Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

My inner trader uses the trading component of the Trend Model to look for changes in direction of the main Trend Model signal. A bullish Trend Model signal that gets less bullish is a trading “sell” signal. Conversely, a bearish Trend Model signal that gets less bearish is a trading “buy” signal. The history of actual out-of-sample (not backtested) signals of the trading model are shown by the arrows in the chart below. Past trading of the trading model has shown turnover rates of about 200% per month.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Risk-on

- Trading model: Bearish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers will also receive email notices of any changes in my trading portfolio.

Bifurcated opinions

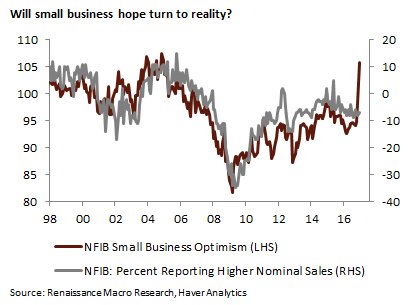

Opinions are starting to split badly on the market and the economy. Main Street has become more upbeat on the economic outlook. The NFIB small business survey showed that optimism surged in December, though Renaissance Macro pointed out that optimism has not translated yet into a significant upswing in sales growth.

The preliminary January report of UMich consumer confidence shows that it is elevated, though opinions are reportedly split along political lines:

The post-election surge in optimism was accompanied by an unprecedented degree of both positive and negative concerns about the incoming administration spontaneously mentioned when asked about economic news. The importance of government policies and partisanship has sharply risen over the past half century. From 1960 to 2000, the combined average of positive and negative references to government policies was just 6%; during the past six years, this proportion averaged 20%, and rose to new peaks in early January, with positive and negative references totaling 44%.

Chart via Calculated Risk:

By contrast, I am seeing signs of doubt from political circles that Trump will be successful with his pro-growth agenda, even among Republicans. Traditional approaches to sentiment analysis states that the public tends to be slow. When the public finally latches onto an economic theme, it is indicative of a contrarian top (or bottom). On the other hand, the improvement in business and consumer confidence can be signals of broad based economic strength.

So who is right? Main Street, or Washington?

The stakes are high

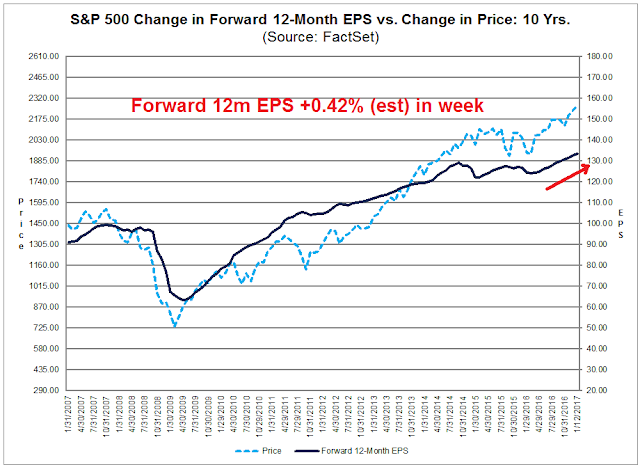

Here is what’s at stake for equity investors. As we enter earnings season, Factset shows that forward EPS continues to rise, which is indicative of Street expectations of broad based cyclical strength.

However, broad based cyclical upturn can only get you so far. This Factset chart also shows that forward P/E ratio is elevated and expensive compared to its own history. Current forward P/E is based on bottom-up derived earnings based only analyst expectations of economic conditions without the Trump fiscal plan. That’s because you can’t make estimates when you don’t have the details of the proposals. A top-down analysis suggests that the Trump tax cuts could add roughly 10% to forward earnings, which would bring down the forward P/E ratio to more reasonable levels (annotations are mine).

To rephrase my previous question: Who is right about the expectations for the Trump tax cuts? Main Street or Washington?

Republican skepticism

When Donald Trump takes his oath of office, he will be entering the White House with an unusually high unfavorability rating for an incoming president. It is therefore no surprise that consumer confidence is bifurcated and there is skepticism from Democrats that he will be able to implement all of the policies that he promised on the campaign trail.

I was surprised that skepticism is also coming from die hard Republicans. Bloomberg report that Republican governor of Kansas, Sam Brownback, had words of caution for the incoming president:

The governor of Kansas has some wisdom for Donald Trump, from one Republican tax-cutter to another: The reductions may take longer than expected to give the economy a sustained lift.

Like President-elect Trump, who said on the campaign trail that slashing taxes would jump-start growth, Sam Brownback in 2012 said steep cuts to personal income and small-business taxes in the Midwest state would provide the economy a“shot of adrenaline.” What followed wasn’t the promised jolt. The shortfall in revenue has instead forced the government to curtail spending on everything from health care to higher education.

John Mauldin, market analyst and staunch Republican from Texas, described himself as “skeptically optimistic” about the new regime. Passing legislation is never easy. Seemingly straightforward proposals can get delayed, watered down, or simply fall apart:

I’m told the Republicans have a long list of relatively uncontroversial (at least on their side of the aisle) bills that they can pass very quickly. They want to show progress, and they think quick passage of some popular measures will buy them credibility to use later. I expect an initial burst of activity after January 20, probably followed by a lull as the Congress moves into more contentious issues like Social Security and healthcare reform. Things will keep happening, but we may not see as many votes.

The hard part is getting agreement on the big items like taxes and healthcare reform. I love seeing Trump and Pence and Ryan and McConnell and all the guys holding hands and acting as if they’re all ready to walk into the bright new future together, but the reality is that there are some quite different ideas in Washington about what serious reforms should look like, and a lot of congressmen want to put their personal stamp on the final bills.

The reform effort could fall apart for various reasons. The Senate majority is narrow enough that just a handful of GOP defectors will be able to stop any given bill, assuming Democrats stay united in opposition. I think Republicans should be on guard against hubris, as well. The decision last week to kick off the year by softening ethics rules was a terrible idea. They accomplished nothing and energized an opposition that was otherwise on its heels.

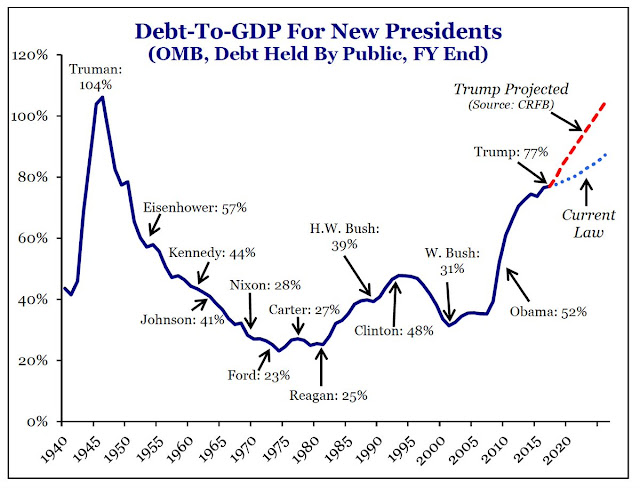

As an example, this pattern of debt to GDP could give GOP deficit hawks some pause as they consider Trump’s fiscal plan, which is expected to balloon the deficit.

Maudlin added that the new administration could get distracted by an unexpected crisis that weakens its ability to pass legislation.

Finally, as I cautioned last week, there is always the chance that some “bolt from the blue” could change everything. An international crisis, a large bank failure, terror attacks – any one of a long list of unforeseeable events could conceivably derail this train. Not to mention the endemic problems of Europe and China, which we will deal with below and which are entirely foreseeable. But if we can get through the first 100 days with this administration, then I think its agenda will have enough momentum to keep rolling.

The latest story that Russian intelligence had compromised Trump is just one of many tests that will face the new administration. The Lawfare blog had a the most balanced perspective that I had seen on this episode.

First, we have no idea if any of these allegations are true. Yes, they are explosive; they are also entirely unsubstantiated, at least to our knowledge, at this stage. For this reason, even now, we are not going to discuss the specific allegations within the document.

Second, while unproven, the allegations are being taken quite seriously. The President and President-elect do not get briefed on material that the intelligence community does not believe to be at least of some credibility. The individual who generated them is apparently a person whose work intelligence professionals take seriously. And at a personal level, we can attest that we have had a lot of conversations with a lot of different people about the material in this document. While nobody has confirmed any of the allegations, both inside government and in the press, it is clear to us that they are the subject of serious attention.

Third, precisely because it is being taken seriously, it is—despite being unproven and, in public anyway, undiscussed—pervasively affecting the broader discussion of Russian hacking of the election. CNN reported that Senator John McCain personally delivered a copy of the document to FBI Director James Comey on December 9th. Consider McCain’s comments about the gravity of the Russian hacking episode at last week’s Armed Services Committee hearing in light of that fact. Likewise, consider Senator Ron Wyden’s questioning of Comey at today’s Senate Intelligence Committee hearing, in which Wyden pushed the FBI Director to release a declassified assessment before January 20th regarding contact between the Trump campaign and the Russian government. (Comey refused to comment on an ongoing investigation.)

Politico reported that, on late Friday after the market close, the Senate Intelligence Committee has opened an investigation into this affair, Even before the Inauguration, this inquiry already has the potential to either distract the Trump team or weaken its apparent authority to pass legislation.

A Trumpian “animal spirits” revival?

Independent of what happens inside the Beltway, the latest NFIB survey represents a boost to economic confidence. Even though small business owners tend be conservative and therefore not reflective of views the general population, Ed Yardeni made some good points on why small business confidence matters:

(1) Small business is big employer. ADP, the payroll processing company, compiles data series on employment in the private sector of the U.S. labor market by company size. At the end of 2016, the shares of employment attributable to small, medium-sized, and large firms were 40.5%, 37.7%, and 21.8%.

(2) Small business drives jobless rate. There has been a very high correlation between “poor sales” reported by small business owners and the national unemployment rate. If Trump succeeds in boosting their sales by cutting personal income tax rates, the jobless rate should remain low.

There is also a high correlation between the earnings of small businesses and the inverse of the poor sales. Trump’s proposed tax cuts would boost their earnings, which are inversely correlated with the national unemployment rate.

Yardeni believes that rising small business confidence is a sign that the economy’s “animal spirits” are stirring, which will serve to drive further growth. Another manifestation of these “animal spirits” can also be found in the recovery in consumer confidence, despite the political bifurcation of opinions.

Investment implications

How should investors resolve this apparent contradiction? Should they be cautious, or bullish?

I interpret these conflicting signals in terms of differing time frames. It turns out that consumer confidence are coincidental indicators (via Bill McBride of Calculated Risk):

Consumer sentiment is a concurrent indicator (not a leading indicator). The survey shows some people are now much more positive than prior to the U.S. election – and others are much more negative.

Luke Kawa also observed that small business confidence is highly correlated with GDP growth, which makes it another coincidental indicator.

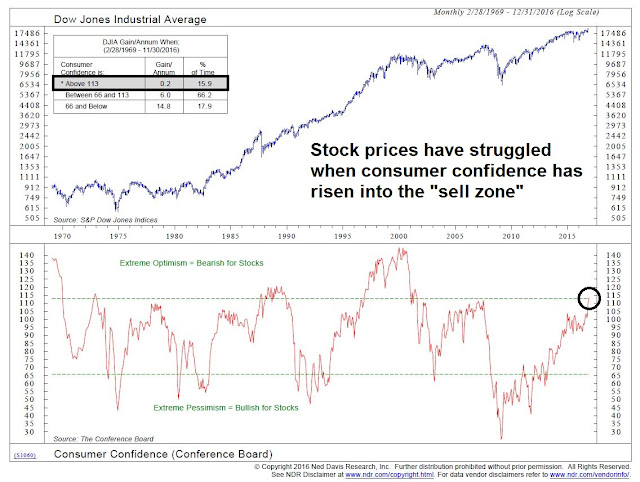

If you try to forecast a leading indicator, like stock prices, with coincidental indicators, it doesn’t work very well. In fact, Ned Davis Research found that extreme readings in consumer confidence can be used as contrarian indicators – and it’s flashing a sell signal right now (annotations are mine).

In the short term, the Trump rally looks overdone. Mark Hulbert reported that his sample of NASDAQ market timers is at a crowded long level, which is contrarian bearish.

The inverse of contrarian sentiment is insider activity. The latest update from Barron’s of insider trading is flashing a sell signal as this group of “smart investors” have stepped up their selling for a second consecutive week.

From a cross-asset viewpoint, the disappointing tone of Trump’s tone in his Wednesday press conference served to deflate the US Dollar and therefore also has bearish implications for equities. Instead of talking up tax cuts and deregulation, the president-elect chose to focus on protectionism (via CNBC):

The U.S. dollar index hit a one-month low Thursday after President-elect Donald Trump disappointed investors in a Wednesday press conference. Rather than discussing infrastructure spending, deregulation or tax cuts, Trump emphasized a tough position on trade and a border tax.

“The market had priced in a very positive scenario of Trump: fiscal policy without trade protectionism,” said Athanasios Vamvakidis, a European currency strategist in Europe for Bank of America Merrill Lynch.

“That’s why the press conference is a scare,” he said, noting that traders are now focused on the dollar and what the new administration does after next Friday’s inauguration.

This chart from Hedgopia shows that the USD Index is pulling back, but large speculators are still in crowded long position. That’s a recipe for further weakness.

Short term cautious, medium term bullish

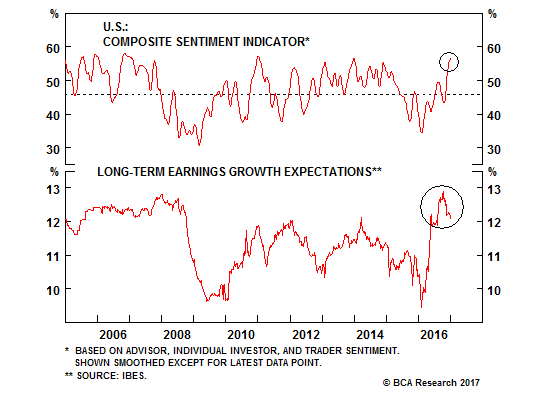

My own views are well summarized by BCA Research‘s expectations for equity markets. In the short term, bullish sentiment is overdone and a period of consolidation or pullback can be expected. Longer term, growth expectations are still high and stock prices should rise after a corrective episode.

From a technical perspective, the MACD buy signal for the Wilshire 5000 based on monthly price data remains in force.

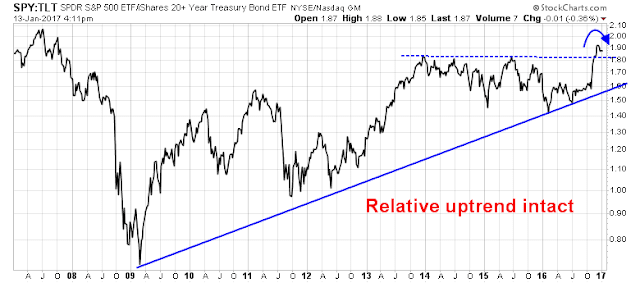

We can see a similar pattern from the relative performance of stocks (SPY) vs. Treasuries (TLT). The longer term trend remains bullish, but stocks have started to pull back against bonds. Further short-term weakness would be no surprise. As long as the long term trend remains intact, my inner investor is inclined to remain equity bullish.

Indeed, the sell-off in bonds appear to be overdone. Michael Hartnett at BAML demonstrated that the drawdown in UST prices are at levels where past major bottoms have occurred.

This chart from Hedgopia shows that even as 10-year yields have started to retreat, large speculator short positions continue to rise.

These conditions all suggest bond prices are poised for a powerful counter-trend rally for the next couple of months. From a cross-asset perspective, it also points to softer stock prices ahead.

There is an important caveat to this forecast. This scenario of near-term equity weakness and longer term strength falls apart if unexpected events, such as a trade war or even a shooting war, were to occur.

The week ahead

Looking to the week ahead, I expect volatility to rise as the market becomes subject to the event risk from Q4 earnings season. As well, Inauguration Day is Friday and who knows what kinds of fireworks and new initiatives will be announced.

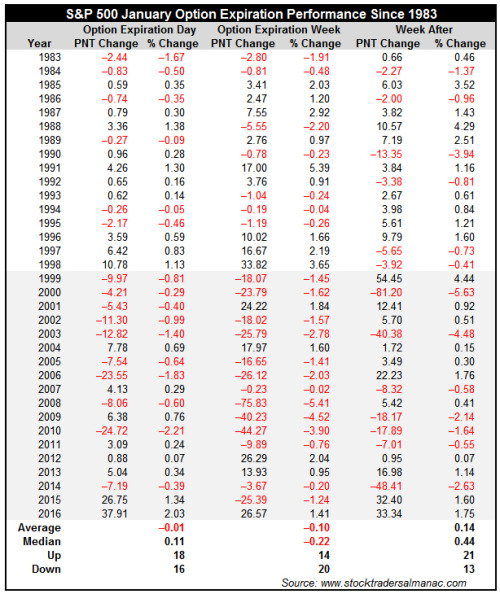

Next week is also option expiry week. Jeff Hirsch at Almanac Trader observed that returns during January OpEx week tends to be a mixed bag and does not show the usual bullish seasonal bias of OpEx weeks.

The SPX has spent several weeks in a narrow range and it is testing a key uptrend line. For the reasons I outlined, I expect that the upside potential to be limited. Should the uptrend get violated, support exists at the 2180-2200 zone, which is roughly the level where the index staged its upside breakout to all-time highs.

Market internals also point to a bearish resolution of the sideways consolidation. Analysis from Trade Followers shows a negative divergence as bullish Twitter breadth has been deteriorating even as the market has rallied.

My inner investor remains constructive on stocks. My inner trade has taken a small short position in the SPX.

Disclosure: Long SPXU

Just a thought;

There has been a lot of commentary that Trump promised to ‘drain the swamp’ but instead he has appointed all these billionaires to his cabinet. That tells me, these commentators think successful business people are what he was referring to. I’d don’t think so. In my mind, he was referring to the politicians in Washington. It was great that he outed them when the GOP Congress tried to do away with the independent oversight department as their first piece of business and he stopped it.

Left wingers tend to think successful business people are self-centered and unethical as a class. I don’t. Some are, but the vast majority are not, just as some athletes take steroids but most don’t. That cannot be said for most congressmen and women. The constant demand to raise money for future campaigning forces them into the sphere of lobbyists. The people in their districts are often not served by the legislation the lobbyists pay money to get passed. This is the swamp Trump is talking about. I believe he will mercilessly bully them to get his business oriented policies passed. He may shock everyone and tackle campaign finance reform.

I see Trump going all in to fulfill his promise to Make America Great Again. To me, he means strong domestic business conditions that create good-paying jobs. He feels or knows the media hates him so he will play to his voters to do this with most of his energy devoted to strong business. NATO, Putin, North Korea, Israel, Europe are sideshows to be handled mainly by others.

This is all good for the stock markets.