When the markets crash unexpectedly, everyone is on the lookup for culprits. One of the leading theories behind the latest downdraft in stock prices is the rise in bond yields, which spooked the stock market. Derivative analysts have pointed the finger at Risk-Parity funds as the leading actors in the bond market rout. They contend that the combination of leverage use in these funds and forced selling because of changes in market environment have exacerbated the rise in bond yields.

I considered the effects of Risk-Parity funds on the bond market. Using three different analytical techniques, we concluded that Risk-Parity strategies did not exacerbate the downturn in bond prices (picture via Cliff Asness).

The evolution of risk-parity fund exposures

I considered the question of how the bond market exposure of Risk-Parity funds are evolving. As global bond prices have sagged, one of the questions for investor is the potential for a disorderly unwind of bond holdings in leveraged Risk-Parity portfolios.

I am skeptical that Risk-Parity strategies have significant near-term potential to tank the bond market for three reasons:

- Interest rate sensitivity of Risk-Parity portfolios is less than popularly thought.

- While virtually all asset classes declined in the latest risk-off episode, bonds outperformed equities.

- My sensitivity analysis of the AQR Risk-Parity Fund as a proxy for the strategy reveals that bond market beta was flat to up during the latest risk-off episode.

Risk parity bond sensitivity less than popularly thought

For some understanding of Risk-Parity strategies sensitivity to the bond market, consider this 2015 post by Matthew C. Klein in FT Alphaville, who worked at Bridgewater researching the benefits of the Bridgewater All-Weather Fund, which is the firm’s Risk-Parity offering:

The most common — and least sophisticated — criticism of “risk parity” is that it’s just a levered bet on bonds.

This bet supposedly looks smart in retrospect only because bonds have done very well since the early 1980s as nominal interest rates collapsed. However, the argument goes, that kind of performance can’t happen again unless rates keep falling far below zero. Some people go further and argue that interest rates are bound to rise from today’s levels (we think we’ve heard that one before), which will hit “risk parity” investors on the asset side at the same as borrowing costs hit the funding side of the strategy.First of all, “risk parity” isn’t about levering up bonds. Rather, it’s about constructing the best possible risk/reward tradeoff you can at the portfolio level and then levering that. In our experience, the bonds were bought outright, some of the most liquid ones were used as collateral to borrow in the repo markets, and the exposure to equities and commodities was bought with futures. There was generally some cash left over that could be used to cover margins and redemptions. The idea was to minimise trading costs while preserving liquidity.

We struggle to imagine how this arrangement could ever lead to forced sales. Recall that the biggest players managed to endure the collapse of the repo markets in 2007-8 with aplomb.

While the investment process for every Risk-Parity strategy is different, also consider this 2013 Bloomberg article, Dalio Patched All Weather’s Rate Risk as U.S. Bonds Fell:

As the bond market plunged in late June, Ray Dalio convened the clients of Bridgewater Associates, the world’s largest hedge-fund manager, to tell them that a fund designed to withstand a broad range of market scenarios was too vulnerable to changes in interest rates.

Westport-based Bridgewater, citing months of study, said it had underestimated the interest-rate sensitivity of various assets in its All Weather fund and was taking steps to mitigate the risk, according to clients who listened to or read a transcript of the June 24 call. By the end of the month, the firm had sold off $37 billion of All Weather’s most rate-sensitive assets, Treasuries and inflation-linked bonds, according to fund documents and data provided by investors.

Bonds outperformed in the latest risk-off episode

Another reason why I am skeptical that a forced liquidation of bonds by Risk-Parity strategies sparked the latest sell-off.

The conventional explanation of the sell-off was the market was spooked by the strong Average Hourly Earnings (AHE) print in the January Employment Report. Strong wage gains puts greater pressure on the Federal Reserve to act and raise interest rates. Bond yields spiked, which spooked the stock market.

That explanation would be satisfying except for a few details. First, while headline AHE was strong, AHE for the working stiffs (production and non-supervisory employees) was rather tame. Therefore, the increase in AHE could be attributable to bonuses and other incentives paid to managers.

Second, the stock market was already weak before the Non-Farm Payroll (NFP) report. Moreover, interest-sensitive issues outperformed the stock market during the sell-off, which contradicts the theory that the weakness was fixed-income inspired.

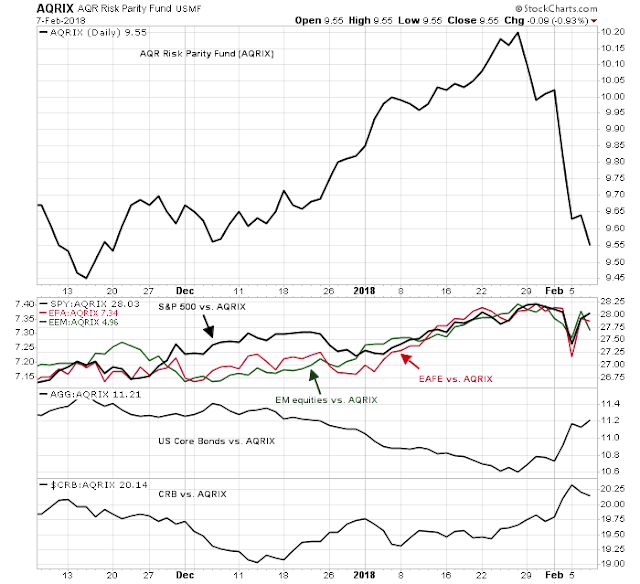

While not Risk-Parity funds are alike, we do have a highly visible risk parity mutual fund with daily prices, the AQR Risk Parity Fund (AQRIX), which can form a basis for the analysis for this class of strategy. Morningstar reports that the AQRIX is levered 2x, with a 106% long exposure to the bond market, 49% long exposure to equities and 44% long exposure to other asset classes, which are likely commodity-related assets.

The following chart also shows that during the latest risk-off episode, bonds and commodities outperformed AQRIX NAV.

If AQRIX is representative of the behavior of Risk-Parity strategies, I find it hard to believe that it aggressively sold bonds, which outperformed, even as the fund value declined.

AQRIX implied bond exposure flat to up in latest risk-off episode

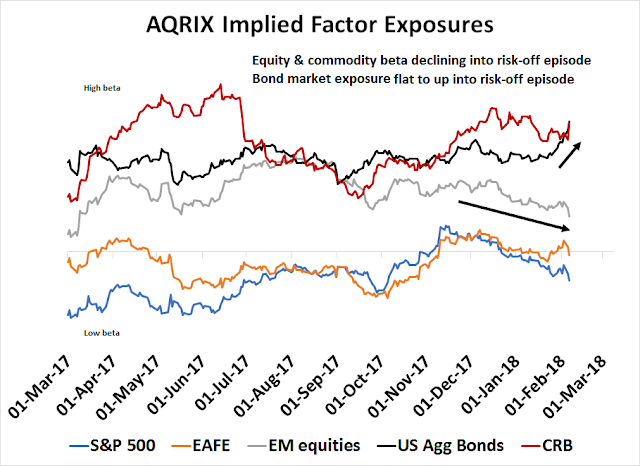

My heuristic analysis of factor exposures also revealed that the bond market factor exposure of AQRIX was flat to up in the weeks leading up to the latest risk-off episode, while the factor exposure to equities and commodities was sliding.

I developed a simple heuristic for decomposing fund factor exposures in real-time while analyzing hedge funds in 2005 (original research and methodology available upon request). Briefly, here is how the methodology works.

Imagine that we had the daily returns of a market neutral fund. Here is how we would discover whether the fund had a positive or negative market beta:

- Put the daily fund returns into two buckets. The first bucket contains the returns of the fund on the days when the stock market rose, and the second contains the returns of the fund when the stock market fell.

- Calculate a moving average of the two buckets.

- Calculate the spread of the two buckets.

- Calculate and analyze a moving average of the spread. If the average spread is consistently positive, the fund is performing better when the market is rising, and we can conclude that it has a positive market beta. Conversely, if the average spread is consistently negative, we can conclude that the fund has a negative beta and it is short the market.

While this heuristic is useful, this technique has a number of limitations.

- It is sensitive to how the daily alpha is defined. In our example, we used the daily returns of a market neutral fund. We could also apply the same technique to a plain vanilla equity or bond fund, and replace the daily return in the analysis with the daily alpha, which is defined as the fund return less the benchmark return.

- It is sensitive to the lookback period, or the number of days in the moving average window. The lookback period should ideally be tuned to the turnover of the portfolio in order to minimize the noise of the analysis.

- It is better at estimating the direction of factor exposures rather than magnitude. In our example, I put the fund returns into two buckets, one when the stock market rose, and one when the stock market fell. This methodology does not distinguish between returns when the market is up 0.01% or 2% on the day.

With those caveats, I analyzed the factor exposure of AQRIX. We defined the daily alpha of AQRIX as the returns of the fund against a portfolio of 30% S&P 500, 20% EAFE, 10% MSCI Emerging Market Index, 30% US Aggregate Bond Index and 10% CRB Index. I also used a six-month lookback period to estimate factor exposures.

The following chart shows the estimated factor exposures of AQRIX for the past year. Estimated equity exposure had been declining from early November into the latest risk-off episode, while estimated commodity exposure also peaked in December and fell in the same period. By contrast, estimated bond market exposure was flat to up in the same period, and spiked during the risk-off episode, indicating that the fund bought bonds during that period. However, I view that conclusion with a degree of skepticism as I indicated that this technique is less revealing of magnitude than direction of exposure, especially during periods of high market volatility.

In conclusion, it is difficult to believe that Risk-Parity strategies had an adverse effect on bond prices. As demonstrated, I arrived at that finding based on three separate and independent analytical techniques.

Equity market implications

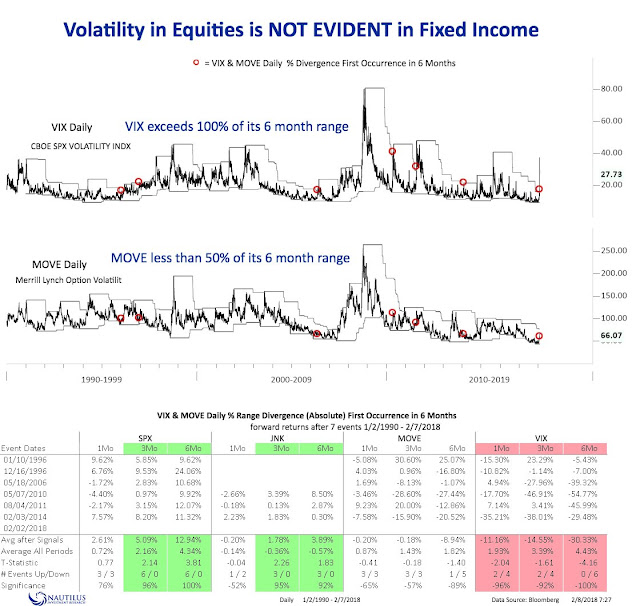

As a postscript, there is also a bullish equity market implication to this analysis. The spike in stock market volatility has not been matched by bond market volatility. A study by Nautilus Research found that these conditions have tended to be equity bullish, though the same size is small (N=6).

Hang on, the Vol Tantrum should be over soon.

We have a tsunami wall of debt coming at us over the next two years. The U.S. budget deficit that will need bond buyers will run a trillion dollars-plus a year with the Fed at the same time selling bonds adding to that total rather than buying them as in past QEs. The supposed hard-money GOP Tea Party group just blew up the deficit with a stimulative tax cut when the economy is already rocking. Ron Paul gave a nine hour Senate floor speech decrying the deficit AFTER voting for the tax cut. There is no fiscal sanity left. We have the Chinese government, Trump’s whipping dog, with over a trillion in Federal bonds that may be for sale after the next Tweet. We have European corporate debt at ludicrously low yields that won’t have the ECB buying support once Draghi is replaced this year by a German banker. We have many doves at the Fed being replaced with hardliners.

The bond market just might have woken up to envision this debt tsunami heading their way. The stock market, (especially the rate sensitive utility and REITs) are waking up too,

The most negative thing I’ve seen during this correction is the 10 year only fell a couple of basis points when stocks crashed. THAT tells you something about the outlook for bonds. Past corrections have seen fifty basis points.

Regardless about hedge fund positioning, the tsunami is coming. They can have their chairs anywhere on the beach.

Demographics & the inherent stupidity (rigidity) of wealth managers with their preordained asset allocation models will keep a lid on interest rates…3.3 on the 10 yr is the maximum rate I see for the next year.

thank you cam. The annuity fund that my local union runs has some risk parity elements to it … the article is reassuring, but I feel queasy about the idea of a dual equity bond selloff and risk parity funds getting smoked