Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

My inner trader uses the trading component of the Trend Model to look for changes in the direction of the main Trend Model signal. A bullish Trend Model signal that gets less bullish is a trading “sell” signal. Conversely, a bearish Trend Model signal that gets less bearish is a trading “buy” signal. The history of actual out-of-sample (not backtested) signals of the trading model are shown by the arrows in the chart below. Past trading of the trading model has shown turnover rates of about 200% per month.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Neutral

- Trading model: Bearish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers will also receive email notices of any changes in my trading portfolio.

September headwinds and tailwinds

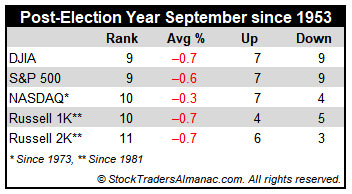

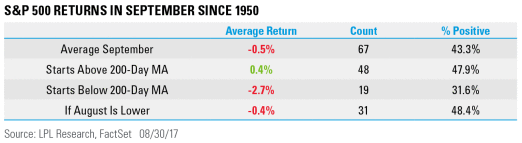

Welcome to September. Looking forward, this month is known to be seasonally bearish. Jeff Hirsch of Trader`s Almanac found that September was the worst month of the year, based on seasonal factors.

Ryan Detrick of LPL Financial Research further dissected past September seasonality. While while returns have been negative, he found a silver lining. When the SPX is trading above its 200 dma, which it is today, the market has seen positive average returns, though the percentage positive is still below 50% at 47.9%.

That said, investors face a sea of uncertainty as we head into September. I have never known the market to perform well under conditions of high uncertainty, but consider the hurdles ahead:

- Legislative uncertainty over the debt ceiling and tax reform

- Geopolitical uncertainty over North Korea

- Uncertainty over Fed actions

Can stock prices climb the proverbial wall of worry in September, or will it retreat and test its correction lows seen in August?

Debt ceiling brinkmanship

One immediate problem that the US Congress faces as it returns from recess is the passage of a bill that raises the debt ceiling. That legislation is complicated by the damage caused by Hurricane Harvey. Longer term, the market has to be concerned about the viability of Trump’s tax reform initiatives.

Even though the Republicans control the White House, and both chambers of Congress, Steve Collender explained the problem of legislative chaos as seven GOPs at war with each other.

This year there are seven GOPs rather than just one Republican Party and they are all fighting each other far more than they’re confronting Democrats.

And eventually they’re going to have to deal with the Democrats too.

The first two groups of Republicans are in the House, where the ultra conservatives in the Freedom Caucus and the relative moderates in the Tuesday Group support vastly different policies and have enough votes to stop the other..and the whole House of Representatives…from doing anything.

The second two are in the Senate, where there’s also a huge divide between ultra conservatives and moderates. But the two Senate groups have to be considered different from their House counterparts because they have institutional concerns that often equal or exceed their ideological preferences. As a result, the policies, strategies and tactics that House Republicans use or demand frequently are unacceptable to GOP senators.

The next two are the Republican leaders — House Speaker Paul Ryan (R-WI) and Senate Majority Leader Mitch McConnell (R-KY) — who have management responsibilities that often conflict with their party’s political preferences. Ryan and McConnell have also become such personal targets for the other GOP groups that they have to spend a great deal of time, energy and political capital protecting themselves and their positions on most issues.

Finally, there’s Donald Trump.

Trump’s political needs and goals are different from almost every congressional Republican. Not only is he not up for reelection in 2018, his base of supporters is very different from that of most GOP representatives and senators. As the Affordable Care Act debacle amply demonstrated, what’s politically correct for Trump sometimes isn’t even close to what’s right for many others in his party…and continued funding for the federal government and the debt ceiling are two of those times.

Trump also continues to refuse to accept that Congress is not a wholly-owned subsidiary of his presidency. His ongoing attacks on individual Senate Republicans for not doing what he wants on health care, the wall, the debt ceiling, the Russia sanctions law and the collusion-with-Russia investigation undeniably shows that he considers the House and Senate to be subservient divisions of Trump Administration, Inc. rather than the equal partners created by the U.S. Constitution.

The existence of these seven Republican groups all point directly to legislative and political chaos and perhaps an explosion in September on the shutdown and debt ceiling.

That article was written before Hurricane Harvey devastated South Texas. Before the hurricane, Trump stated in a speech that he was prepared to shut down the government if a debt ceiling bill did not include sufficient funds to fund his Wall. In the wake of the hurricane, most analysts believe that Harvey has changed the legislative calculus of a debt ceiling increase, as no legislator wants to be seen to be so cold-hearted as to hold up a bill for hurricane victim relief.

Not so fast! Collender, in a separate Forbes article, detailed the political maneuvers behind hurricane relief and each GOP faction’s political motives:

In theory, providing funds for Hurricane Harvey relief should be quite easy. Fiscal 2018 begins on October 1 and some type of funding — either individual appropriations or a continuing resolution (CR) — will have to be enacted by then to avoid a government shutdown. In other words, there’s an almost must-pass-and-must-sign legislative vehicle already in the works that can be used for Hurricane Harvey and adding those funds should make the CR even easier to enact.

Except that’s not the case.

President Trump’s vow that he’ll veto the CR and shut down the government if money for his wall between the U.S. and Mexico isn’t included is still in effect. In fact, it’s noteworthy that he hasn’t yet withdrawn or modified that threat in the face of the Harvey-caused destruction.

Trump may be thinking that adding the funds for his wall to a bill with Harvey relief will make it easier for him to get the dollars he wants. After all, would congressional Democrats, who so far have indicated they’re adamantly against the wall, dare oppose a bill if funding for the wall and Harvey relief aid were combined?

But House and Senate Democrats almost certainly see this coming and are likely to announce very soon — perhaps even this week — that they insist that the hurricane relief funds be in a standalone bill rather than the CR and that this bill not include anything other than aid for Harvey victims. As a sweetener, they could ask that a Harvey relief bill be considered now rather than by the end of the month so that the aid can start flowing immediately.

That would put the White House in a political bind. If the president signed the standalone relief bill, he might be giving up what he considers to be the best chance at getting the funds for his wall. If he vetoed it, he would be delaying aid to Texas, Louisiana and everywhere else that will be affected by the storm and causing a great deal of voter and congressional GOP angst.

The political theater is already starting to play out. The Washington Post reported that the House Freedom Caucus leader Mark Meadows has urged Congress not to attach a hurricane relief to a debt ceiling increase bill. Politico reported that GOP lawmakers plan on doling out Hurricane Harvey relief in increments, rather than one big bill as was the case with Hurricane Sandy. Such an approach could mitigate the political costs of attaching a debt ceiling increase provision to any single relief legislation. Late Friday, the Trump Administration sent Congress a request seeking $7.85 billion for Harvey aid, and “suggested” that Congress link the bill to a debt ceiling increase. The request was consistent with a Bloomberg report that House leaders planned to omit a debt ceiling provision to a hurricane relief bill.

What about money for the Wall? Will Donald Trump blink, or will he make a stand on that issue and veto any debt ceiling increase that doesn’t contain Wall funding? Trump could take some comfort that his base remains committed to a Wall. A Morning Consult poll indicated that 51% of Republican voters were willing to shut down the government if Wall funding is not forthcoming (see rightmost column).

In the meantime, Business Insider highlighted analysis from Beth Ann Bovino of Standard & Poor’s, who warned that a Treasury default (which is different from a government shutdown) would be “more catastrophic to the economy than the 2008 failure of Lehman Brothers”. Moreover, every week of a government shutdown would shave an annualized 0.2% from Q4 GDP growth. No pressure at all – there are only 12 working days in September to raise the debt ceiling.

Get your popcorn. The show has only just begun – and, incidentally, the same “seven GOPs” problem applies to the tax reform efforts too.

The North Korea wildcard

In light of the recent news that North Korea’s H-bomb test and its claim that it had perfected the technology to mount an H-bomb warhead on an ICBM, I suggest that everyone take a deep breath and calm down. I wrote in a recent post (see “Fire and Fury” is hard) that there were two “speed bumps” to an American attack on North Korea. First, Washington had to secure the cooperation of the South Koreans, who is at risk of suffering Hiroshima and Nagasaki sized civilian losses in an attack.

As these tweets from NoonInKorea shows, the South Koreans are getting on board with the idea of a strike on the North with the agreement of the highest levels in the military.

As well, ROK aircraft has been practicing executing decapitation strikes on the North Korean leadership.

That said, Chinese objections to war remain in place. The Diplomat reported that China has refused to condemn North Korea’s missile launch over Japan and instead has called for all sides to exercise restraint.

On August 29, questions about North Korea’s latest missile launch dominated the regular press conference of the Chinese foreign ministry. Yet the Chinese foreign ministry spokesperson Hua Chunying refused to put out any harsh word on North Korea.

When asked if North Korea deserves special condemnation for launching missile flew over populated areas of Japan, Hua said:

The Security Council resolutions have explicit stipulations concerning the DPRK’s launch activities using ballistic missile technology, and the Chinese side is opposed to the DPRK’s launching activities in violation of the resolutions.

Then, she used hundreds of words to explain why the Korean Peninsula nuclear crisis is a complicated issue and implied that sanctions toward North Korea are useless:

[T]he Security Council has passed several resolutions, and sanctions never stop, but do they really have any actual effects? Everyone notices that sanctions and missile launches are happening side by side…The current development of the situation has just proved once again the fact that sanction and military pressure alone will never be the final way out.

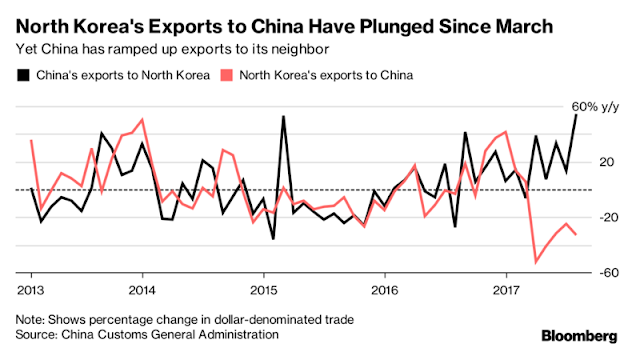

Further, the semi-official Communist Party organ Global Times was restrained in its reaction to the H-bomb test, and advised that “China needs a sober mind and must minimize the risks Chinese society has to bear”. Moreover, it stated that China “should avoid resorting to rash and extreme means by imposing a full embargo on North Korea” by “[cutting] off the supply of oil to North Korea or even [closing] the China-North Korea border”. As for the criticism that China is not putting enough pressure on North Korea, Beijing can point to the fact that North Korean exports to China has collapsed since March (chart via Bloomberg).

The greater risk of the North Korean situation is a war of a different sort, namely a trade war with China. Axios has reported that President Trump has fumed that his aides have been bringing him inadequate solutions in response to trade with China: “I want tariffs! Bring me some tariffs!”

Notwithstanding the American trade frictions with China, The Washington Post reported that Trump is preparing to withdraw from a free trade agreement with South Korea. If Trump is willing to throw his South Korean allies under the bus on trade, what would the outcome be if he is less than satisfied with the Chinese position on North Korea?

Any move to impose tariffs on Chinese exports would bring on an inevitable round of retaliation. Therefore the risk of a trade war that collapses global trade is high.

A hawkish or dovish Fed?

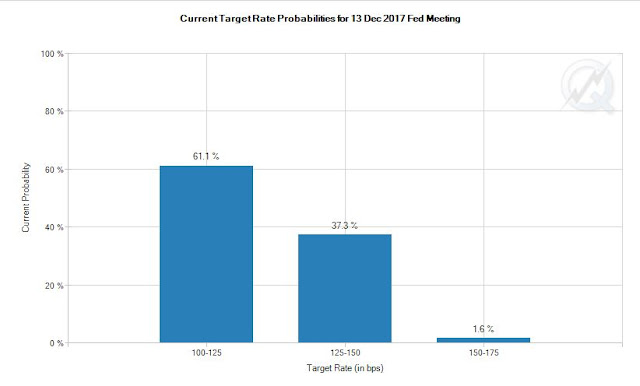

Finally, the FOMC is scheduled to meet September 19-20, where it is expected to begin its Quantitative Tightening (QT) program of shrinking its balance sheet, subject to an adequate agreement on a debt ceiling increase. The latest market expectations shows that market expects the next rate hike to occur at its June 2018 meeting, and a less than 40% odds of a December rate hike.

What if the market is wrong? Current market positioning (via Hedgopia) shows a crowded long by large speculators, or hedge funds, in the 10-year note and long Treasury bond.

…a crowded short in USD futures, even as the index tests a key support level…

…a crowded long in the euro, which is a major component of the USD Index.

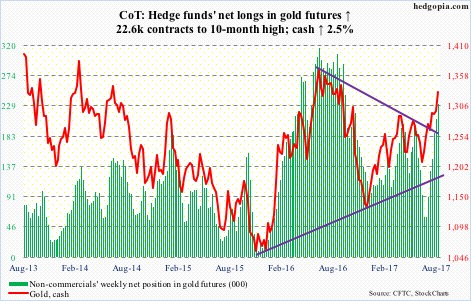

…a crowded long in gold, which is inversely correlated to the USD.

In other words, hedge funds have all rushed to one side of the ship in the futures market. Market internals, however, are not supportive of the crowded position. As an example, Andrew Thrasher pointed out that the recent upside breakout in gold was unconfirmed by action in the Japanese Yen, which makes the recent strength in bullion suspect.

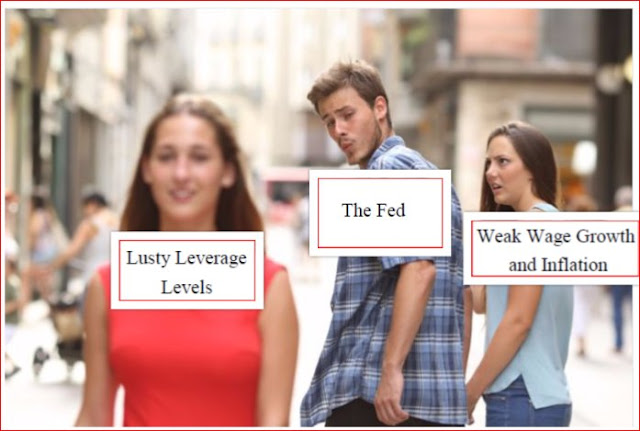

A picture is worth a thousand words. The following picture dramatically illustrates the Fed`s policy dilemma, as it balances its financial stability responsibilities with current data showing weak inflation and wage growth. Current Fedspeak has focused on the need for financial stability, which indicates that it is likely to remain on its policy normalization path.

Should the Fed become more hawkish than expected, it would spark a USD rally. The risk of a disorderly unwind in these crowded positions could become chaotic. Volatility would spike and a market tantrum could be the result. Watch for clues from speeches from Fed governor Lael Brainard on Tuesday, and New York Fed President Bill Dudley on Thursday.

In addition, there is the risk of a change in Fed leadership before year-end. Should Trump decide not to re-appoint Janet Yellen as Fed chair when her term expires in February, the alternatives are likely to set a more hawkish path for monetary policy. PredictIt shows the leading contenders to be the next Fed chair as: Janet Yellen, Gary Cohn, Kevin Warsh, Glenn Hubbard, John Taylor, and Thomas Hoenig. Gary Cohn had been the frontrunner to succeed Yellen, but his chances have fallen in the wake of his criticism of Donald Trump’s comments after the Charlottesville affair. The remaining candidates are Republicans with rules-based approaches to the conduct of monetary policy, which yield Fed Funds targets that are significantly higher than what they are today.

That’s another level of uncertainty that is not widely discussed in the financial press.

My inner investor`s outlook

While near-term uncertainty is likely to create some volatility in stock prices, the long-term investor`s outlook of stocks is not so dire. Barron`s feature article this week warned about the end of the bull market. The bottom line: equities don`t perform well in recessions.

However, current recession risk is relatively low. As I pointed out last week (see Is the Fed tightening into a weakening economy?), there are some signs of weakness in the economy. Taken by themselves, they are just the signs of a late cycle expansion and do not constitute a recession warning. In the current environment, however, the risk of a Fed policy mistake that over-tightens the economy into a recession is high.

My inner investor is still constructive on stock prices. Don’t get overly bearish unless there is evidence of overly aggressive Fed action. There is still some valuation support for equity prices. Bloomberg pointed out that the forward dividend yield on stocks is now higher than the 10-year Treasury note.

In the absence of an aggressive Fed, TINA (There Is No Alternative) still rules.

The technical condition of the market

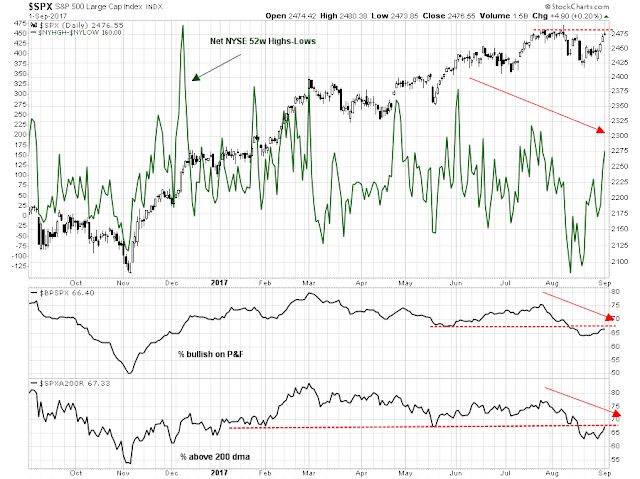

Looking to the week ahead, the technical condition of the stock market appears to be challenging for the bulls in the short term. Even as the SPX tests its all-time highs, breadth indicators are tracing out negative divergence patterns of lower lows and lower highs.

Other short-term breadth indicators from Index Indicators are flashing overbought signals.

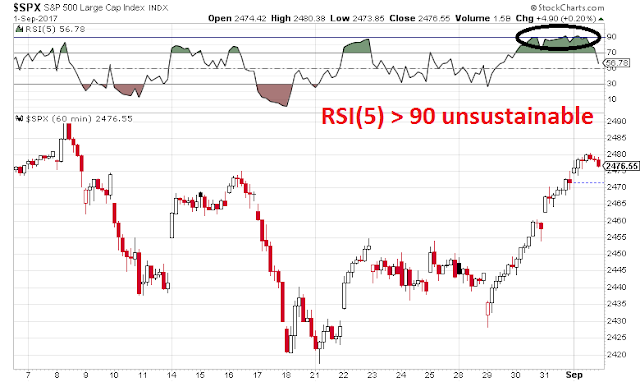

On a very short-term basis, the hourly chart of SPX shows RSI-5 surging above 90, which are levels that are rarely sustainable for a very long time.

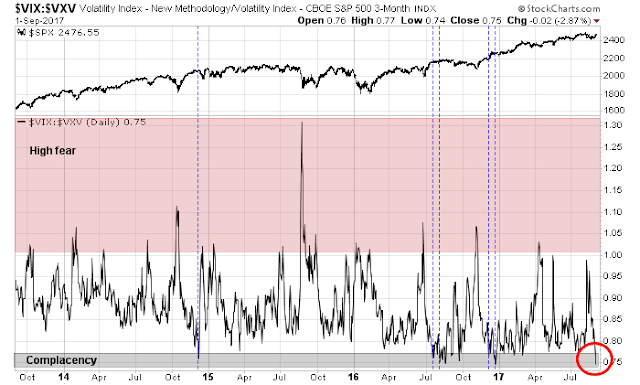

The term structure of the VIX shows that sentiment is now signaling complacency. Past episodes of complacency, which are marked by vertical lines, has seen the market struggle to advance. At a minimum, expect a neat-term flat to down bias in prices.

These readings suggest that the market is due for either a period of consolidation or some weakness ahead. The bearish potential that it will revisit and re-test the August lows in the weeks ahead.

My inner investor is neutrally positioned at his investment policy equity weight. My inner trader got caught offside as short last week, but he is not abandoning his position as he believes that near-term weakness lies ahead. His risk control discipline will require him to cover his short should the market decisively rally to new highs.

Disclosure: Long SPXU