- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)

- Trend Model signal: Neutral (Last changed from “bearish” on 16-May-2025)

- Trading model: Neutral (Last changed from “bullish” on 14-Apr-2025)

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Waiting for the Next Shoe to Drop

Michael Kantro at Piper Sandler recently highlighted the unusual elevated levels of narrative volatility in AAII sentiment. As a consequence, the volatility has created “a lot of false-start leadership moments for rate-sensitives and small caps”.

In other words, when does the next shoe drop and how can traders capitalize on the break?

An Iranian TACO?

The headline of the week is the Israeli attack on Iran. Undoubtedly, there will be more strikes and counter-strikes in the days ahead. Energy and gold prices have already spiked and altered the global economic outlook in different ways. A BBC article succinctly summarized the worst-case scenarios of this conflict:

- America gets dragged in

- Gulf nations get dragged in

- Israel fails to destroy Iran’s nuclear capability

- There’s a global economic shock

- Iran’s regime falls, leaving a vacuum

While the attacks were conducted without U.S. participation, they could have been done without American acquiesce. It is known that Trump doesn’t like war and would prefer to conduct business deals instead. Even his social media threats offer the exit ramp of an agreement. How long before the TACO (Trump Always Chickens Out) trade manifests itself and he orchestrates a truce or peace deal?

Here is how I would position myself. Energy stocks have been depressed and become a value play. Geopolitical tensions have provided a bullish catalyst to the sector and the conflict is likely to be extended, which will put a bid on energy prices for several months. The sector has staged an upside breakout through resistance and relative strength is improving.

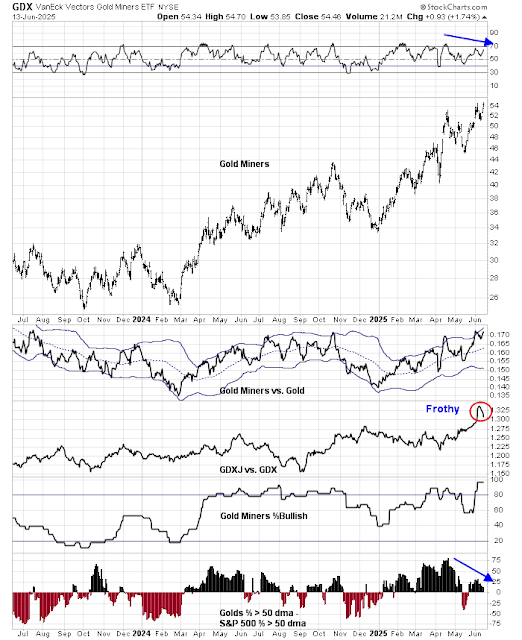

By contrast, gold stocks appear extended and due for a pause as short-term geopolitical tail-risk fades. While the timing of the TACO trade is fraught with risk and I am a long-term bull on gold, market internals are signaling a frothy group ready for a breather. The new highs in the GDXJ to GDX ratio, which measures the performance of junior to senior golds, already looks frothy. Relative breadth indicators (bottom pane) are already rolling over.

From Growth to Value

Another possible source of narrative volatility could be a rotation from growth to value stocks. Growth stocks have outperformed value stocks since the “Liberation Day” panic bottom, but that seems to be mainly restricted to the U.S. Outside the U.S., value and growth have been choppy but flat during the same period. Catalysts like the Israeli attack could spark a leadership rotation from growth to value.

Even before the attack, investors already saw incipient weakness in the price momentum factor, which is mostly dominated by growth stocks.

The Sell America Equity Trade

I am also reiterating my Sell America trade of avoiding U.S. equities in favour of non-U.S. markets. The Sell America equity trade has been successful since Moody’s downgraded U.S. debt in bonds, when non-U.S. sovereigns have outperformed duration-equivalent Treasuries in USD, and in USD weakness. The relative performance of the S&P 500 against MSCI EAFE has been flat over the same period. I expect non-U.S. equities to exhibit superior performance in the future, especially if U.S. growth stocks weaken against value stocks, as much of S&P 500 leadership was provided by large-cap growth names.

The weakness in the USD Index is especially disconcerting for two reasons. First, it has decoupled from the 10-year Treasury yield. As well, it usually rallies during periods of global stress, but it was only roughly flat from the time news of U.S. Mideast evacuations hit the tape. These are all signs of a loss of confidence in the greenback.

The thesis for the Sell America equity trade is also supported by the behaviour of the trade war factor, which is trading flat but exhibited minor strength in the wake of the London handshake agreement between U.S. and Chinese negotiators. This is a signal of rising trade tensions, which is likely to be more bearish on U.S. stocks than non-U.S. stocks. Trump’s efforts to isolate China has failed. Instead, his trade war with the entire world has isolated America on trade instead.

Cautious on S&P 500

Finally, I would be cautious on the S&P 500 and a reversal of its recent bullish trend could be another source of narrative volatility. The S&P 500 advance was accompanied by a negative RSI divergence and a failure by the equal-weighed S&P 500 to stage an upside breakout.

In addition, a spike in the 5-day correlation of the S&P 500 and VVIX, or the volatility of the VIX Index, has been a warning of a bearish reversal.

As well, keep an eye on small cap stocks for bearish confirmation. The Russell 200 staged an upside breakout from an inverse head and shoulders pattern with bullish implications last week but it retreated below the neckline. Continuing weakness would be an indication that the bears have taken control of the tape. There is nothing worse than a failed breakout.

In conclusion, the current market environment is characterized by high market volatility, which has manifested itself as narrative volatility. I offer four ways to capitalize on the short-term volatility for traders. The suggested trades are the combination of identifiable underlying trends and a technical breaks as signals for short-term profit.

- Iranian TACO: Long energy, cautious on gold.

- Rotate from growth to value.

- Sell America: Rotate from U.S. to non-U.S. equity exposure.

- Cautious on S&P 500

Disclosure: Long GDX

https://www.marketwatch.com/story/citi-forecasts-golds-last-hurrah-as-it-says-prices-may-fall-as-much-as-25-next-year-9c1e73ce?mod=home_ln

Despite last night’s developments, neither energy nor gold nor bonds have rallied meaningfully.

https://www.marketwatch.com/story/why-markets-are-ignoring-scary-headlines-about-iran-trade-wars-and-u-s-debt-4d7ae3e5?mod=home_lead