Mid-week market update: In my post written last Sunday (see September uncertainties), I outlined three disparate sources of uncertainty that faced investors in September.

- Legislative uncertainty over the debt ceiling and tax reform;

- Geopolitical uncertainty over North Korea; and

- Uncertainty over Fed action.

While some of those problems have been temporarily resolved, developments since the weekend have raised further questions about others. This suggests that the market will follow the recent pattern of a stepwise advance, but remain range-bound pattern until many of these uncertainties are resolved.

The debt ceiling logjam breaks, sort of…

Let’s start with the good news. The Washington Post reported that the House had passed $7.85 billion Hurricane Harvey aid package, along with Continuing Resolution to fund the government until December 15, based on a deal that Trump made with the Democrats:

President Trump wants Congress to fund the government for three months and raise the debt ceiling for the same amount of time, defying leaders from his own party and potentially giving Democrats leverage in debates over immigration, health care and federal spending.

Trump made his position clear at a White House meeting with congressional leaders on Wednesday, overruling top Republicans.

“In the meeting, the President and Congressional leadership agreed to pass aid for Harvey, an extension of the debt limit, and a continuing resolution both to December 15, all together,” Senate Minority Leader Charles E. Schumer (D-N.Y.) and House Minority Leader Nancy Pelosi (D-Calif.) said in a joint statement. “Both sides have every intention of avoiding default in December and look forward to working together on the many issues before us.”

This development is unsurprising, especially as Hurricane Irma bears down on Florida. After the devastation from Harvey, Irma victims will also need aid. No politician would want to be seen so heartless as to deny the hurricane victims the help they need.

That said, this deal just kicks the can of uncertainty down the road to December. October T-Bill yields fell as immediate tail-risk dwindled, but December T-Bill yields rose in response.

Apocalypse averted, but the problems of the debt ceiling and tax reform remain unresolved.

North Korean tensions rise

On the other hand, tensions over North Korea`s nuclear and missile capabilities are rising internationally. Bloomberg reported that both Russia and China, both permanent members of UN Security Council with veto power, have resisted the call for more sanctions:

Russian President Vladimir Putin again rejected U.S. calls for new sanctions against North Korea after its sixth and most powerful nuclear test, echoing China’s resistance to more punitive measures to pressure Pyongyang into abandoning its atomic and missile programs.

The Russian leader criticized sanctions as “useless and ineffective,” instead urging the international community to offer security guarantees to North Korea.

“They’ll eat grass, but they won’t abandon their program unless they feel secure,” he told reporters Tuesday at an emerging markets summit in Xiamen, China, which was hosted by his Chinese counterpart Xi Jinping.

Bottom line: The White House is not going to get anywhere with additional UN sanctions on North Korea.

However, the US has a very effective weapon in its arsenal to unilaterally “go nuclear” on the sanctions front. As Ian Bremmer of Eurasia Group pointed out in 2015, the US could deny countries, or specific entities access to the financial markets. As an example, instead of cutting off trade with any country that trades with North Korea, which was Trump’s initial reaction, the US could impose an embargo on any entity or country that trades with North Korea. (Looking at you, China.) Between China and Hong Kong, those two entities have roughly $2 trillion in external debt, whose financing, and rollover could come to a screeching halt. It would, indeed, be a nuclear option as it would collapse the financial markets in Asia.

Hopefully, it won’t come to such a drastic step, because China has an equally potent “nuclear trade weapon” of its own, rare earths. When Japan arrested the captain of a Chinese fishing boat in 2010 over a territorial dispute in the South China Sea, China responded by imposing a rare earths embargo on Japan. The Orlando Sentinel described what’s at stake today:

China controls the world’s production and distribution of rare earths. It produces more than 92 percent of them and holds the world in its hand when it comes to the future of almost anything in high technology.

Rare earths are great multipliers and the heaviest are the most valuable. They make the things we take for granted, from the small motors in automobiles to the wind turbines that are revolutionizing the production of electricity, many times more efficient. For example, rare earths increase a conventional magnet’s power by at least fivefold. They are the new oil.

Rare earths are also at work in cellphones and computers. Fighter jets and smart weapons, like cruise missiles, rely on them. In national defense, there is no substitute and no other supply source available.

To be sure, the West has adapted since 2010 and new sources of supply have appeared. Nevertheless, Chinese supply remains dominant in that market. The combination of a financial embargo on China, which would tip Asia into a slowdown, and a rare earths embargo, which is the modern equivalent of the Arab Oil Embargo in the wake of American support for Israel in the 1973 Yom Kippur War, is an Apocalyptic scenario that will tank the global economy into a deep and synchronized recession.

And we haven’t even discussed the possibility of military action.

More uncertainty at the Fed

Meanwhile, there is more uncertainty over the direction of Fed policy. Fed governor Lael Brainard gave a remarkable dovish speech on Tuesday. In a speech she gave last May, Brainard had been on the fence on the direction of monetary policy, but decided to give the consensus view the benefit of the doubt:

In recent quarters, the balance of risks has become more favorable, the global outlook has brightened, and financial conditions have eased on net. With the labor market continuing to strengthen, and GDP growth expected to rebound in the second quarter, it likely will be appropriate soon to adjust the federal funds rate. And if the economy evolves in line with the SEP median path, the federal funds rate will likely approach the point at which normalization can be considered well under way before too long, when it will be appropriate to adjust balance sheet policy. I support an approach that retains the federal funds rate as the primary tool for adjusting monetary policy, sets the balance sheet to shrink in a gradual and predictable way for both Treasury securities and MBS, and avoids spikes in redemptions.

While that remains my baseline expectation, I will be watching carefully for any signs that progress toward our inflation objective is slowing. With a low neutral real rate, achieving our symmetric inflation target is more important than ever in order to preserve some room for conventional policy to buffer adverse developments in the economy. If the soft inflation data persist, that would be concerning and, ultimately, could lead me to reassess the appropriate path of policy.

Her speech this week signaled that she has changed her tune, as Brainard has become increasingly concerned about persistently low inflation and low inflationary expectations:

To conclude, much depends on the evolution of inflation. If, as many forecasters assume, the current shortfall of inflation from our 2 percent objective indeed proves transitory, further gradual increases in the federal funds rate would be warranted, perhaps along the lines of the median projection from the most recent SEP. But, as I noted earlier, I am concerned that the recent low readings for inflation may be driven by depressed underlying inflation, which would imply a more persistent shortfall in inflation from our objective. In that case, it would be prudent to raise the federal funds rate more gradually. We should have substantially more data in hand in the coming months that will help us make that assessment.

Tim Duy has interpreted Brainard’s speech as a dovish tilt on Fed policy:

Brainard is making a push to slow the pace of rate hikes. I am not sure she will be as successful as her last effort to change the course of policy. But she still has two important takeaways for investors. First, if you think interest rates will rise sharply, think again. The neutral rate of interest is too low to expect much more tightening – we need much faster growth to justify a higher estimate of the neutral rate. Second, assuming she is right and the Fed doesn’t take her advice, her colleagues are positioning themselves for a substantial policy error that would both bring the expansion to an end sooner than later and further entrench disinflationary expectations. And that would only make the Fed’s job harder in the future.

Before getting overly excited about Brainard’s dovish turn, I would wait for New York Fed’s Bill Dudley speech, which is scheduled for after the market close on Thursday. Dudley is known to taken a far more hawkish view of monetary policy. That said, Duy’s comment was written before the surprising news of the resignation of vice chair Stanley Fischer. For readers who are unfamiliar with Fischer’s record, in addition to being the head of the Bank of Israel, he was the Ph.D. thesis committee of both Ben Bernanke and Mario Draghi.

Fischer’s departure, which is scheduled for October, throws a wrench into the future of Federal Reserve monetary policy. On one hand, Fischer is a close confidant of Janet Yellen, and he is regarded as a hawk on interest rate policy. With only three active governors on the Federal Reserve Board, it tilts the center of gravity towards the doves, at least in the short term.

The wild card is the reaction of the Trump Administration. There are now four open seats on the board and Donald Trump can fashion the Fed in the manner of his own choosing. What kind of appointee will he nominate and pack the board with? Will they be pragmatic (and likely dove), such as a Gary Cohn, or economists hewing to Republican orthodoxy like John Taylor, whose approach to monetary policy would be far more hawkish than the Yellen Fed?

Moreover, the decision to rescind the Obama DACA initiative also raises a high degree of uncertainty for future Fed policy. Most estimates indicate that up to 800,000 people are subject to deportation if Congress does not pass a bill in the next six months. What happens if 800,000 people disappear from the labor force in a year, and what are the implications for labor market dynamics, wage inflation, and, most importantly, the conduct of monetary policy?

Noah Smith at Bloomberg highlighted this problem of labor force dynamics:

Jobs don’t just appear out of the sky. People give each other jobs. When new people arrive, either by being born or by immigrating, businesses expand — to take advantage of the new labor, and to sell things to the newcomers. Also, new businesses get started. Often, newcomers start the businesses themselves — immigrants and young people are both overrepresented among the ranks of entrepreneurs.

Now, it’s possible that immigration or population growth could temporarily put some people out of work. Economists have found that with some changes, like trade and automation, there are long-term gains but short-term pain as the economy rearranges itself. It takes time to start new businesses, and for existing businesses to expand, so it’s theoretically possible that a big surge of immigrants or a baby boom could temporarily raise unemployment.

I have no answers, but undoubtedly Federal Reserve staff economists are hard at work on this question.

Bottom line: Much of the Fed related uncertainty has also been kicked down the road until late this year, when nominations for Fed governors, as well as the fate of Janet Yellen, is known.

Expect further choppiness

The market went risk-off on Tuesday as investors returned to the desk after the Labor Day long weekend over North Korean jitters. It recovered on Wednesday when further North Korean related stress failed to appear, and on the news of the temporary debt ceiling deal.

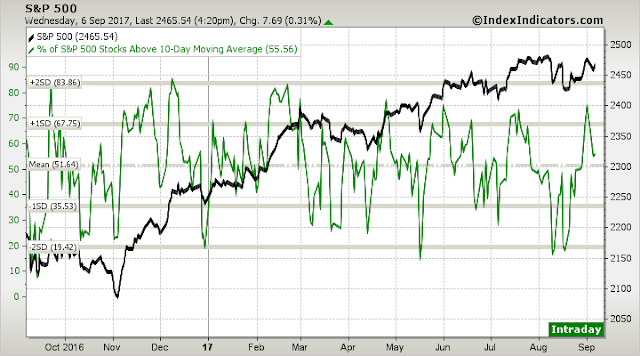

Short-term breadth indicators from Index Indicators have retreated from overbought levels and they are now in neutral territory.

My base case scenario calls for a range-bound market for the next several weeks, until much of this uncertainty gets resolved. In the meantime, my inner trader is inclined to buy when the market reaches the bottom of the range and sell at the top of the range.

Disclosure: Long SPXU

SPUX?

Sorry for the typo: SPXU

Cam–I doubt that the majority of the Congress want 800,000 “dreamers” to be deported. Quite few Repubs are in favpor of across the board immigration into the US. The economic rewards/cost favor immigration. There is no group that Trump will not disappoint sooner or later. He wants tarrifs against China. He will not get them. Reality intrudes all the time. Bob Millman

Robert

I hope you are right. That said, Trump is slavishly loyal to his base that elected him. Given that, anything is possible, including deportation of 800k illegal migrants. Economic (non)sense does not matter.