Mid-week market update: Last Friday, subscribers received an email alert indicating that the trading model had flipped from short to long. In my weekend commentary (see “Fire and Fury” is hard) that my inner trader expected “the time horizon of that trade to be not much more than a week.”

I am reminded of the Trooper song, “We’re here for a good time, not a long time” when referring to this trade. On one hand, the relief rally has been impressive. Both my VIX model and Zweig Breadth Thrust Indicator had flashed deeply oversold conditions (see Three bottom spotting techniques for traders). If history is any guide, the duration of the rally should last, at a minimum, until Friday or Monday.

On the other hand, breadth indicators are not showing the bulls any love. The chart below shows negative divergences in credit market risk appetite, % bullish, % above 50 and 200 dma, In particular, the latter three indicators are exhibiting bearish patterns of lower lows and lower highs.

Looking into September, the stock market faces a number of macro headwinds that could serve to further depress prices.

Debt ceiling default?

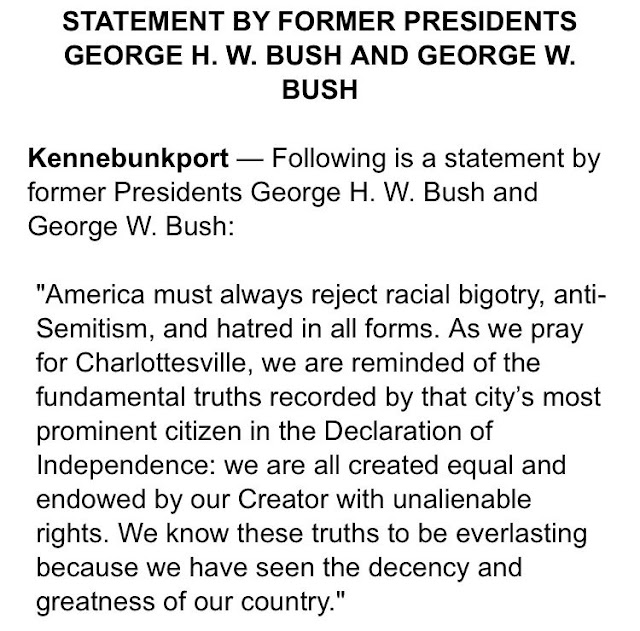

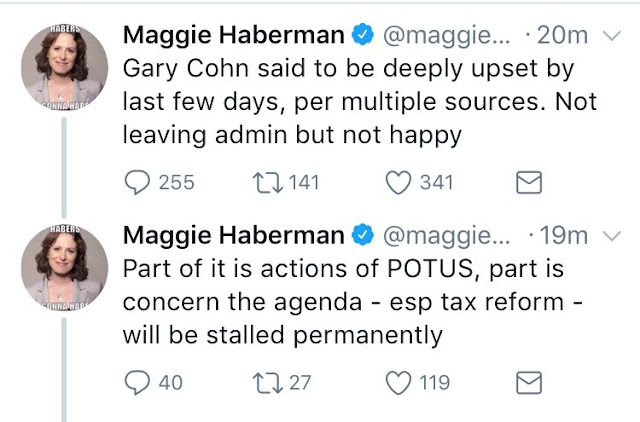

Donald Trump’s unusual performance press conference (see CNBC transcript) yesterday is raising the odds of a schism within the Republican Party at precisely the wrong time for the markets.

The emerging split in the party is threatening Trump`s economic agenda. National Economic Council director Gary Cohn, who is Jewish, is said to be upset.

Congress has only 12 working days to reach an agreement to raise the debt ceiling when it returns from recess in September. Based on the experience with ACA repeal, it was already going to be difficult enough to reconcile the different wings of the GOP to come to an agreement to raise the debt ceiling. Now Republican Congressional leaders may have to heal a ruptured party, and probably reach out to Democrats to raise the debt ceiling and avoid a Treasury default of its financial obligations.

Watch for political fireworks, brinkmanship, and risk premiums to rise.

A determined Fed

At the same time, despite the bifurcated opinions evident in the FOMC minutes, a recent speech from a member of the Fed triumvirate of Yellen, Fischer, and Dudley has signaled a determination to stay the course on policy normalization. In an AP interview, New York Fed President Bill Dudley stated, “If [the economy] evolves in line with my expectations … I would be in favor of doing another rate hike later this year.”

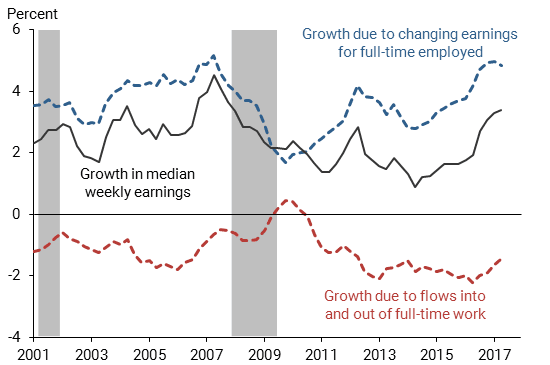

What about the lack of wage growth and inflation? There are answers for that, too.

A San Francisco Fed study explained the lack of acceleration in wage growth as new entrants to the workforce dragging down overall growth statistics. Wage growth among the fully employed (blue dotted line) is behaving as expected. On the other hand, new entrants (red dotted line) tend to make below average wages.

In addition, the demographic effects of the retirement of Baby Boomers and young people entering the workforce is also depressing average wages. Overall, the internals of the labor market looks fine.

As for inflation undershoot, Matt Busigin recently highlighted analysis from BLS which concluded that the lack of inflationary acceleration is attributable to a currency effect. Non-tradable inflation has been behaving as expected, but inflation in tradable goods and services has been a drag on headline CPI.

This chart of the Trade Weighted Dollar (red line, inverted scale), import prices of capital goods (blue line), and CPI (black line) tells the same story. Headline CPI is highly correlated to import prices and inversely correlated to the TWD.

In short, inflation is on the way. Regardless of whether you believe these two analytical reports or not, the important thing is the Fed believes it. And the Fed is set on a stubborn path of monetary policy normalization. Rates are going to rise at a faster rate than the market consensus. Balance sheet normalization will possibly push up bond yields. As well, expect mortgage rate spreads to see some additional upward pressure as the Fed implements its quantitative tightening program.

Turbulence ahead

Neither of the debt ceiling fight, nor a more aggressive Fed, are fully discounted by the market. The weeks ahead are likely to see risk premiums risk, and the markets take on a risk-off tone.

My inner trader sold out of his long position today and went to 100% cash, as he is about to leave on a week-long vacation. In addition, short-term breadth indicators had moved from an oversold to overbought reading, though overbought markets can get more overbought. The trading model remains at a “buy” ranking, though that could change at any time.

He only bought for a good time, and not a long time.