infrastructural and institutional capital.19 Ideas needed these foundations to flourish. A steam engine is not much use without the skills to build it, the tracks to run it on, the institutions to oversee it, the trust of the public to accept it. The causes of the growth inflexion in 18th century England were as much sociological as technological.

The other revolutionary idea came from an important paper by Broadberry and Wallis, whose conclusion was “don’t lose when you’re in a recession”:

Another lens through which to view this alternative growth story has recently been provided by economic historians, Steve Broadberry and John Wallis.20 Indeed it was probably this lens on the world, above all others, that led me to change my own story about growth.

FT Alphaville explained the Broadberry and Wallis paper this way. Innovation and the conditions for innovation are critical to growth, but institutions are just as important:

In a 2017 paper for the National Bureau of Economic Research, they collected growth data for several European countries back to the 14th century. They had noticed that poorer countries go through more frequent contractions. In other words, they shrink a lot. So Broadberry and Wallis decided to quantify not just periods of growth, but periods of shrinkage. They found the countries that began sprinting in the 19th century didn’t grow faster. They just shrank less often.

When economies start to grow fast, says Wallis, “80 per cent of the increase in growth rate can be explained by shrinking rather than growing.” It was his idea to look at shrinking, and he was surprised by how important it ended up being. That Solow-Swan story of how to grow isn’t enough on its own. It needs a complement, the story of how not to shrink. Broadberry and Wallis point to what economists call “institutions” — customs and laws that create order and make regular transactions even possible.

To grow, it’s not enough to provide labour, capital and ideas. You have to be able to co-ordinate exchange, to trust that when you extend credit, your counterparty will be there, and the plant you just bought won’t be arbitrarily seized by the government. In the post-colonial United States, for example, it was impossible to charter a bank in many states unless you were a patron of the right political party. Getting rid of that — moving towards equal treatment under the law — was as important to the American industrial revolution as the capitalisation of the mills in Lowell, Massachusetts.

Institutions prevent countries from shrinking, because they provide a baseline guarantee of economic co-ordination. They create trust, which makes growth less fragile. (Though Wallis avoids the word “trust,” which he finds too morally loaded.) Countries that fail to develop institutions fail to become rich countries:

The fading American Dream

To summarize, the conditions for growth are the following:

- Create the conditions for innovation and their exploitation

- Create the institutions to foster growth

That sounds like the American Dream, where anybody can make it, where if you build a better mousetrap the world will beat a path to your door.

Here is the actual data. Alan Krueger, who was Obama’s chairman’s of the Council of Economic Advisors, called it the Great Gatsby Curve. Krueger studied the connection between concentration of wealth in one generation and the ability of those in the next generation to move up the economic ladder compared to their parents.

Here is an updated version of that data that include EM economies. At the top of the list is China. The US is just behind developed markets in the UK and Italy. The American Dream is alive, but in the “socialist” Scandinavian countries, as well as former British colonies Australia and Canada.

We have all heard about the stories of nepotism and cronyism in China. Many Politburo are princelings, or the sons of former revolutionaries. The SCMP recently reported that the deputy Communist Party chief in Shenzhen had 1 billion yuan in cash that money launderers refused to touch. If we were to focus on the other tail of the income distribution, China tops the world in child poverty rates, while the Scandinavians rank at the bottom.

What about the US? The Financial Analysts Journal recently published an article entitled “Corporate Political Strategies and Return Predictability”. Here is the abstract [emphasis added]:

We assess whether observable corporate political strategies can serve as channels of value-relevant political information flow into stock prices and form the basis for profitable return predictability strategies. We document that returns of politically connected firms’ stocks lead those of their non-connected peers, suggesting that information shocks associated with new policies and other political developments become evident first in the stock prices of firms that pursue political strategies and then, with delay, in those of similar, non-connected firms.

Former IMF chief economist Simon Johnson discussed the response to the Great Financial Crisis and other EM crises in The Atlantic:

To IMF officials, all of these crises looked depressingly similar. Each country, of course, needed a loan, but more than that, each needed to make big changes so that the loan could really work. Almost always, countries in crisis need to learn to live within their means after a period of excess—exports must be increased, and imports cut—and the goal is to do this without the most horrible of recessions. Naturally, the fund’s economists spend time figuring out the policies—budget, money supply, and the like—that make sense in this context. Yet the economic solution is seldom very hard to work out…

Typically, these countries are in a desperate economic situation for one simple reason—the powerful elites within them overreached in good times and took too many risks. Emerging-market governments and their private-sector allies commonly form a tight-knit—and, most of the time, genteel—oligarchy, running the country rather like a profit-seeking company in which they are the controlling shareholders…

Squeezing the oligarchs, though, is seldom the strategy of choice among emerging-market governments. Quite the contrary: at the outset of the crisis, the oligarchs are usually among the first to get extra help from the government, such as preferential access to foreign currency, or maybe a nice tax break, or—here’s a classic Kremlin bailout technique—the assumption of private debt obligations by the government. Under duress, generosity toward old friends takes many innovative forms. Meanwhile, needing to squeeze someone, most emerging-market governments look first to ordinary working folk—at least until the riots grow too large.

That’s why institutions matter. Innovation matters, but institutions create the equality of opportunity, though the equality of results is not necessarily an objective. The situation has deteriorated sufficiently that even Barron’s (!) has called for a bigger welfare state:

Life is filled with risks, and most of them skew to the downside: losing a job or getting hit by a car is much likelier than winning the lottery. While private insurance and ample savings can help, those who are most vulnerable to sudden drops in earnings or unexpected expenses are often the people least able to afford these protections.

The inequality gap has opened up not just among individual Americans, but at the community level, as this Brookings study concluded:

The 2016 election revealed a dramatic gap between two Americas—one based in large, diverse, thriving metropolitan regions; the other found in more homogeneous small towns and rural areas struggling under the weight of economic stagnation and social decline.

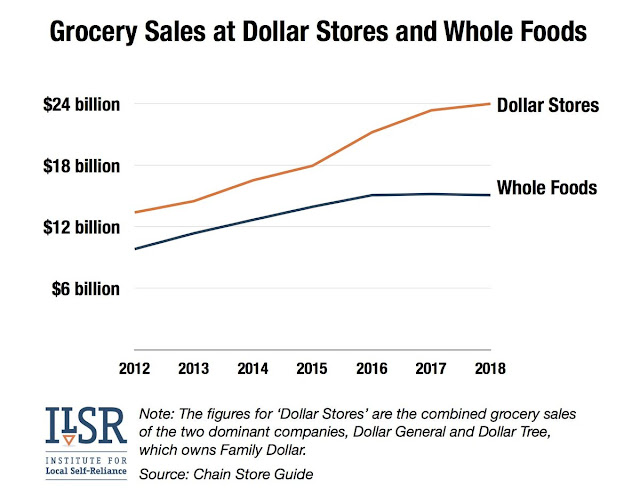

Here is another remarkable observation. Dollar stores now feed more Americans than Whole Foods, even though most of them don’t sell fresh food. The number of dollar stores in America now outnumber McDonald’s and WalMart stores.

Another sign of fragility can be found in the divergence in life expectancy between Americans and other western developed economies.

As the Broadberry and Wallis paper showed, you win by not shrinking. Corruption, inequality, and weakening institutions raise economic fragility. The Chinese boom is fragile. In America, the weakening of institutions did not begin with Trump, but the populism manifested by Trump is just another symptom of that fragility.

Michael Lewis’ new book tells of the chaos in government institutions under Trump’s administration. A new Obama Netflix series, will talk about this.

Cam, your article is very frightening in that context. Hopefully these institutions can survive four years of purposeful neglect. If he’s reelected and that becomes eight years, heaven help the U.S. of A.

Is it just me, or is it utterly remarkable that the chief economist of the BoE is just now realizing the massive importance of institutions? Intellectuals of a certain political persuasion have been banging this drum since de Tocqueville!