- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)

- Trend Model signal: Neutral (Last changed from “bullish” on 15-Nov-2024)

- Trading model: Neutral (Last changed from “bullish” on 17-Jan-2025)

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Good news, bad news

The tactical news is the short-term technical picture hasn’t changed very much in in the last few weeks. The market is still choppy and range-bound.

Bearish confirmations

I am seeing other confirmations of long-term weakness. I have highlighted the negative breadth divergence from different Advance-Decline Lines, which failed to make an all-time high even as the S&P 500 did so in January.

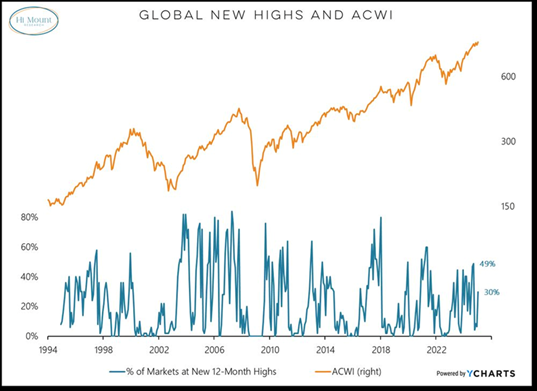

Technical analyst Willie Delwiche confirmed the negative breadth divergence globally by pointing out the contraction of global markets making new highs.

Other indicators are flashing warning signs. The BoA’s Sell Side Indicator, which measures Wall Street strategist sentiment, is within a hair of a sell signal. Street sentiment is becoming a little giddy, which is contrarian bearish.

SentimenTrader also observed that the S&P 500 Sharpe Ratio, which is an indicator of risk-adjusted returns, recently approached 2.0 and retreated. While the sample size is small (n=2), past instances were “too good to be true” episodes that resolved in bear markets.

Michael Howell of CrossBorder Capital, who is the guru of global liquidity, is calling for the top of a 5–6-year liquidity cycle in mid-2025 in an interview. This is consistent with my view of a major market top in H1 2025.

That said, all of these warnings fall into the category of condition indicators. They are warning conditions, but don’t work as immediate sell signals. As an example, Howell’s latest (gated) Substack update shows that global liquidity has stabilized due to improved central bank liquidity from the PBOC and ECB, but Fed liquidity remains a problem. Not all is lost yet.

Q4 earnings season has been a bit of a disappointment as the results can be described as neutral to weak. Forward EPS revisions stalled last week, which is indicative of a loss of fundamental momentum. The EPS beat rate was in line with the 5-year historical average, but the sales beat rate was below.

No tactical sell signal

That said, all of these warnings fall into the category of condition indicators. They are warning conditions, but don’t work as immediate sell signals.

From a short-term perspective, the S&P 500 staged an upside breakout from a bull flag (dotted lines) and left an unfilled price gap just below 5900. As long as the index stays above the dotted breakout line, it opens up the possibility of a test of the all-time high. However, the technical structure of the market remains choppy and range-bound.

However, the bulls should be overly excited until they can see an upside breakout to fresh highs and the technical underpinnings of any breakout. Keep in mind that analysis from Almanac Trader shows the second half of February tends to be seasonally negative.

In conclusion, plenty of warnings of a long-term market top are appearing, but the warnings belong to the category of condition indicators and not actionable trading signals. Current conditions amount to just a sell signal setup, and a review of the short-term technical picture shows a resilient market structure. Long-term investment-oriented accounts should de-risk to more neutral positions. Traders can wait for more definitive signs of downside breaks before turning defensive.

Looking at AD lines there are some notable exceptions where the RSI dropped for a long time before the crash.

What strikes me as the common factor is the narrow breadth of the times. So we had the Nifty Fifty in the 60s, and the Dotcom bubble with the nasdaq going nuts, and now we have the mag 7. Even in 1928 the RSI was sub 50 and the stochs oversold.

The RSI for the ADLINE for the nasdaq peaked in 1983 and went to sub 30 in 1998.

So maybe manias are different.

The other thing is the fiscal dominance of federal deficits makes for the rising tide lifting all boats.

But warnings need to be noted.

If we keep having deficits and money going from public to private this helps equities, but those zombie companies that need refinancing in an era of change from ZIRP to over 4% for short term paper, this must show itself in high yield bond spreads unless we get a real elevator shaft move.

The ADline chart for the nasdaq is shocking to the point that I question the data, but it’s what stockcharts provides.

What they say is when the leadership is very narrow you have to be wary.