As a rule, I don’t do book reviews. However, regular readers know that I am a big fan of trend following models and I use them extensively in my asset allocation work. When a publicist offered a free review copy of Michael Covel’s Trend Following, 5th Edition: How to Make a Fortune in Bull, Bear and Black Swan Markets, I jumped at the chance.

The book also featured a forward by Barry Ritholz. Ritholz’s partner Josh Brown recently wrote that they use trend following techniques for tactical asset allocation, which is a sensible decision that I wholeheartedly agree with:

At my firm, we use trend for tactical asset management. It takes everything above into account- not only the things, but people’s actual reaction to the things, a sort of realpolitik for markets. Will it always work? Doubtful. What is the downside when it doesn’t work? What is the expected benefit when it does? Is there a behavioral aspect to why it makes sense to include tactical in client portfolios? We think so. Not everyone would agree that this is worthwhile.

After all that buildup, the book left me vaguely disappointed. Covel’s approach has been to be a cheerleader for traders who use trend following techniques without digging into the deeper issues that face investors. He treats trend following almost as a magic black box that everyone should use. He doesn’t take the next step to discuss the characteristics of this class of strategies, which sophisticated investors think about when they consider the use of such techniques have a place in their portfolio.

An evangelical cheerleader

This excerpt from the book explains how trend following works:

Trend following, and assorted derivatives of price-based trading, is not a new concept. It goes back across names like David Ricardo, Jesse Livermore, Richard Wyckoff, Arthur Cutten, Charles Dow, Henry Clews, William Dunnigan, Richard Donchian, Nicolas Darvas, Amos Hostetter, and Richard Russell. Believe it or not, it literally goes back centuries, with data to prove it.

AQR’s Cliff Asness clarifies: “Historically, it’s been a strategy pursued primarily by futures traders and in the last 10–20 years by hedge funds. The trading strategy employed by most managed futures funds boils down to some type of trend following strategy, which is also known as momentum investing.”

Excerpted with permission of the publisher, Wiley, from Trend Following, 5th Edition: How to Make a Fortune in Bull, Bear and Black Swan Markets by Michael Covel. Copyright (c) 2017. All rights reserved. This book is available at all booksellers.

Covel extols the virtues of the technique with a touch of evangelical fervor:

Nonetheless, if you look at how much money trend following has made before, during, and after assorted market bubbles, it becomes far more relevant to the bottom line of astute market players.

Yet, even when over the top trend following success is thrown onto the table, skeptical investors can be tough sells. They might say markets have changed and trend following no longer works. But philosophically trend following hasn’t changed and won’t change, even though markets might not always cooperate.

Let’s put change in perspective. Markets behave the same as they did hundreds of years ago. In other words, markets are the same today because they always change—humans are involved, after all. This behavioral view is the philosophical underpinning of trend following. A few years ago, for example, the German mark had significant trading volume. Then the euro replaced the mark. This was a huge change, yet a typical one. If you are flexible and have a plan of attack—a solid strategy—market changes, like changes in life, won’t kill you. Trend followers traded the mark; now they trade the euro. That’s how to think.

Excerpted with permission of the publisher, Wiley, from Trend Following, 5th Edition: How to Make a Fortune in Bull, Bear and Black Swan Markets by Michael Covel. Copyright (c) 2017. All rights reserved. This book is available at all booksellers.

While I believe that these techniques have their place, trend following models represent only one tool out of many in an investor’s toolbox. Trend following, when applied properly, is no different from the fundamental analyst who digs into a company financials and operations to discover that the shares are dramatically undervalued because of some hidden asset on the balance sheet.

Unanswered questions

For some perspective, here are the questions I ask when someone presents me with an investment or trading strategy:

- Why does it work, or what is the source of the alpha?

- Under what circumstances does it not work?

Covel scratches at the surface of the first question in his book, by referring to behavioral finance research from the likes of Daniel Kahneman and then asserting “you have to believe”. He went on to blame non-believers for their own failure for the following reasons:

- Lack of discipline

- Impatience

- No objectivity

- Greed

- Refusal to accept truth

- Impulsive behavior

- Inability to stay in the present

- False parallels

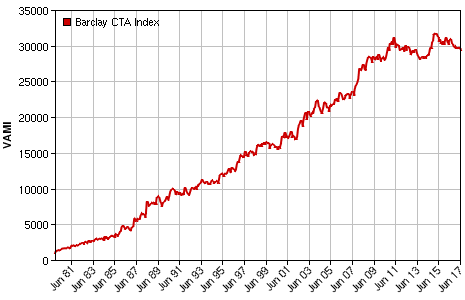

What`s more, he doesn’t really address the second question at all. This issue is particularly important in light of the poor performance exhibited by trend following Commodity Trading Advisors (CTAs) in the past few years, as shown by the BarclayHedge CTA Index.

A glance at the above chart raises a couple of important questions.

- Are the models broken? Perhaps CTAs have hit some magic aggregate capacity limit for trend following.

- If not, then what are the characteristics of this strategy that made it fail?

I found no answers in Covel’s book.

Alpha becoming beta?

I believe that Michael Covel’s book illustrates the wide chasm between professional traders and investors. Simply put, they don’t think the same way.

Covel’s approach has been to be a cheerleader for trend following principles by showing how successful traders and hedge funds have used these techniques to make a lot of money. War stories are great, but they don’t get at the heart of the how, why, as well as the pros and cons of these techniques.

By contrast, here is an article from Pension and Investments that illustrate how institutional investors think about the managed future and trend following space:

Competition for institutional investor assets is fierce in the managed futures market — widely accepted as the most commoditized in the hedge fund industry — with intense price competition between old-school firms such as Man AHL, Winton Capital Ltd. and Aspect Capital Ltd. and banks, alternative risk premium managers and replicators offering lower-cost exposure to trend-following strategies.

“Institutional investors are forward-looking now in the face of predicted market declines and this is playing out in the managed futures space,” said Mark S. Rzepczynski, co-managing partner and CEO of AMPHI Research+Trading LLC, Boston, a global macro/managed futures advisory and brokerage firm.

“Chief investment officers are looking for crisis alpha production from systematic trend strategies that will make money in down markets but they aren’t willing to pay high fees for them. Pricing is the biggest issue with these asset owners,” Mr. Rzepczynski said.

In other words, alpha is turning into beta. Institutional investors view these strategies as “crisis alpha” because trend following strategies are uncorrelated to the returns of risky asset classes, such as equities. At the same time, institutions are putting fee pressure on managers because they’ve figured out that these models can be turned into a factor beta:

The response from institutionally oriented trend-followers has been to break apart and reassemble their traditional strategies into cheaper, stripped-down versions without the modulating factors that adjust the systematic portfolio’s model response to real-world factors, sources said. Also on offer are new alternative risk premium strategies that replicate the beta of the core strategy’s systematic trend-following approach.

The result is a 50- to 100-basis-point flat fee range for most risk-premium strategies, sources agreed. Fees for traditional systematic trend-following strategies range between 0.75% and 1% for management fees and 10% to 20% for performance fees.

The rise of hedge fund replication strategies means that you can more or less turn trend following into a “smart beta” ETF that anyone can use. The barriers to entry for using these techniques are falling very quickly.

In that case, trend following doesn’t sound like such a magic black box anymore. That represents my main source of disappointment. Covel’s book is in its fifth edition, and therefore he should be the authority on this topic. Where is he on these crucial issues of the characteristics of trend following?

Cam you are bang on. Trend investing or under its other name, momentum investing is my specialty. Academic research has proved that it is the best factor over the last hundred plus years but, and it’s a big BUT, you must know when NOT to use it. Quant analysts love to crunch numbers without know why the numbers happen. This might be fine for an institution with an infinite time horizon but most folks are investing for a few decades. Mere mortals need to use trend/momentum when it’s working.

I love this quote that is taped to my monitor, ‘The young man knows the rules, but the old man knows the exceptions. – Oliver Wendall Holmes’.

Learn the exceptions in my book on momentum investing, ‘The Pathway … Your money in a changing world.’

http://www.thepathway.ca/

The book and its companion report has almost 600 dynamically linked momentum charts of key industry ETFs and the top ten stocks in them. They update automatically every night (gotta love new technology). These are the tools to put momentum to work.

Here is an example of one chart in the book. It’s of the Momentum ETF (MTUM) . It is a smart beta ETF that uses the momentum strategy. Note on the chart when you click on the URL or paste it to your browser – the Momentum ETF just started outperforming in May. Until then, it was better to be in the general market or other ETFs that were outperforming.

https://product.datastream.com/dscharting/gateway.aspx?guid=0a8f1ed1-3fa1-4594-9660-45235830e8ce&action=REFRESH

In my experience, we are now at the stage in the market cycle that momentum strategy beats the other factors, value, small cap, and growth. Keep this link and check occasionally to see how Momentum is doing.

There are different flavours of momentum. MTUM does not look anything like the kind of price momentum that academics study:

http://blog.alphaarchitect.com/2017/07/24/momentum-and-size/

Cam, I love you two questions – especially the 2nd question.

Why does it work, or what is the source of the alpha?

Under what circumstances does it not work?

casual love drop.

Try this for an analysis into the principles behind trend following models: https://humblestudentofthemarkets.com/2016/01/05/revealing-secret-behind-trend-following/

Cam: re-read your “… secret-behind-trend-following” post. I agree, as if that matters, that trends work because of macro economic trends which work because everyday people respond in predictable ways to economic forces. Interest rates rise, people react a certain way but not all at once. GDP is rising same thing.

So, if trend following works because it takes advantage of macro economic trends then how important is the particular trend following strategy? For example, is a complex exponential moving average package replete with various RSI models and MACD systems better than a single simple moving average? And by “better” I am asking is it likely to be better enough to warrant the effort to determine the details?

How important is the trend following strategy to successfully trading a market?

Jeff – All of those techniques that you mentioned are the specifics of how traders:

1) Define and measure the trend

2) Manage risk

What I outlined is a conceptual framework about how to think about trend following models. How you implement such a model is up to you.

I forced myself to read Covel a few years ago, but found it quite annoying. Little data, very much rah-rah cheerleading. I’m glad to see Cam’s take isn’t quite so different.

How do you folks think about Gary Antonacci’s Dual Momentum?