Mid-week market update: I turned cautious on equities last Wednesday (see Out of words for ‘extreme’ and ‘unprecedented’). Since then, the market rallied, and fell for two straight days on Monday and Tuesday, ending the last five days slightly negative.

Is this the start of a downside break, or just a blip in a continuing market rally?

On one hand, investors have been buying the dip, indicating continuing confidence in the market. Eric Balchunas of Bloomberg pointed out that investors poured $8 billion into equity ETFs during the two day selloff.

On the other hand, this funds flow data poses a high degree of downside risk. Should the market continue to correct or consolidate, sentiment needs to wash out before a durable short-term bottom can be seen.

What’s the real story?

Mixed messages

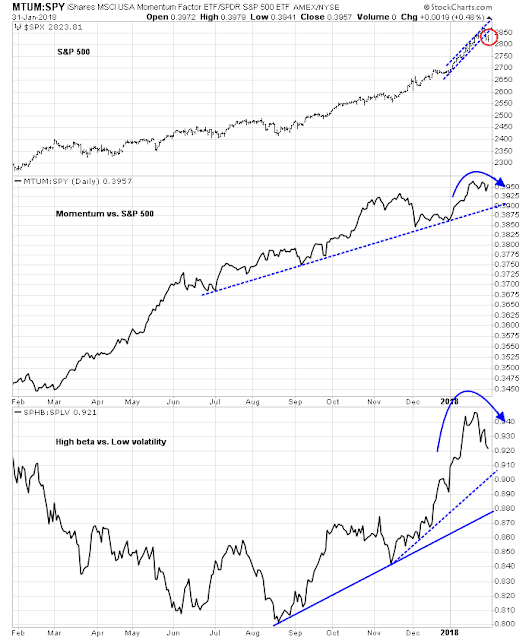

In these pages, I have made the point that the latest melt-up is price momentum driven. Here, the market is giving mixed messages.

Here is the bull case, the chart below shows that the relative performance of momentum and the relative performance of high beta to low volatility stocks remain in uptrends. Until those relative uptrends are broken, dips are buying opportunities.

The bears can argue that sufficient technical damage has been done to the uptrend that usually signals a period of consolidation or correction. When stock prices fell for two consecutive days, capped by a 1% down day on Tuesday, it breached the upward sloping channel that the market had been on for all of January.

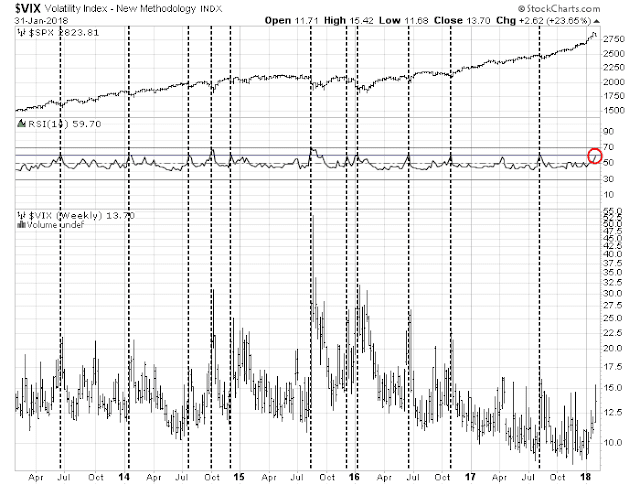

The bulls can point to the spike in the VIX as putting a floor on stock prices. If history is any guide, the weekly RSI levels indicate minimal downside risk for equities in the past (h/t Andrew Thrasher).

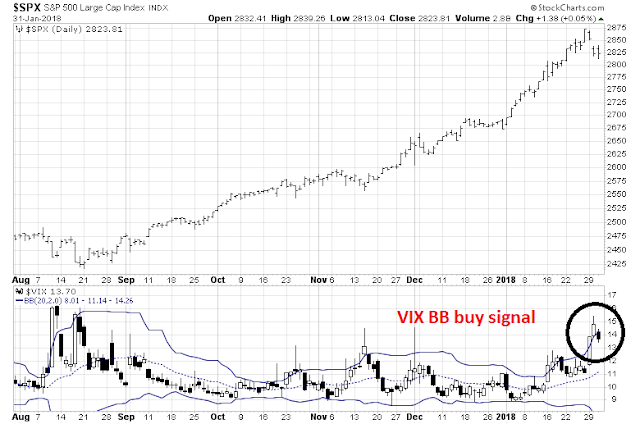

As well, the VIX rose above its upper Bollinger Band during the market selloff this week, which is indicative of an oversold condition. Reversions below the BB have proven to be good trading buy signals for the stock market.

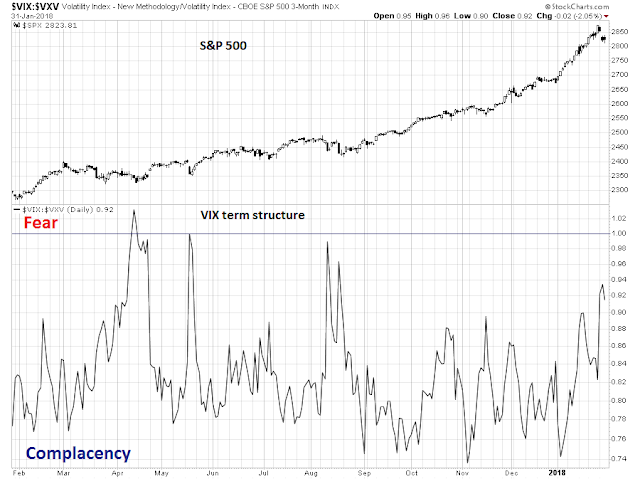

The bears can point out that the neither the absolute level of the VIX, nor changes in the VIX are very relevant to future stock market direction. A better way to measure fear is to normalize the VIX by observing its term structure. Inverted term structures, where short-term implied volatility is higher than long term volatility, are much better indications of real fear. As the chart below shows, the term structure has not inverted, which is a signal of a lack of fear.

There are too many bull and bear arguments. My head hurts.

Inter-market and cross-asset signals

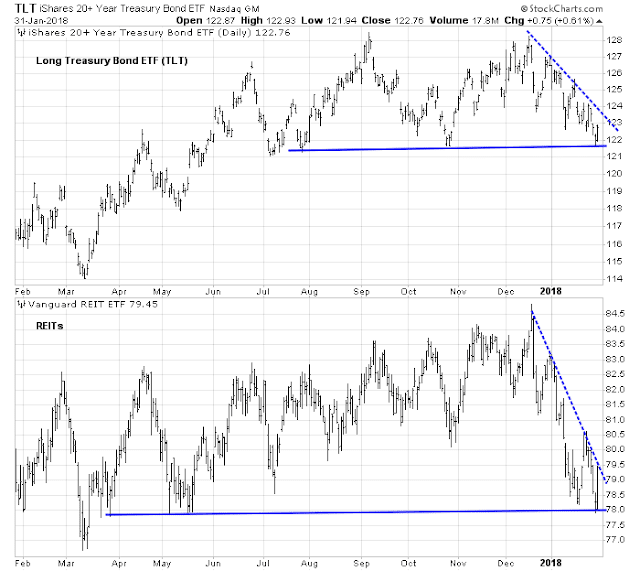

For some clarity, here are some clues to further market direction. I recently wrote about possible bottoms forming for interest sensitive vehicles and the USD (see The pain trade signals from the bond market). Since the publication of that post, selected interest rate sensitive ETFs have tested key support levels and bounced, though their downtrends remain intact.

In addition, the USD Index appears to be setting up for RSI buy signals should they mean revert above the oversold readings of 30.

Should these reversals occur, it could be indicative of a change in regime. By implication, such a regime change would coincide with a period of correction or consolidation for stock prices.

I don’t have any firm answers just yet, but I am closely watching developments. For the time being, my inner trader is giving the bear case the benefit of the doubt, and he remains short the market.

Disclosure: Long SPXU

1 thought on “A glass half full, or…”

Comments are closed.

Here is an updated copy of my December 2018 Fed Funds Futures chart.

https://product.datastream.com/dscharting/gateway.aspx?guid=b7ec9234-f31b-4931-89e1-1040262ad80a&action=REFRESH

It keeps going higher. This is quietly pulling the rug out from under this stock market.

In June, the futures were predicting a 1.35% December Fed Funds rate. Now it up to 2.05%. That’s one hell of a difference.

I put a vertical line on today’s price. It will be important to watch if the contract goes up (bad for stocks) or down (good) from here.

The above link updates every night. Copy and paste it to an email to yourself or a word document. Then save the email or Word doc and have the link handy for future reference. You can also save the link to your browsers favorites once you have it pulled up on your browser to have it for the future.