Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “

Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post,

Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The

Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found

here.

My inner trader uses a

trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly

here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)

- Trend Model signal: Neutral (Last changed from “neutral” on 16-May-2025)

- Trading model: Neutral (Last changed from “bullish” on 14-Apr-2025)

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

A Wide Trading Range

I warned you. Last week, I warned that the stock market was undergoing a wide trading range because of policy uncertainty (see

What the Trade Détente Means for Investors): “The news out of the meeting in Geneva underlines an important point about the latest market tantrum and recovery. It was all attributable to U.S. policy that depends on the whims of one man, whose opinions can be unpredictable.”

I also argued that it was time for the stock market to take a breather. Since then, the S&P 500 began to pull back. The catalysts came in the form of a credit downgrade to U.S. debt and a poor 20-year Treasury auction, followed by President Trump’s threat to put a 50% tariff on the EU and a 25% tariff on Apple products not assembled in the U.S.

Let’s start with the fallout from the debt downgrade and bond market tantrum. While the sample size is extremely small (n=2), the experience from past credit downgrades has shown sloppy S&P 500 returns on a short-term horizon and positive on a 6–12-month time horizon. At a minimum, stock prices need some time to digest their gains after the rebound off the April low.

A Bond Vigilante Moment

The combination of the credit downgrade and the poor 20-year Treasury auction spike the 30-year Treasury yield above 5%. It isn’t just U.S. yields, bond yields are rising around the world.

The last two times the 30-year yield topped 5% were buying opportunities for stocks as rising yields were contrarian signs of market panic. Here’s what’s different this time. Past occasions of high 30-year yields attracted funds into USD assets, as the USD Index was either flat to up on those occasions. This time, rising Treasury yields coincided with USD weakness, which is a signal of an erosion of USD assets as a safe-haven and calls into question the stability of Treasury paper.

Investors should therefore not regard the current episode as a contrarian buy signal for stocks. Instead, it should be seen as a warning signal of further headwinds for equity prices. That’s because Treasury Secretary Scott Bessent finds himself in a similar situation as Treasury Secretary Janet Yellen did in October 2023 when bond yields were spiking. Yellen responded by shifting Treasury issuance to short-term paper. The subsequent change in market psychology which saw short rates fall boosted the economy and stock prices. Today, Treasury issuance is already heavily tilted to short maturities, and the Fed is less inclined to cut rates. It’s not clear what other tools Bessent has to stabilize the stock market and economy.

Market Headwinds

The stock market is facing a number of headwinds.

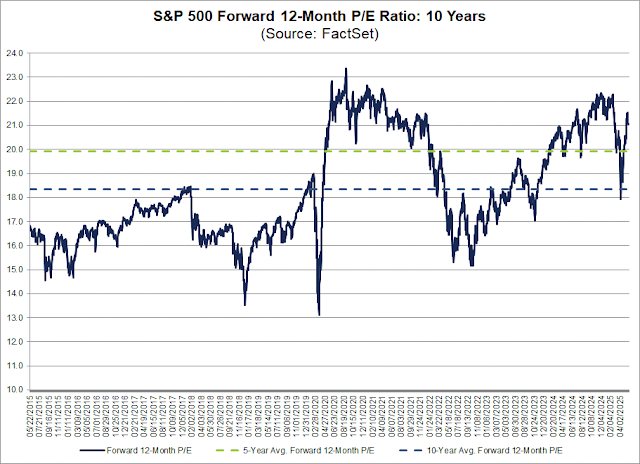

To begin, valuations are elevated by historical standards. With the S&P 500 forward P/E at 21.1, which is already historically high, earnings estimates will need to do most of the heavy lifting for stock prices to advance.

Researchers at the San Francisco Fed modeled the effects of a 25% tariff on imported goods. The good news is the inflation effect on consumer goods is relatively low. The bad news is the tariffs have a significantly higher inflation effect on production costs. The study concluded:

Estimates imply that, if completely passed through to finished goods, an across-the-board 25% tariff raises investment prices 9.5%, compared with 2.2% for consumer prices. The former can have important implications for businesses’ investment decisions through an increased cost of capital expenditure.

This translates into margin compression, which will feed into downward pressure on earnings estimates.

At a minimum, companies will be more hesitant to expand, which puts a brake on the economy’s growth potential.

The Trade War Re-emerges

Another growth headwind is attributable to the incomplete nature of the Sino-American temporary trade truce. The terms of the 90-day trade truce did not relax China’s rare earths export ban. A shortage of rare earths is beginning to threaten global supply chains. A Financial Times article reported that “The window to avoid significant damage to production is rapidly closing”.

Then, investors have to face the unpredictability of the Negotiator-in-Chief. Trump threatened to impose a 50% tariff on the EU starting on June 1.

While it’s doubtful that the combined final tariff rate on EU imports will be 50%, the modeled effects of a 50% from the Budget Lab is shown in the table below. U.S. 2025 real GDP growth falls -0.2% to -0.8%. Q4 employment falls by another -130,000 to -590,000. Short-term PCE rises 0.5% from 1.7% to 2.2%. In other words, greater stagflation.

This analysis doesn’t mean I am bearish on stocks. Stock prices rise in the long run and in the absence of recessions, I just believe the opportunities are better in non-U.S. markets, which present better value on a relative basis. Investors should diversify their holdings and underweight the U.S.

Much of the leadership by U.S. stocks since the GFC has depended on the dominance of its technology sector. Tactically, the rebound off the April low was led mainly by the Magnificent Seven. If that leadership were to falter, what’s left?

The consensus rates of earnings growth by the Magnificent Seven are expected to slow compared to the rest of the S&P 493 in 2026.

In the absence of growth potential, investors are likely to rotate into value stocks, which can be found outside the U.S. Investors are already witnessing signs of a shift in leadership. U.S. stocks have lagged global stocks since the end of 2024. Europe and EM ex-China have been in the lead, followed by a choppy Japanese market. China’s relative performance has been erratic.

Would You Buy This?

In conclusion, the stock market advance is due for a pause and faces numerous headwinds. The rise of the bond vigilantes, elevated valuation and heightened earnings risk, and narrow leadership combined to increase risk.

If you are in doubt, ask yourself the following question. The accompanying chart shows the S&P 500 on an inverted scale. Would you buy a stock with chart like this?

As well, the usually reliable S&P 500 Intermediate Term Breadth Momentum Oscillator (ITBM) flashed a tactical sell signal when its 14-day RSI recycled from overbought to neutral. My inner trader wasn’t paying attention when the signal triggered last week. While he is mildly bearish, it may be too late to short the market and he is therefore staying on the sidelines.

The S&P 500 is breaking down technically and a pullback wouldn’t be out of line under these circumstances. At a minimum, expect a period of sideways consolidation.

I think the answer is to see what the prices do. There are so many interconnected pieces and erratic influences.

Consider FOMO, we use the term, but what conditions are needed for FOMO? There is no FOMO when it comes to SGOV, it’s too predictable. The F is important in many ways. It played a role in the setup. Something had to happen to get some hard selling pressure, to enable the missing out part. But it’s irrational.

Things I think few people will argue with is that there has been a lot of uncertainty lately in the market. That there was a sharp drop in the indices, along with a sharp recovery and ZBT along with other thrusts. I would consider these as facts. So the FOMO setup is in place, we just don’t know if we’ll get one. My thinking is that FOMO is self reinforcing once it gets going. If prices start going up people rush to participate in easy fast money, like in any bubble.

So we need to watch prices. S&P at 7500 is not impossible, nor is 1500, the highs of 2000 and 2007.

My call is that if we get the FOMO we don’t have a long wait, the crash can be slower because tops usually take time, unless of course FOMO makes a top that looks like 1929, or the nikkei or Dotcom nasdaq.