Treasury Secretary Scott Bessent has warned that the economy may need to undergo a detox period before it returns to more stable growth. Since that warning, stock prices sharply pulled back and the VIX Index spiked to above 60, which are levels not seen since the 2024 bottom, the COVID Crash and the GFC. Related sentiment indicators, such as the term structure of the VIX, inverted, indicating high levels of fear. The market subsequently experienced a Zweig Breadth Thrust, which is an indicator of price momentum consistent with market bottoms. Is the detox over and is the bull back?

I don’t think so.

The stock market isn’t the economy, but it is nevertheless related to the economy. Investors need to distinguish between the likely economic effects of events and the market reaction to the events. The initial VIX spike to over 60 in the wake of the “Liberation Day” announcement was consistent with the blinding end-of-world fear that occurs at market bottoms. Usually, the subsequent bottom has been accompanied by the reduction or elimination of tail-risk by policy makers. This time, the tail-risk of a recession is very real and there are no signs of significant policy mitigation.

Here are some historical lessons from past fear spikes.

A COVID Under-Reaction

The VIX Spike in 2024 was obviously an over-reaction. Investor psychology was so fearful that they signaled end-of-world conditions, which was nothing resembling reality. In hindsight, the underpinnings of a market bottom was obvious.

Going back to 2020, investors experienced both an under-reaction and over-reaction to events. News of COVID-19 was beginning to emerge in early 2020, and I published a

piece on February 1, 2020 entitled, “Trading the Coronavirus Panic”. At the time, I highlighted sentiment analysis from Mark Hulbert attributed the pullback to excessive bullish sentiment: “The coronavirus was not the real reason for the market sell-off. The real reason was excessively bullish sentiment. The coronavirus news was just the excuse.”

Looking forward, I pointed to analysis from Bridgewater which distinguishes between market expectations, market psychology and actual likely events: “we want to pay attention to what’s actually happening, what people believe is happening that is reflected in pricing (relative to what’s likely), and what indicators that will indicate the reversal.”

As it turned out, the market rallied after the initial pullback and plunged when it became apparent that, in the absence of official intervention, the global economy had come to a sudden stop and it was headed for a repeat of the Great Depression. Tail-risk was substantially reduced when fiscal and monetary authorities responded with unprecedented levels of support. In addition, COVID-19 vaccines were developed around the world in record time. The stock market recovered.

A Bear Stearns Under-Reaction

It was a similar story in 2008. When Bear Stearns failed in March 2008, the stock market rallied in reaction to that event. The market expected things to return to normal. Market expectations of the Fed Funds rate, as measured by the 2-year Treasury yield, rose. M2 money supply growth fell, indicating no monetary stimulus.

It wasn’t until the Lehman bankruptcy in September that the fear of a banking system collapse became serious. The Lehman failure sparked an institutional bank run, and the Fed’s hands were tied as brokerage firms that had taken on excessive leverage were outside the banking regulatory authority. The Fed swung into action with high levels of monetary stimulus, and the rest is history.

History Rhyming in 2025

It is said that history doesn’t repeat itself but rhymes. Here is how it’s rhyming in 2025.

Here’s what’s the same and different today compared to the episodes in 2008 and 2020. The market response to the “Liberation Day” tariff announcement was an over-reaction. Technical indicators had become so oversold they were consistent with end-of-world scenarios that the relief rally was no surprise. If anyone thinks that macro and fundamental conditions were similar, they weren’t working in the markets during the GFC and COVID Crash, or for that matter, the 1987 Crash for the really grizzled market veterans.

That said, the consensus building among technical analysts in the wake of the recent rally and price momentum-driven breadth thrust recovery is reminiscent of the false dawn rallies following the Bear Stearns bankruptcy and the early recovery in 2020. While the stock market isn’t the economy, it is nevertheless tethered to the fortunes of the economy. The growing consensus among chartists is either a V- or W-shaped recovery leading to higher prices on a 6–12 month time horizon. The growing consensus among strategists is the trade war will have minimal impact on earnings growth in the months ahead. From a bottom-up perspective, company analysts are projecting a bout of minor earnings weakness in Q1 and Q2 and a return to EPS growth in the second half of 2025.

These sets of outlooks are set-ups for disappointment.

Already, numerous companies are pulling back from giving earnings guidance in the current environment of uncertainty, which is consistent with the elevated levels of the VIX Index seen during the trade war era of Trump 1.0.

All else being equal, higher volatility and uncertainty argues for a lower forward P/E than the current multiple of 20.5, which is above the 5-year average of 19.9 and 10-year average of 18.3.

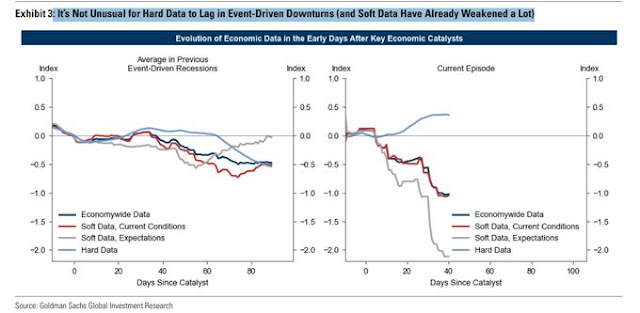

As well, numerous surveys of soft data are badly deteriorating. Analysis from Goldman Sachs points out that it’s not unusual for the hard data to lag soft data. In that case, the market may be in that interim period analogous to the post-Bear Stearns bankruptcy and market recovery, and the February 2020 market recovery when the coronavirus was known, but investors hadn’t fully realized the magnitude of the effect.

Investors are already hearing widespread reports of cratering import volumes from China. This will be followed by port layoffs, first on the west coast, followed by east coast ports owing to the longer shipping times from China. The logistics and trucking industries will suffer. The relative performance of transportation stocks is signaling some anxiety, though it recovered late last week in the wake of the UK trade deal and the news of the weekend China trade talks.

By late May or early June, American consumers will start to see empty shelves and shortages. So far, the relative performance of retailing stocks isn’t an excessive sign of worry.

In the short run, hints of easing trade tensions will spark short-lived rallies. Trump’s announced U.K. “comprehensive trade deal” last week was characterized by U.K. officials as an agreement focusing on specific sectors, with the removal of 25% tariffs on steel and aluminum, a 12-month temporary cut on the tariff rate on British car exports from 27.5% to 10%, in return for no U.K. tariffs on American ethanol and U.S. reciprocal access on beef, though British food standards excluding hormone-treated beef and chlorinated chicken stay in place.

The U.S. blanket 10% on other U.K. products announced on “Liberation Day” will still be applicable. The U.S. runs a trade surplus with the U.K., and trade with the U.K. represents only 3% of U.S. overall goods trade and America’s 11th largest trading partner. While this development is modestly positive, its economic benefits are small and don’t alter the big picture of the challenges of negotiating trade agreements with all the other countries. The FTSE 100 rallied when the deal was announced, but closed the day in the red. As one of the few countries that the U.S. runs a trade surplus with, the U.K. was only able to negotiate a 10% tariff rate, which is an ominous signal for the rest of the world in future negotiations.

Similarly, last week’s news-driven rally of a U.S.-China meeting in Switzerland was relatively weak. The Hang Seng Index rose strongly on the open but closed only up 0.1% on the day. Good news on trade is reaching a point of diminishing returns, the report of the offer of a cut in the U.S. tariff rate on China from 145% to 80% ahead of the meeting barely moved the S&P 500 Friday.

Even under a best-case scenario, and if all parties came to a comprehensive trade deal tomorrow and everyone agreed to restart production and return to business as usual, the economic damage will have been done. It takes about 30 days for a container ship to go from China to the U.S. west coast, and longer to east coast transportation hubs, regardless of whether it’s by truck, rail or ship. The supply chain shock will therefore be already set in stone by this summer. Prices will surge in response to shortages.

On the other hand, if the U.S. concludes U.K.-style and the possibly rumoured Indian “trade deals” which aren’t deals but just frameworks with details that need to be ironed out later, this leaves tariff rates much higher than the post-World War II average levels. This puts stagflation pressures on the U.S. economy. The Trump Administration’s stated objective of 90 trade deals in 90 days will prove illusory. China, Japan, South Korea and countries of ASEAN recently issued a

joint statement that takes a united stance against “escalating trade protectionism”, which is a signal of unity against Trump’s tariff regime. The EU is also signaling belligerence on trade. The European Commission launched a WTO dispute against the U.S. and announced a public consultation on a list of €95 billion of U.S. imports it is ready to hit back on.

In addition, Fed Chair Powell warned in his post-FOMC press conference, “If the large increases in tariffs are sustained, they’re likely to generate a rise in inflation and an increase in unemployment.” This pushes the U.S. economy into a stagflation scenario of rising prices and slow growth, which will be unfriendly to equity prices.

Undiscounted Risks

Putting it all together, the closest market templates to today’s market are the false dawn market rallies after the Bear Stearns bankruptcy in 2008 and the February 2020 false dawn rally after the stories of the coronavirus pandemic emerged in China, which the market knew but fully discounted the risks.

In conclusion, Treasury Secretary Bessent has warned about a detox period for the U.S. economy. While the recent dramatic stock market recovery may have raised hopes of a bullish revival, I think the detox period isn’t over. I believe the closest market templates of today’s market is the false dawn recovery after Bear Stearns bankruptcy in 2008 and the February recovery in 2020 before the full effects of COVID-19 were known when the tail-risks to the economy were fully discounted. Investors should remain in a defensive posture in their portfolio positioning.

Good post Cam. This time, I think it is different. The “trade deal” with UK is just a framework. More importantly, why would we impose a tariff on a close ally with whom we have a trade surplus? It makes absolutely no sense and even with the “deal,” Trump is keeping the 10% tariff, way above what could be considered a reciprocal rate. And note what Torsten Slok of Apollo has to say, “Chinese Exports Redirected From the US to the Rest of the World” (https://www.apolloacademy.com/the-daily-spark/?utm_medium=email&utm_source=pardot&utm_id=701Dp00000017sOIAQ&utm_campaign=EXT_Daily+Spark). The Chinese are wasting no time finding new and friendlier markets for their goods. Good luck as we negotiate. In short, our economic approach is not rational and we may well suffer the consequences.

Looking at a monthly chart of the VIX it doesn’t look like 2008, more like 2007. Same thing for $$HYIOAS.

Like everyone, I am scared stupid

The $$HYIOAS is also similar to 1999.

So, do we get a melt up and then a horrible crash or are we slowly heading over the falls. Either way, I don’t think this ends well.

But any sustained rise above 5800 or so in the S&P and technically we have a bullish argument and bearish sentiment adds fuel to the fire. If that happens, it’s time to head for the door.