The Q4 earnings reporting season kicks off Wednesday with reports from major banks and financial companies. This is a good opportunity to review the outlook for the financial sector.

What election rally?

Let’s begin with the bad news. The post-election gains for financial stocks have completely evaporated (top panel). The good news is the sector remains in a relative uptrend (bottom panel). The outperformance of this sector is one reason I am bullish on financial stocks.

My bullish bias is global. Even as U.S. financials remain in a choppy relative uptrend, European financials have been outperforming its region in the last year.

The fundamental outlook

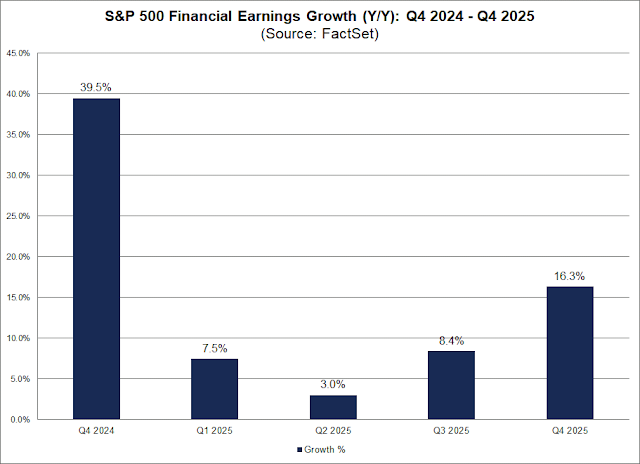

Looking past the technical picture, FactSet reports that the sector is expected to see blowout earnings growth in Q4, followed by deceleration into Q2 and re-aceleration in Q3 and Q4 2025.

One little noticed development that’s relevant to the banking sector happened at the Fed. Federal Reserve Vice Chair for Supervision Michael Barr, the Fed’s top banking regulator, announced that he would resign as vice chair but remain as a Fed governor for the remainder of his term which ends in January 2032. The decision heads off a battle between the Trump White House and the Fed on bank regulation, but the retention of Barr’s governorship draws a line in the sand on the issue of monetary policy independence.

Powell made the case in a 2018 speech that the Fed independence on regulatory matters is important, but the argument isn’t as strong as the case for independence on monetary policy.

Within our narrow mandates, to safeguard against political interference, central banks are afforded instrument independence‑‑that is, we are given considerable freedom to choose the means to achieve legislatively-assigned goals. While the focus is often on monetary policy independence, research suggests that a degree of independence in regulatory and financial stability matters improves the stability of the banking system and leads to better outcomes. For this reason, governments in many countries, including the United States, have granted some institutional and budgetary independence to their financial regulators.

This is a long way of saying that investors should expect further deregulation of the banking industry, which should boost the future earnings outlook and provide a tailwind for financial sector outperformance.