TACO stands for “Trump Always Chickens Out” in trade negotiations. Financial Times journalist Robert Armstrong coined the term “TACO trade” as a colourful way of characterizing the Trump Put. When questioned by a reporter, Trump turned livid when he learned what TACO stood for.

It is in that context when, later in the day, the three-judge panel of the U.S. Court of International Trade unanimously ruled against the Trump Administration in VOS Selections v U.S. and struck down a whole range of tariffs by citing a lack of authority. The most equity bullish outcome would have been Trump taking this legal exit ramp to retreat from his trade war. Instead, he doubled down with the following social media message, possibly egged on by the TACO question. What was even more disturbing was the inclusion of Pepe the frog (my highlight), which was an image appropriated by White supremacists during the 2016 election.

The Court Ruling

The U.S. Court of International Trade ruled that the Trump Administration didn’t have the authority under the International Emergency Economic Powers Act of 1977 (IEEPA) to impose the sweeping tariffs which caused such turmoil in the global trade and financial markets: “The court does not read IEEPA to confer such unbounded authority and sets aside the challenged tariffs imposed thereunder.”

It further found that it would be unconstitutional for Congress to cede “unbounded tariff power” to the President: “An unlimited delegation of tariff authority would constitute an improper abdication of legislative power to another branch of government”, as Congress specified in IEEPA when and how a President could use such authority. IEEPA authority is designed to “deal with unusual and extraordinary threats”. Fentanyl smuggling and trade deficits don’t meet these definitions.

In effect, the court unwound the tariffs levied by Trump on Canada, Mexico and China on fentanyl smuggling, and the “Liberation Day” tariffs exacted by the Trump Administration. By implication, it creates an air of uncertainty over the numerous trade negotiations that the U.S. has undergone or is undergoing with trading partners, such as China, the European Union the U.K., and so on.

The Trump Administration has said that it will appeal the decision. The accompanying chart summarizes the effects of the court decision. Section 204 tariffs on imports from China levied announced in the 2017–2024 period stay in place, as well as the sectoral tariffs on aluminum, steel and autos.

What’s Next?

What comes next? The path forward depends on a variety of variables.

The government has 10 days to remove the tariffs and begin processing refunds. The Trump Administration has said that it will appeal. An appeal court granted an emergency stay on tariff collection, which allows the government to continue collecting the tariffs pending the appeal decision. Otherwise, the loss of revenue would create a hole in the budget process and could unsettle the bond market.

The government has a number of workaround options in light of the court decision that avoid the use of Trump’s authority under IEEPA:

- Trump could immediately issue a Section 122 tariff proclamation of up to 15% for up to 150 days to mitigate a “serious balance of payment deficit”. The tariffs can be extended by Congress beyond the 150-day limit.

- Section 232 of the Trade Act of 1974 authorizes the Secretary of Commerce to recommend sectoral tariffs, which has been done in aluminum, steel and autos. Investigations in electronics, pharmaceuticals, copper and lumber under Section 232 are already underway. Watch for additional preliminary investigations in semiconductors and critical minerals and for the authority to impose tariffs pending the publication of the final reports. Section 232 has a strong foundation of authority, but implementation takes a long time and it requires consultation.

- The U.S. Trade Representative (USTR) can investigate unfair trade practices by foreign governments under Section 301 of the Trade Act of 1974. Once acts of a foreign government are found to be unreasonable or discriminatory and burden U.S. commerce, the USTR may take “all appropriate and feasible action, subject to the specific direction of the president, to obtain the elimination of the act, policy or practice”.

If the IEEPA decision is upheld on appeal, the Trump Administration could replace most of the tariffs with a patchwork of other tariffs. These measures will not be immediate and take time to implement. Depending on the pace of appeals and legislative pace, full implementation of a tariff regime won’t be complete until Q2 2026.

The Economic Fallout

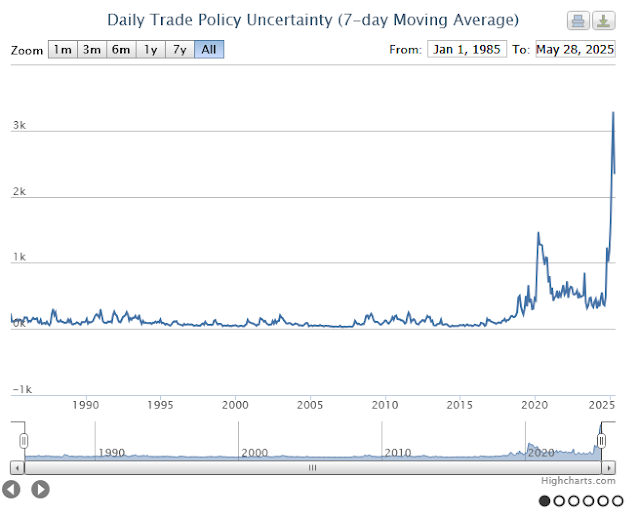

The fallout from the court decision is just beginning. Even before the announcement of the decision, trade policy uncertainty levels had already gone through the roof. Now questions are arising over the timing, implementation of tariffs and even the basis for trade negotiations.

Similarly, the U.S. Economic Policy Uncertainty Index is at record levels.

The recently released FOMC meeting minutes of May 6–7 provide a window into the decision process of not only policy makers at the Federal Reserve, but also businesses operating in the current environment of uncertainty: “Participants agreed that uncertainty about the economic outlook had increased further, making it appropriate to take a cautious approach until the net economic effects of the array of changes to government policies become clearer”.

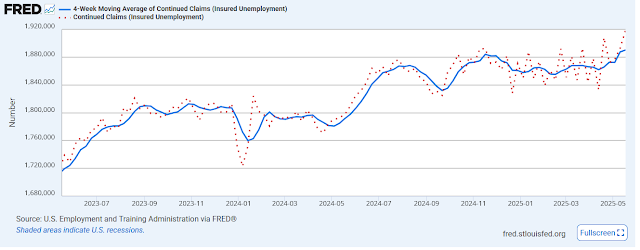

Fed staff forecast was starting to scream stagflation. Price pressures are rising. Tariffs were expected to “boost inflation markedly this year and to provide a smaller boost in 2026”. Regional Fed survey responses suggested firms “were planning to either partially or fully pass on tariff-related cost increases to consumers”. As well, regional Fed Presidents heard from business contacts that businesses who weren’t directly affect by tariffs might raise prices if competitors did so.On the other hand, employment was expected “weaken substantially” over the remainder of 2025. We can see some of the loss of momentum in the jobs market in initial jobless claims and continuing claims reports. On one hand, initial claims have been relatively steady, which reflects a cautious employment market that’s slow to fire workers.

On the other hand, continuing claims have risen to a new high, which underscores the difficulty that job seekers are experiencing finding new employment.

To be sure, Trump reduced the tariffs on China from 145% to 30% after the FOMC meeting, but imagine yourself in the shoes of a business owner or the corporate executive. In the short run, do you reinstate foreign orders, especially from China, and risk a whipsaw in policy or legal decisions? Or do you wait? What about expansion plans? Would you make a long-term commitment to expand U.S. production and hire new staff, or do you wait?

The logical response is to wait. Just as the Fed has done to adopt a wait-and-see attitude to monetary policy. Fed Chair Powell said at the post-FOMC press conference that the costs to waiting to learn more was “fairly low”. Expect business to follow a similar level of decision paralysis, which will resolve in a growth slowdown in the coming months.

Make no mistake, a growth scare is on the horizon. Nancy Qian, professor of economics at Northwestern University, and the co-Director of Northwestern University’s Global Poverty Research Lab, wrote a

MarketWatch op-ed by arguing that Trump’s tariffs will hit harder than how many dolls a family can buy:

Trump and his advisers are both trivializing and misrepresenting the real economic hardship that high tariffs could cause. Most Americans are struggling to meet their basic needs. The pretax income required for the median two-adult, two-child household to cover basic necessities (housing, child care, food, transportation, costs for education, clothing, personal care items) was $106,903 in 2024. And yet, around 60% of households earn less than $100,000 per year; 50% less than $86,000; and around 14% less than $25,000.

Even if one parent drops out of the labor force to save on child care costs, the single earner would need $85,074. These “basic necessities” exclude eating out, leisure activities, holidays, savings, retirement or other long-term financial investments. These are “luxuries” that require even more money.

It should come as no surprise that a large share of basic necessities are imports. Some 59% of fresh fruits and vegetables consumed in the U.S. (including 90% of bananas and 70% of tomatoes) are imported, as is 25% of orange juice. Growing children regularly need new clothes and shoes, more than 95% of which are imported. The same goes for school supplies: two-thirds of all pencils sold in the U.S. are imported, as are many books and the paper used to print books domestically. Personal items for adults will also be affected. For example, nearly all razorblades are imported.

Supply chain tariff disruptions are already occurring. Some are similar in magnitude to the conditions during the COVID Crash, and these disruptions won’t magically disappear overnight. The economy will inevitably begin to see their effects in Q3. It’s just a question of how long the uncertainty lasts.

The Problem with TACO

In addition, I believe that while TACO makes a catchy acronym, it isn’t entirely correct. Trump doesn’t always chicken out. In his book, The Art of the Deal, Trump outlines how he identifies leverage in a negotiation and puts himself to maximize that leverage.

In trade and foreign affairs, Trump has backtracked in his dealings with China and the EU on trade, and Russia, and even the Houthis on foreign policy. He has demonstrated his desire to avoid war, which is the reasoning behind his rapprochement with Iran while brushing aside the priorities of the Israeli government.

He has been more successful in applying his leverage against domestic adversaries, such as law firms, universities in his crusade against “woke culture” and immigrants.

The greatest near-term threat to growth is Trump’s deportation initiative. The

New York Times documented how Trump has expanded the pool of people subject to deportation.

I documented in the past the potential fallout of deportations (see Two Risks to the Bull That No One Is Talking About). A Peterson Institute study estimated GDP growth and inflation of light (1.3 million people) and severe deportation (8.3 million) over a four-year window, as well as the effects of different tariff rates and the revocation of Fed independence. The magnitude of the effects on growth and inflation of deportation is substantially higher than either tariffs or the revocation of Fed independence.

A Brookings Institute study, which assumed an extreme scenario of a mass deportation of over one million people in 2025 is reminiscent of the Eisenhower deportations of 1954, modeled a one-year GDP growth shock of -0.4%. To make an apples-to-apples comparison to the Peterson study, its assumption of the removal of 1.3 million illegals caused a negative GDP growth shock of -3.8% over four years, which averages to just under -1% a year.

As an indication of the priority given to Trump’s deportation initiative, the heads of ICE’s Homeland Security Investigations and Enforcement and Removal Operations divisions were reassigned because they did not reach the government’s arrest and deportation targets.

The Market Reaction

The market reaction to the court decision was unexpected. S&P 500 futures opened up 1.4 % overnight after the news, but gains slowly eroded and the S&P 500 ended the next day up only 0.4%. More importantly, the trade war factor was positive the next day, indicating belief that trade tensions would continue to rise.

Under these circumstances, investors should embrace the “Sell America” trade by avoiding USD assets. The court decision just prolongs the uncertainty over the effects of the trade war. It’s time to buy greater growth outlook certainty by diversifying into non-U.S. assets.

The future is always uncertain. This makes me think of the Greek debt euro crisis, They played it up.

Maybe because of this uncertainty people will stop living, eating food, buying clothes, but I doubt it. People will stop doing those things if they are no longer able to aka no money.

Will Walmart let it shelves go empty? I don’t buy that, not for tariffs, Covid yeah, we didn’t know if there would be a tomorrow.

Hey if Trump backs off on a Tuesday can we call it Taco Tuesday?

We have retraced more than 78.6% of the drop, that is usually bullish, not always though.

Enough bearish narrative out there, I’m not ready to toss in the towel.