No serious economist takes Trump’s desire to cut rates by 1% seriously. However, as Jerome Powell’s term as Fed Chair nears its end, it is useful to consider how a Trump-dominated Federal Reserve might affect future policy in the future.

The Fed’s Dilemma

The Fed’s policy dilemma can be summarized by the accompanying chart. In the past, recessions have followed whenever the annual change in nonfarm payroll employment has fallen below 1.2% (blue line). On the other hand, the term premium on a 10-year Treasury (red line) has been slowly rising, which reflects growing bond market unease. The rising term premium can be attributed to a combination of rising inflation expectations and falling confidence in the U.S. fiscal picture.

A weakening employment picture focuses the Fed’s attention on its full employment mandate and argues for monetary easing. On the other hand, rising term premium focuses attention on the Fed’s price stability mandate, as well as the problem of fiscal dominance, or the uncomfortable situation where a government’s high debt starts to dictate monetary policy.

Signs of Weak Employment

Turning to the Fed’s full employment mandate, the latest NFIB monthly survey summarizes the situation. The NFIB survey is valuable because small businesses have little bargaining power and therefore they are sensitive barometers of the economy. First, the NFIB survey sample leans small-c conservative and Republican, and its responses need to be viewed in that context. Here are the main takeaways:

- Opinion-based soft optimism rebounded, but hard data optimism did not.

- Uncertainty remains elevated: “It’s hard to steer a ship in the fog”.

- The job market is soft: “Labor market is softening, including compensation pressures”.

George Pearkes at Bespoke took a closer look at the NFIB survey and found a trend of labour market weakness, while capital expenditure indicators moved sideways.

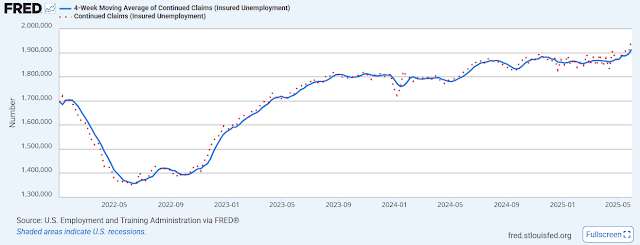

The latest release of continuing jobless claims rose to another cycle high. On the other hand, initial claims rose, but levels are not excessively alarming. The combination of anecdotal evidence of management caution of expansion paints a picture of growing weakness in hiring, but not layoffs.

Signs of Tame Inflation

Turning to the Fed’s price stability mandate, the market received welcome news when both the May CPI and PPI came in below expectations.

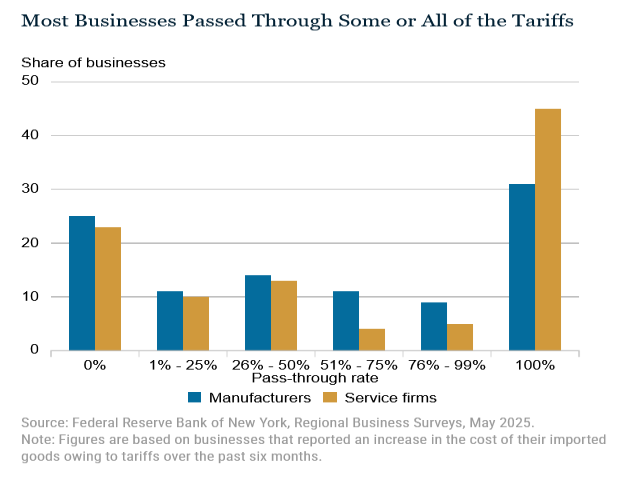

Even though CPI was tame, different surveys revealed the extent of tariff pass-through to end-users. A New York Fed survey found that roughly three-quarters of firms passed through tariff increases to some degree.

The RSM U.S. Middle Market Business Index, which measures the business confidence of middle market firms, fell sharply in Q2, though readings remain in expansion territory. This survey is important because “unlike large multinational businesses, small and medium-sized enterprises simply do not have the financial depth to absorb the increase in costs”. Middle market firms are therefore more sensitive barometer of o economic and financial stress. As a reminder, tariff price pressures didn’t rise sharply under four months after the tariffs were implemented under Trump 1.0.

In summary, middle market firms are struggling with the Trump tariffs, as “executives reported declines across a range of categories, with 20% reporting lower capital expenditures, 24% citing reduced gross revenues and 26% reporting lower net earnings”.

The inflation bears and bond market bulls shouldn’t celebrate just yet. The Cleveland Fed’s trimmed-mean CPI, which excludes outlying components, (blue line) edged up in May, and the Atlanta Fed’s sticky price core CPI (red line) has been falling very slowly.

An Atlanta Fed post in the wake of the soft inflation figures threw cold water on the notion of any urgency to cut rates, though it cannot be interpreted as a statement of official Fed policy. This argues for a continued go-slow and wait-and-see approach to monetary policy.

The market will be watching closely to see how the Fed’s staff forecast has changed in the wake of the upcoming FOMC meeting, as well as the evolution of the dot-plots.

Trade War Wildcard

The greatest unknown that the Fed is struggling with is the effects of Trump’s trade war.

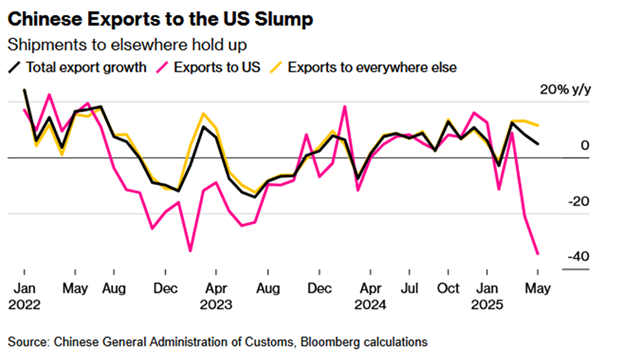

By launching trade wars with all countries, Trump may have succeeded in isolating the U.S. on trade instead of isolating China.

Investors will have to weigh President Trump’s next move. My trade war factor has traded sideways in the last month and actually rose in reaction to the London accord, indicating renewed trade tensions.

The Fed will have to struggle with the prospect of stagflation as the already high tariff rates put upward pressure on prices while reducing growth potential. Further escalation in the trade war will exacerbate stagflation effects.

The Future of Fed Policy

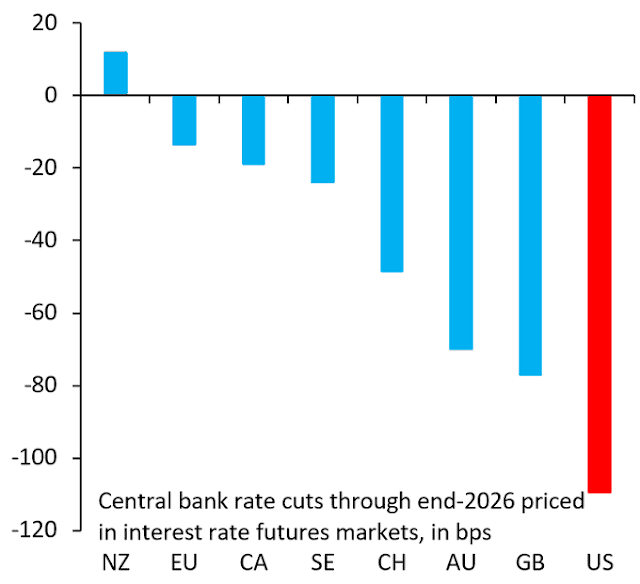

In summary, the Fed is in wait-and-see mode to observe how the price effects of tariffs flow through to inflation and inflation expectations before cutting rates. Global monetary policy is already stimulative. All else being equal, the Fed is behind other central banks in its easing path. The key question for investors is how quickly the Fed will cut rates in 2025 and 2026.

The market is discounting two quarter-point rate cuts in 2025 and a more aggressive rate cut path compared to other central banks in 2026. I find it difficult to square the circle between rate cut expectations and the realities of trade war. The U.S. is a large importer and trade deficit country while most other countries are net exporters and trade surplus countries. If tariffs are inflationary for the U.S., they will conversely be disinflationary for the exporters. How can the Fed cut so aggressively in 2026?

The only answer is Trump’s choice of Fed Chair to replace Jerome Powell, whose term ends in May 2026. The market is discounting the appointment of an uber-dove to the Chairmanship. Such an outcome would erode Fed credibility and put downward pressure on the USD.

In conclusion, the Fed remains on hold and in wait-and-see mode as it assesses the inflationary tariffs against the backdrop of a weakening labour market. The market is discounting two quarter-point rate cuts in 2025 and a rapid pace of cuts in 2026. Future Fed policy will depend on how the market perceives the new Fed Chair’s affects the Fed’s inflation fighting credibility.

2 thoughts on “A Preview of the Trump Fed”

Comments are closed.

Also, on Friday yields rose on the 20 and 30 years Treasuries. No sign of flight to safety or quality. With the rise in oil prices and 50 % tariffs on steel the likelihood of stagflation rises. Shorting the 20 year seems like a no brainer. More so, because of the movement away from dollar denominated assets.

Inflationary pressures are building up from a multitude of factors now and it will be more difficult to see through this for the current Fed. Anti-immigration efforts, decoupling from China and now the middle East escalation. All that against an “AI is going to change the world” mindset that is taking hold in the tech world as seen in the valuations that AI companies are getting. The real danger I see for the current valuations of anything AI related is that Chinese competitors will be coming up with good-enough solutions as happened with electric vehicles.