Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “

Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post,

Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The

Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found

here.

My inner trader uses a

trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly

here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)

- Trend Model signal: Bullish (Last changed from “neutral” on 11-Oct-2024)

- Trading model: Neutral (Last changed from “bearish” on 19-Sep-2024)

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Did you buy Yom Kippur?

The stock market is setting up for a buy signal. The accompanying chart shows the S&P 500 with the usually reliable Intermediate Term Breadth Momentum Oscillator (ITBM). Its 14-day RSI has become oversold. A buy signal is triggered when RSI recycles to neutral.

While I am near-term cautious on the stock market, I believe a strong upside breakout is just around the corner. You just have to be patient.

Short-term caution

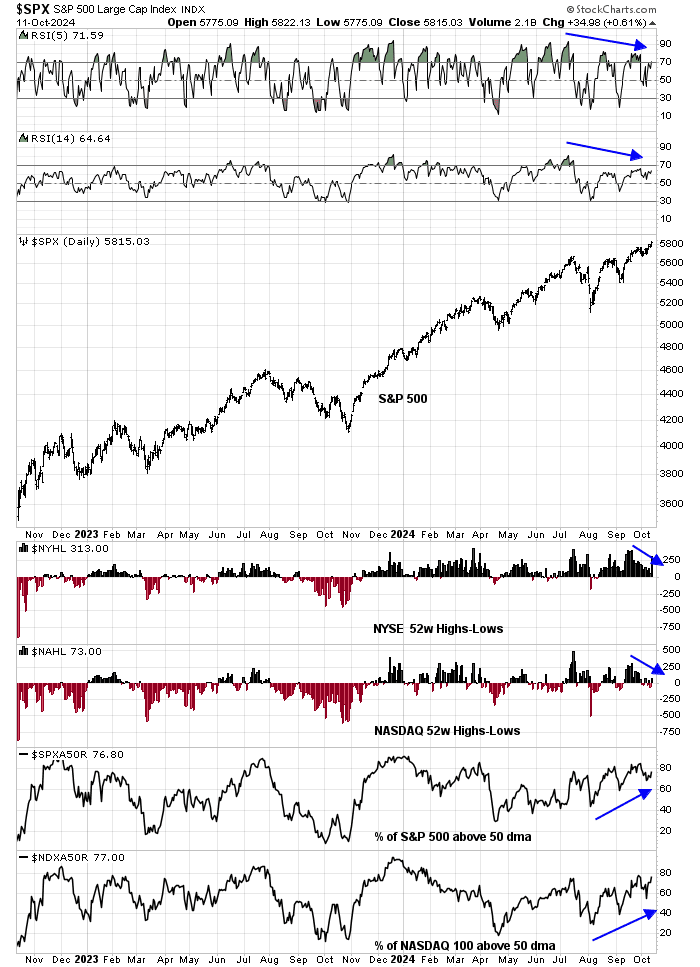

Here’s why. The S&P 500 has been trading mostly sideways for the past few weeks and staged an upside breakout to an all-time high last week. Market internals show a short-term bearish, but intermediate-term bullish outlook.

In the short term, negative RSI divergences and falling net 52-week highs-lows argue for caution. On the other hand, the percentage of stocks above their 50 dma calls is indicative of an intermediate-term bull trend.

The 10-year Treasury yield has risen above 4%, which could put downward pressure on stock prices.

i believe Treasury yields are responding not only to the unexpectedly strong CPI report, but also to electoral uncertainty. The VIX Index recently rose above 20, indicating market anxiety. Analysis of the term structure of the VIX shows an unusual condition of flat term structure between one and three months, which is a sign of fear, but a steep upward slope between nine days and one month, indicating complacency. i interpret this to mean that the option market is exhibiting signs of election anxiety, which is just under a month away.

We just have to survive the uncertainties of October.

Intermediate-term bullish

Surprisingly, market internals reveal a near-oversold market, indicating relatively low downside risk. The NYSE McClellan Oscillator (NYMO) is almost in the oversold zone in spite of the sideways to positive market action.

Advance-Decline Line breadth looks healthy. All A-D Lines, except for the S&P 600 small-caps, made fresh recovery highs in early October. Intermediate-term market tops don’t behave this way.

In conclusion, stock market internals are calling for near-term caution but intermediate-term bullishness. Election uncertainty, along with cross-currents such as the stronger-than-expected CPI report, is creating market volatility. But market internals reveal a strong bull trend and a near-oversold condition. This is a set-up for a bullish buy signal. Investors just have to be patient.

The tailwinds for the market are twofold. First is continuing Federal deficits, because things have to balance a federal deficit means a surplus coming to us. It may be in a roundabout fashion because of trade balances but how many people are banking their social security checks? It gets spent, which supports the economy. As boomers retire , more and more get those checks and spend them. Another tailwind is those locked in mortgages. Prior to 2022, the 30 year fixed was below 3%. The shortage of homes coming on to the market when rates moved higher was unexpected, but makes sense. The mortgage market is 12 trillion, of which the bulk is pre 2022. If your mortgage is 3% instead of 6 1/2% , this gives more spending money. My guess is that as long as rates are significantly higher than 3% we shall see that the average holding time of a property will increase above the usual 7 years. How many people are saving 3% or so from the usual mortgage rates on approximately 10 trillion I don’t know, but it’s a lot of money.

Of course at some point the party will end.

How to recognize the signs of party end?? I really appreciate your posts.

Citi ESI just turned positive. The traditional playbook says to favor cyclicals, evidence of IYT at 4-year high. But if you look at tech internals, IGV, FDN, CIBR, and SKYY. All just broke out. The AI trade is going strong again: NVDA, AVGO, TSM, ANET, CARR, VRT, IBM, ORCL, NOW, PLTR, … Quietly NVDA is approaching AAPL’s market cap. In all likelihood it will surpass AAPL during next earnings report next month. A few months ago I did some data crunching and speculated that NVDA would reach $3T market cap. It happened really fast. Now with more clarity and more data about the buildout and adoption/use cases I did some more modeling again. This time it puts NVDA’s asymptotic terminal value at $10T. Can’t believe my own eyes. How long it takes? Will it happen? I don’t know. But I have also seen numbers from a few quants. Numbers are close to mine. We could all be seriously wrong and have to eat crows.

So I just have to repeat the data crunching regularly to examine the time series. My general observation is that modeling is getting more and more accurate if the input data is reasonably valid. With ever larger models and better algos, the confidence level is going higher year after year. SnP500 2025 earnings growth is 14-15% YOY and has not changed since earlier this year. But we just take it one step at time, as always.