Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “

Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post,

Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The

Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found

here.

My inner trader uses a

trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly

here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)

- Trend Model signal: Bearish (Last changed from “neutral” on 11-Apr-2025)

- Trading model: Neutral (Last changed from “bullish” on 14-Apr-2025)

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

A Leadership Review

The recovery of the S&P 500 off the “Liberation Day” downdraft seems to be stalling just below the 200 dma. A review of value and growth leadership shows that the rebound was led by growth stocks, both on a global basis and across all market cap bands.

Does that mean the rally is vulnerable to a setback in growth names? I review the character of market leadership to answer that question.

A Sector Review

The accompanying chart shows the relative performance of growth sectors. Leadership among growth stocks was narrow, as only technology led the way. Communication services and consumer discretionary stocks traded sideways with the S&P 500 during the rally. To be sure, the technology sector was the largest sector within the S&P 500 at a weight of 30%, which form the principal basis for the rebound.

An analysis of the relative performance of value sectors, which tend to be more cyclically sensitive, shows sustained strength by financial and industrial stocks. I interpret that as constructive for the bull case.

Before the bulls become overly excited, the relative performance of cyclically sensitive industries are flat to down. This represents a market warning about the economic outlook.

As well, the relative performance of defensive sectors is a mixed bag. Healthcare is rolling over and real estate is trading sideways with the S&P 500. On the other hand, consumer staples and utilities are in relative uptrends. I interpret this as a sign that the bulls and bears are still battling for control of the tape.

A Holding Pattern

Where does that leave us?

In the short run, the U.S. equity market is in a holding pattern. The bulls will point to the buying pressure from hedge funds and trading desks which were forced out of their positions during the recent market downdraft.

The growth/value recovery can be explained by the recovery of the price momentum factor (fast money) against quality (patient money). The rally can continue as long as volatility, which includes upside volatility, stays tame and stocks are in a bull trend. One key test of the bull is whether the S&P 500 can convincingly break above the 200 dma.

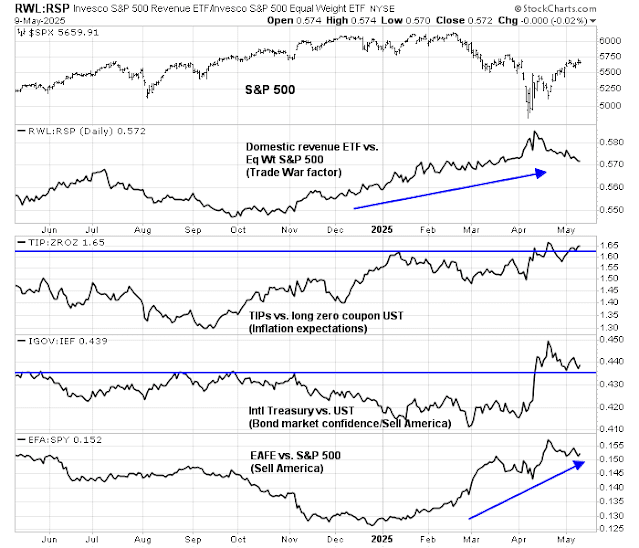

On the other hand, a review of Trump factors shows heightened anxiety over his policies. The trade war factor is in retreat, but it’s still in an uptrend. The inflation expectations factor is staging an upside breakout. The combination of market response to the trade war and inflation expectations factors reflects heightened concerns about stagflation. In addition, combination of the bond market confidence factor and the “sell America” factor is signaling growing anxiety about the U.S. global geopolitical and financial leadership. These are all intermediate warning signs about the health of the U.S. economy and USD assets.

In conclusion, a review of factor and sector leadership in the U.S. equity market reveals short-and intermediate-term cross-currents. The underweight of risk by hedge fund, vol control funds and other systematic traders are likely to put upward pressure on stock prices. On the other hand, investors cannot ignore signs of growing anxiety over the health of the U.S. economy and confidence in USD-denominated assets.

One thing that also I believe is showing up is buybacks.

This is a huge tailwind for stocks.

Personally, I don’t believe in buybacks, give me a dividend. Those who benefit the most from buybacks are the C-suites that get obscene compensation in share options, and this way there is less dilution for the shareholder to see.

But anyways, does anyone expect them to hold off on buybacks? Maybe the last chance for a big score when they have their window to sell? Maybe I’m too cynical, I would answer that nowadays it’s hard to be cynical enough.

But if buybacks, combined with big fund FOMO because of rebalancing tips the balance, one never knows.

A large group of people don’t want too much dividend payouts. One needs to pay tax on dividends and the rates are large if income levels are high. US tax laws have a carry interest for loans. So many rich people borrow against their equities from their brokers and incur loan carryover. A good broker like IBKR will offer you an interest of about 5% today, much smaller than the qualified dividend tax rate. You can also carry the loans year after year to offset some other income and capital gains. I know individuals who carry loans until their death.

Overall buyback is probably net positive for America’s aggregate wealth, condidering that the 401K money alone is in $5T at least plus other large pension funds’ assests. It has a magnifying effect, considerded one form of modern day alchemy. America is a country where one can use his/her imagination to do things and exploit legislations to the fullest. One just needs determination and skills. Whatever tariffs bring about and evolve, we will adapt and move on.